In operations management, personnel management, payroll template, payroll role as a tool standardized, enterprise synthetic, transparent calculation of income staff. Not only is internal documents, the pay table is also important bases to ensure compliance with legislation on labor, tax and social insurance.

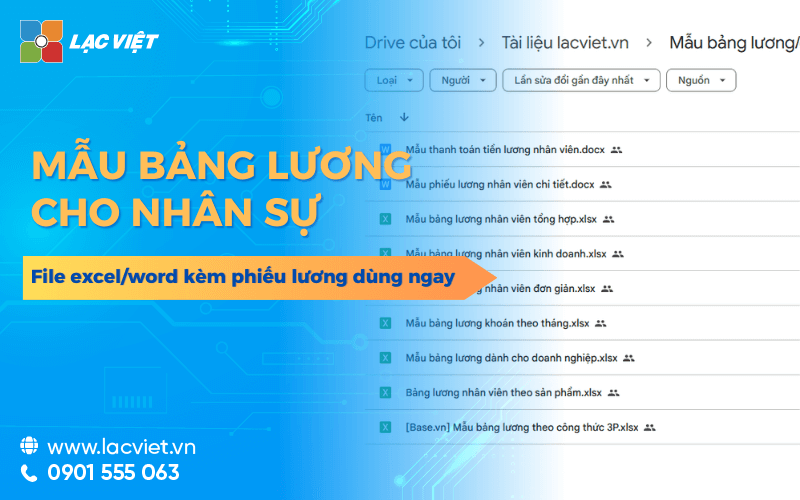

Many businesses SMEs in Vietnam are still set up payroll on Excel, however, easy to deploy, but potential risks, errors, time-consuming test, especially when the number of employees increased rapidly. Many managers looking for sample employee payroll Excel or template payroll staff available to both save time and ensure that the right targets required.

This article Lac Viet will help you understand the type of table common pay structure, standards, optimising the process in Excel, or automatic software to help businesses reduce errors, increase operational efficiency, enhance the experience staff.

1. Sample payroll what is?

Sample payroll are synthetic forms of the entire information related to the income of employees in a pay period including earnings (basic salary, allowances, bonuses), deductions (SOCIAL security, UNEMPLOYMENT INSURANCE, personal income tax), the amount of money actually received. This is an important document for both the accounting department – personnel and workers.

For employees, payroll, ensure benefits are paid true enough, transparency. For hr departments – finance, payroll is the basis for:

- Manage personnel costs efficiently.

- Meet the requirements of financial reporting, audit, inspection and labor.

- Record storage service for projectors or dispute resolution.

According to the Ministry of Labor law 2019, the business is responsible for making payroll, detailed message to employees about the earnings, deductions, actually each pay period. In addition, Circular no. 200/2014/TT-BTC and Circular 133/2016/TT-BTC also given specific instructions about the form, content of payroll to serve the accounting work.

For example, a sample employee payroll Excel basic usually include:

- Employee information: name, employee code, parts.

- Day work, shift work, number of hours of overtime.

- Basic salary, allowances, bonus.

- Deductions as prescribed.

- Total income, food field.

Standard structure this business just ensure transparency, has just fully meet legal requirements, at the same time convenient when need to switch to the software manager salaries modern.

- 15 software HRM integration of AI in human resource management optimization

- 15 Payroll Software employee oldest standard business manager salaries

- LV SureHCS C&B, timekeeping, and payroll automation of all business tasks

- Lac Viet SureHCS C&B paid by the customized products according to specific business

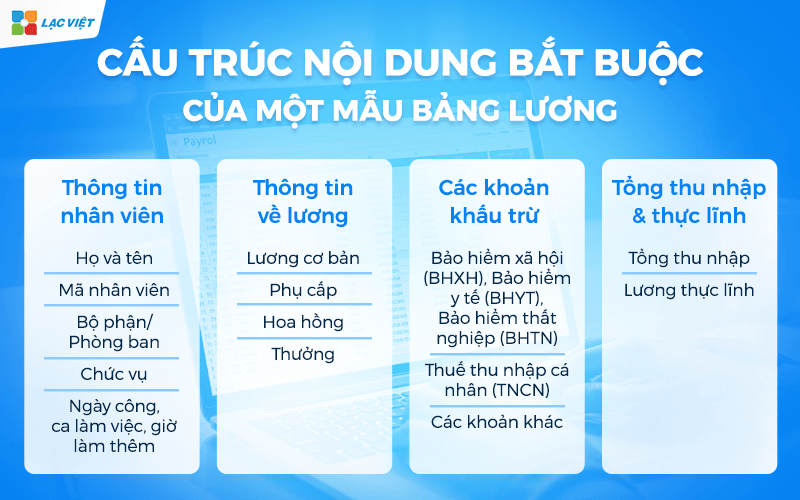

2. Structure content of a template, payroll

A sample payroll standard is not merely a list of numbers but also the management tools and proven legal about the business has taken the obligation to pay wages to workers. Setting up the right structure to help businesses easily control personnel costs, reducing risks, errors ensure transparency.

2.1. Employee information

This section is the foundation of payroll, help determine exactly who is paid a salary. A table full wages typically includes:

- Name: specifies to avoid confusion between the staff with a similar name.

- Employee code: unique Code of business rules, support fast lookups in the system.

- Division/department: Helps to analyze the cost of personnel in each unit.

- Position: Related to the wage level of responsibility.

- Day work, shift work, overtime hours: The basis to calculate salary according to the time or output.

2.2. Salary information

This is the current earnings before deductions, including:

- Basic salary: Account fixed income under a contract of employment.

- Allowance: May include allowances for lunch, gasoline, telephone, accommodation...

- Rose: Usually applied to parts business, as measured by revenue.

- Bonus: includes bonus, performance bonus, holidays or unexpected bonus.

When setting template employee payroll Excel, should be clearly stated unit (VND, USD...), pay period (month, week, according to the project) to ensure transparency.

2.3. Deductions

In accordance with the law of Vietnam, the deduction common include:

- Social insurance (SOCIAL insurance), health insurance (health INSURANCE), unemployment insurance (UI): Calculated as a percentage of wages, premiums, due to state regulations and often varies with each stage.

- Personal income tax (PIT): Charged according to the progressive tax each section.

- The other account: Except compensate advance, fines for violations of rules (if any regulations).

A report from the General department of Taxation (2024) showed that 12% of the business is sanctioned by the false personal income tax, in large part due to not updating the reduction level new family. So, when building template, payroll, staff should ensure that the data is updated according to the latest regulations.

2.4. Total income & real field

This is the workers ' interest is also the indicator reflects the efficiency of the establishment payroll.

- Total income = basic Salary + allowance + commission + Bonus.

- Food field = Total income – Total deductions.

The clearly show the formulas or notes right in the help staff, easy check out, from which reduce complaints, save processing time when you have questions.

3. The type of table common pay in business

Việc lựa chọn mẫu bảng lương phù hợp ảnh hưởng trực tiếp đến hiệu quả quản lý nhân sự, mức độ chính xác của cách tính lương nhân viên và khả năng tuân thủ pháp luật. Tùy vào quy mô, đặc thù hoạt động, mức độ ứng dụng công nghệ, doanh nghiệp có thể lựa chọn một trong các dạng bảng lương sau:

3.1. Sample employee payroll Excel

This is the form template employee payroll Excel are many small and medium business preferred thanks to its flexibility, easy-to-create no cost software. People do pay just set up the formula once, then enter the monthly data.

- Values bring: to Help businesses proactively customize for specific jobs, from payroll to time to payroll exchange products.

- Restrictions: Easy-to-happen errors when entering data manually, take time for projectors, hard security. Report of PwC Vietnam (2024) shows that 34% error wages incurred from the calculations in Excel of error formula or data.

When should I use: Business, less than 50 personnel, the volume of payroll is not complicated, does not require data connection from multiple departments.

3.2. Sample payroll hourly employee/ca

Phù hợp với các doanh nghiệp hoạt động trong lĩnh vực dịch vụ, sản xuất, nhà hàng – khách sạn, nơi thời gian làm việc của nhân viên không cố định. Giúp doanh nghiệp tính lương tăng ca công bằng dựa trên thời gian, khối lượng công việc thực tế, giảm khiếu nại về số giờ công.

Sample payroll this clearly:

- The number of hours worked or the number of cases completed.

- The coefficient of wage according to the hours/ca.

- The number of hours of overtime, overtime the night or on holiday.

- Allowances, bonus ca.

3.3. Sample payroll circular 133 and circular 200

This is a form of payroll standard accounting, in full compliance with the requirements of the Ministry of Finance.

- Circular 133/2016/TT-BTC: Apply for small and medium enterprises.

- Circular no. 200/2014/TT-BTC: Apply for big business. Payroll is mandatory show full indicators such as gross salary, deductions from wages, taxable income and is not taxable.

Values bring: to Help businesses meet the requirements of audit, tax settlement, reducing the risk of sanctions. Data from the General department of Taxation (2024) showed 15% of business is tax arrears of pay table does not match the financial statements.

3.4. Sample payroll online software

This is the trend now, when template employee payroll is managed on the system software payroll professional as LV SureHCS. Not only reduce errors, the software also offers analysis report wage costs, according to the department, support leadership decision fast and accurate.

Advantages:

- Tự động lấy dữ liệu từ attendance system và hợp đồng lao động.

- Calculate quickly, up to 90% of the time to enter data manually (according to the survey of Lac Viet SureHCS, 2024).

- Easily store, access, information security.

- Automatic update of the SOCIAL tax latest.

When should I use: Business from 50 hr back up, or demand-related data between multiple branches.

DOWNLOAD FULL THE TYPE OF TEMPLATE, PAYROLL, BUSINESS CASUAL USER

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

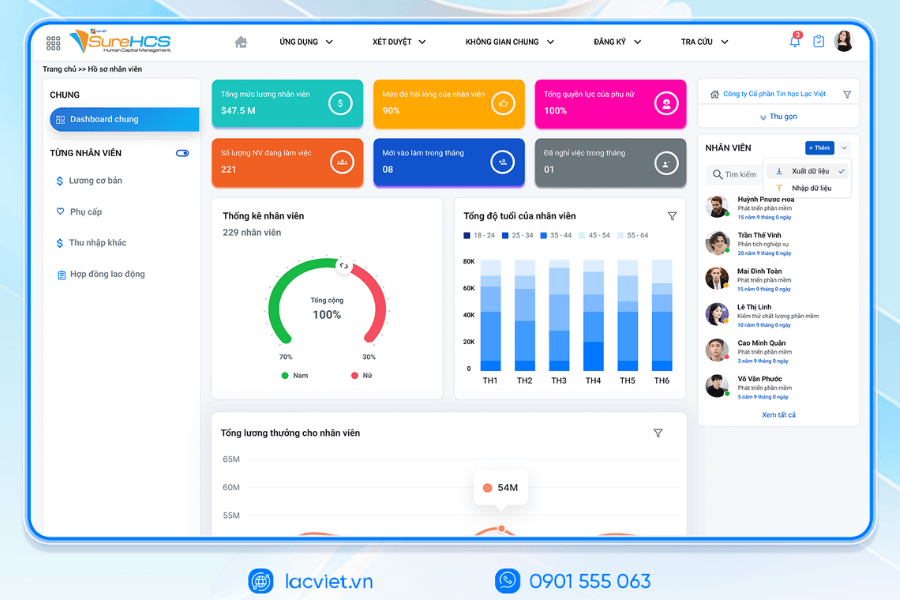

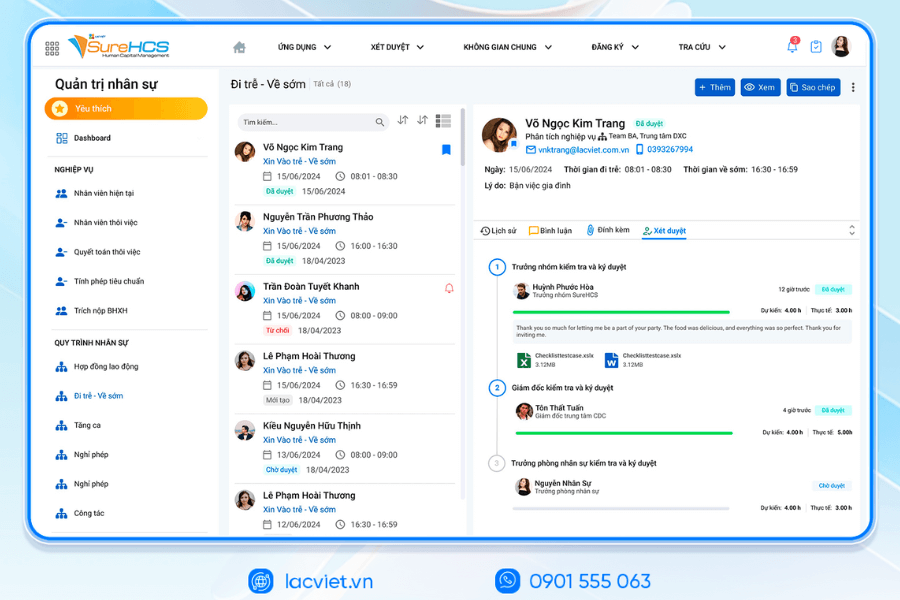

4. App hr software lacviet SureHCS to optimally process the payroll

In the context of business must handle the volume of data in hr is growing, the establishment management template payroll manually is not only time consuming but also potential risks flaws. This is the reason why many businesses turn to apply management software, payroll professional such as Vietnam SureHCS.

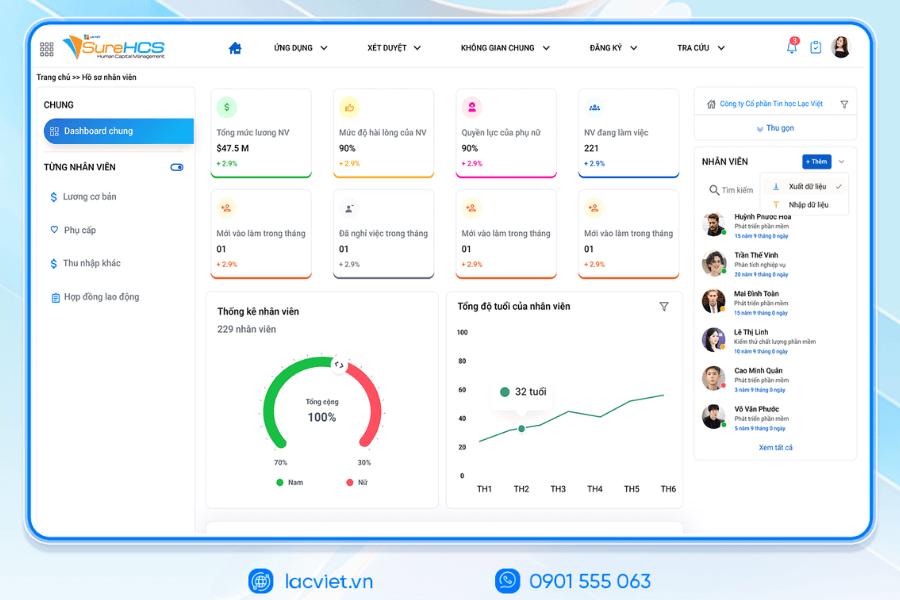

Practical benefits when using hr software lacviet SureHCS:

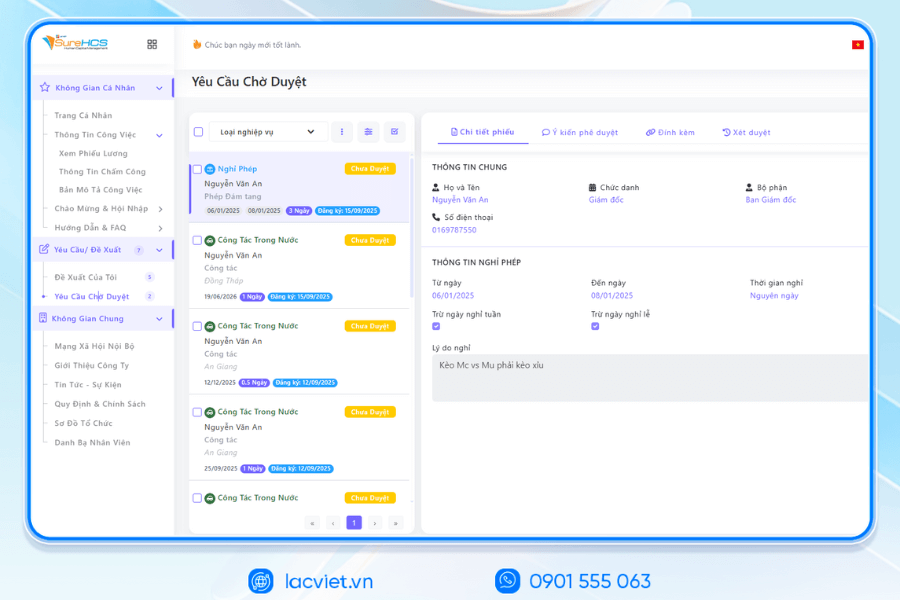

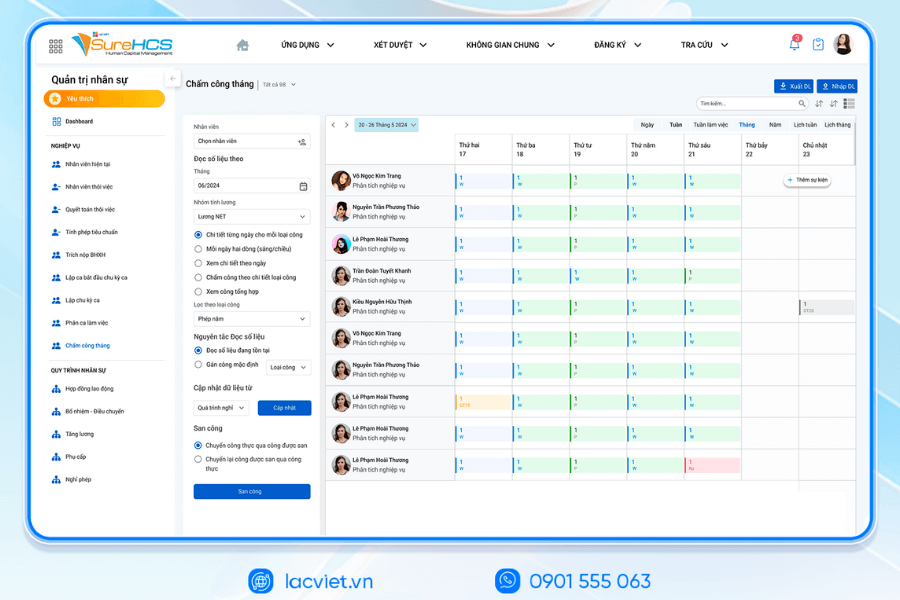

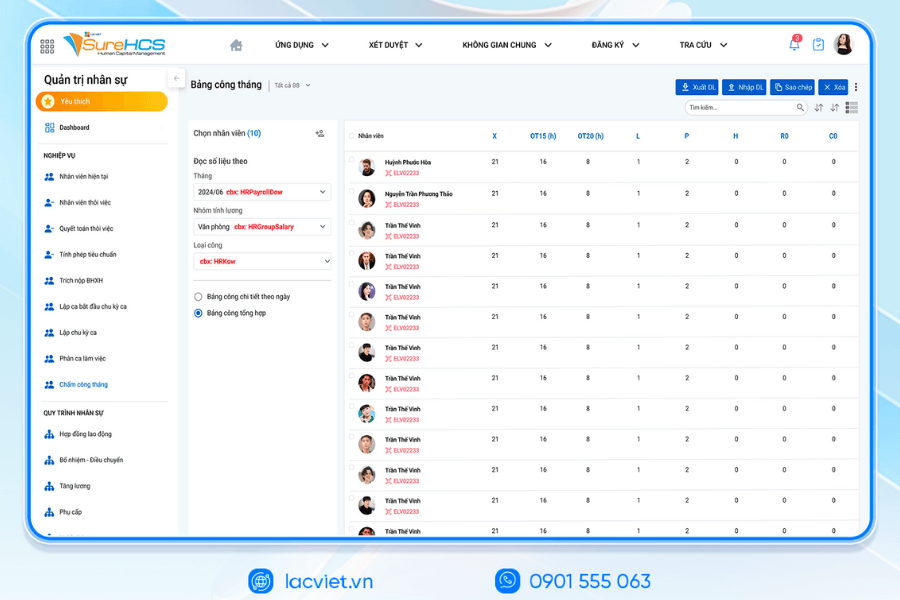

- Automation salary calculator: software direct link with attendance system, contract labor, data on bonus. Thanks to that payroll is automatically calculated, and minimize errors compared to the input sample employee payroll Excel.

- Tiết kiệm thời gian chi phí: Thời gian lập bảng lương có thể giảm tới 50% so với phương pháp truyền thống. Điều này giúp bộ phận nhân sự tập trung nhiều hơn vào các hoạt động mang tính chiến lược thay vì xử lý số liệu thủ công.

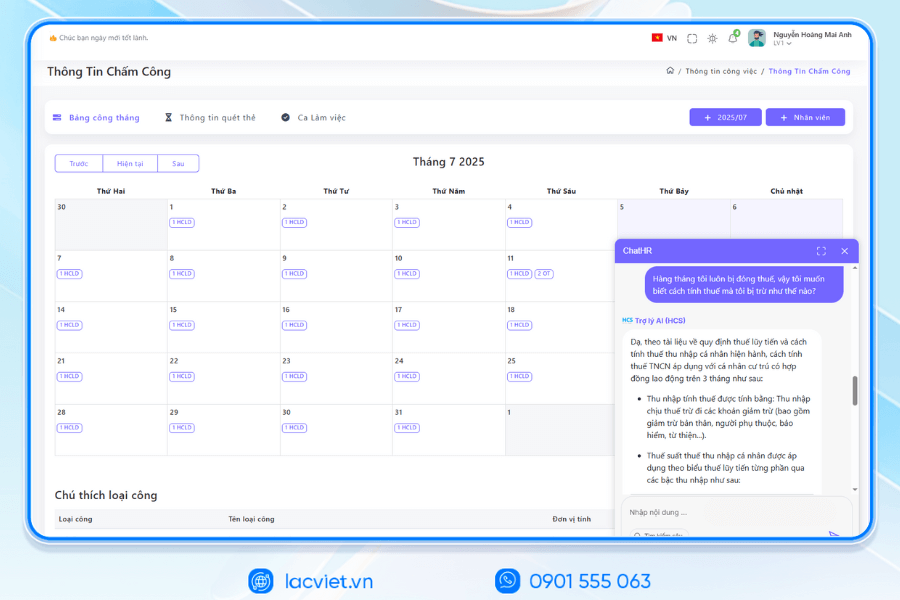

- Timely updates of the legal provisions: the System is designed to automatically update the level of SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance and tariff PIT according to the latest regulations of The state. Business no longer worry about the wrong level of deductible or penalties due to violation of regulations.

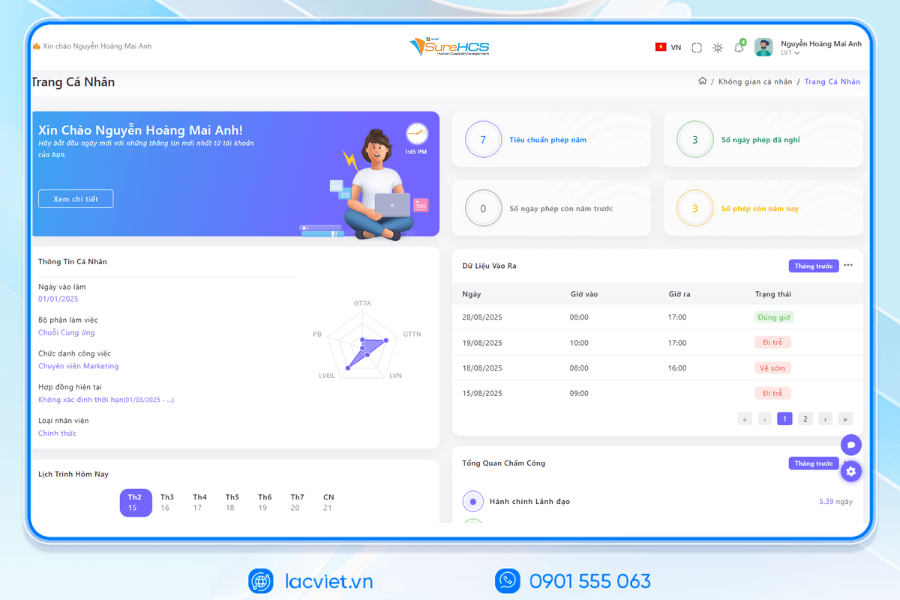

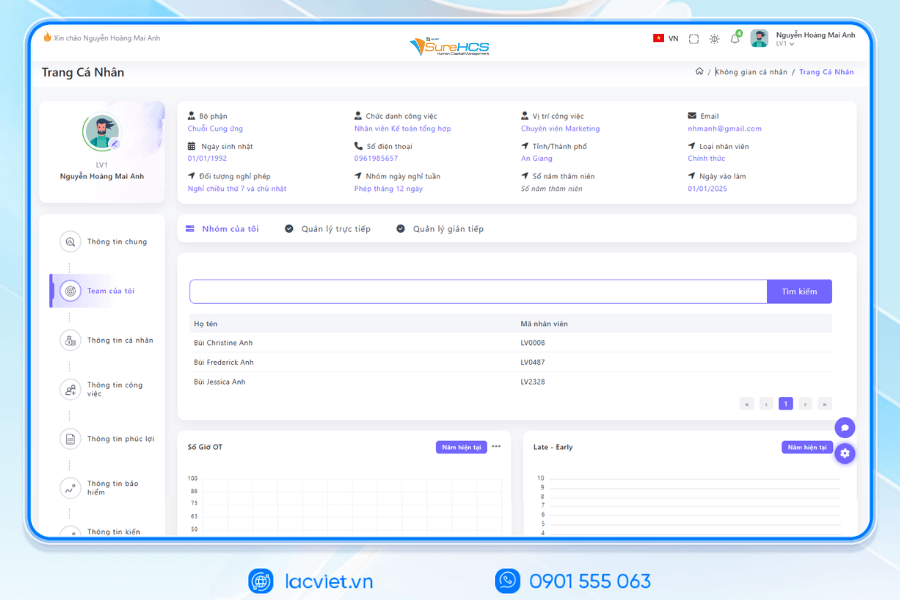

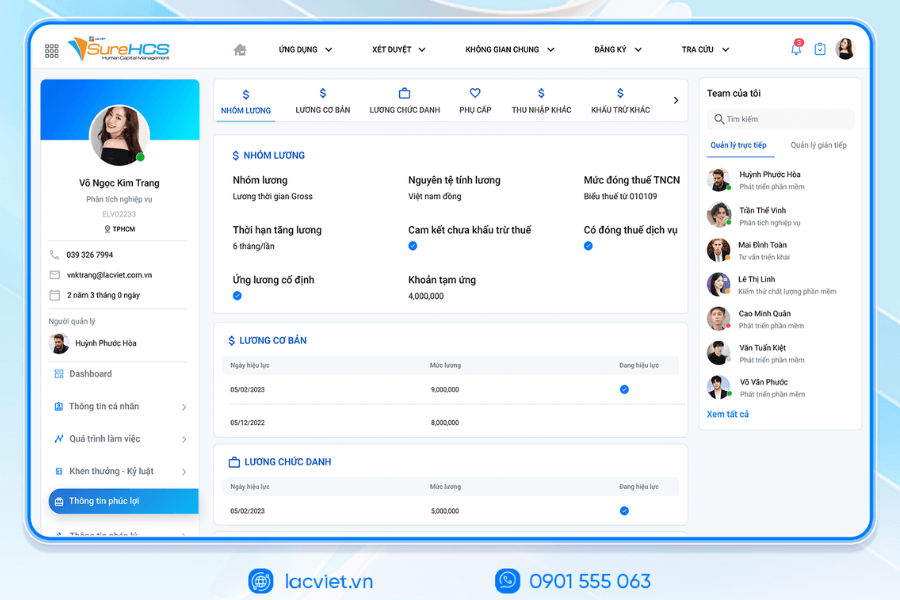

- Increased transparency, security: Each employee can login to lookup their paycheck, without passing through the room, at the same time data is encrypted, avoid leaking sensitive information.

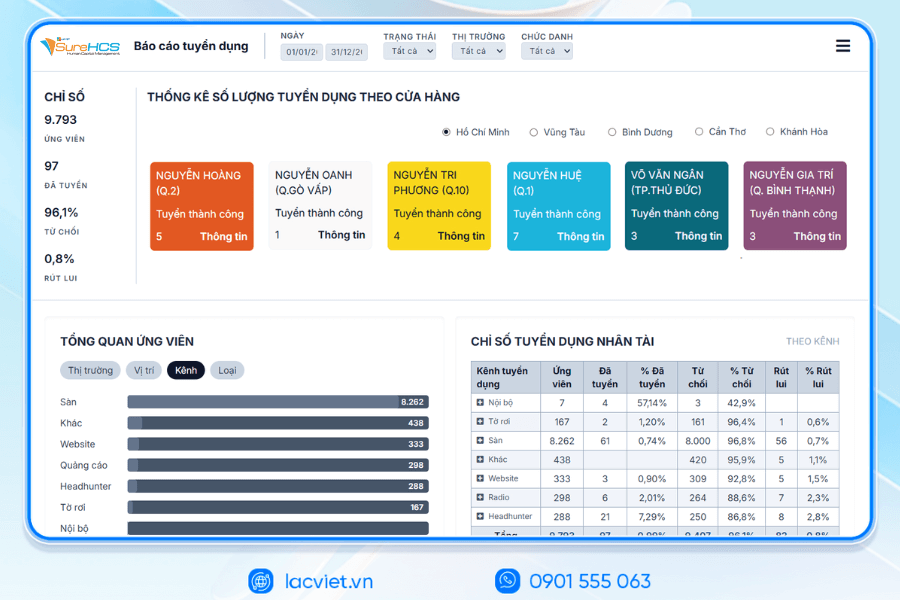

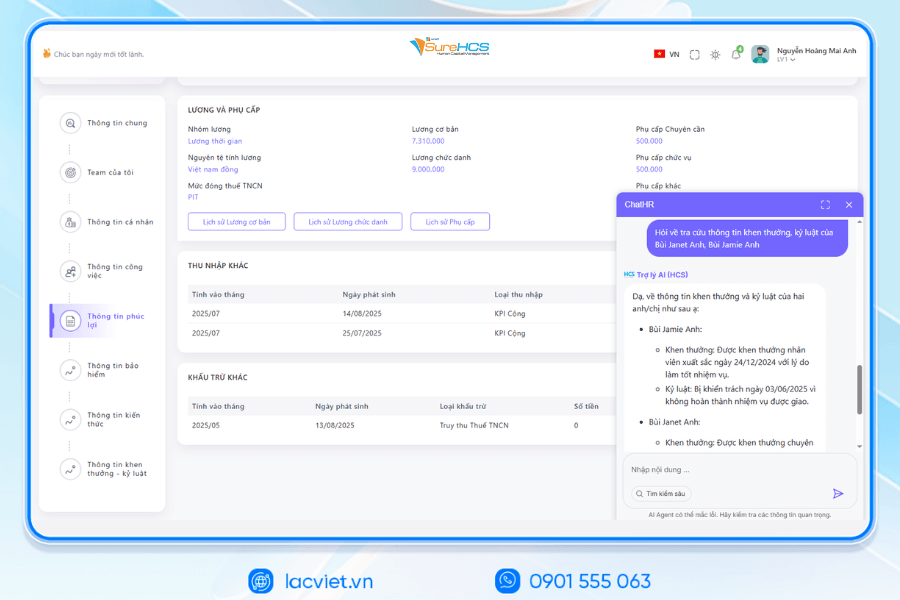

- Hỗ trợ phân tích ra quyết định: Ngoài lập bảng lương, LV SureHCS HRM còn cung cấp các báo cáo phân tích chi phí nhân sự theo phòng ban, vị trí, hoặc dự án. Đây là cơ sở giúp ban lãnh đạo kiểm soát ngân sách tối ưu phân bổ nguồn lực.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

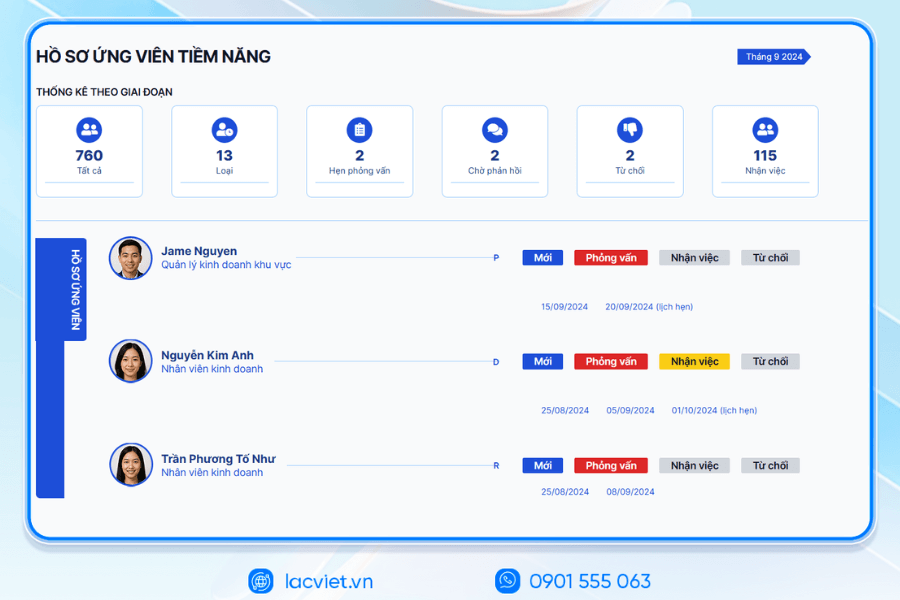

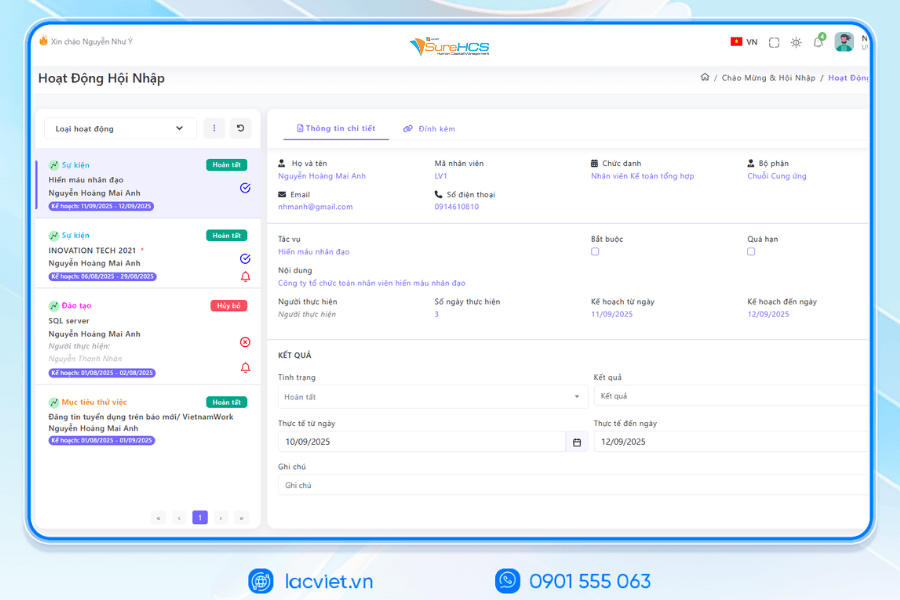

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

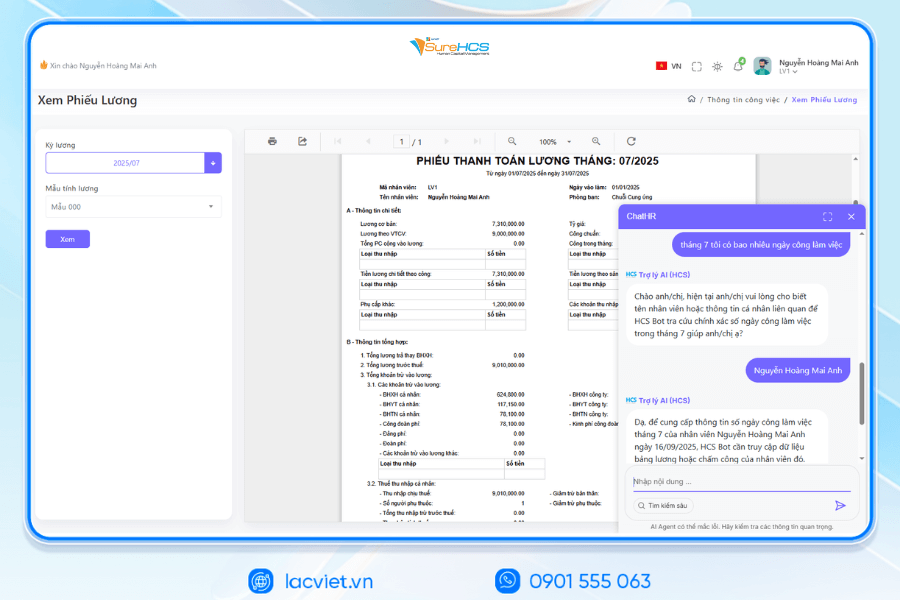

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

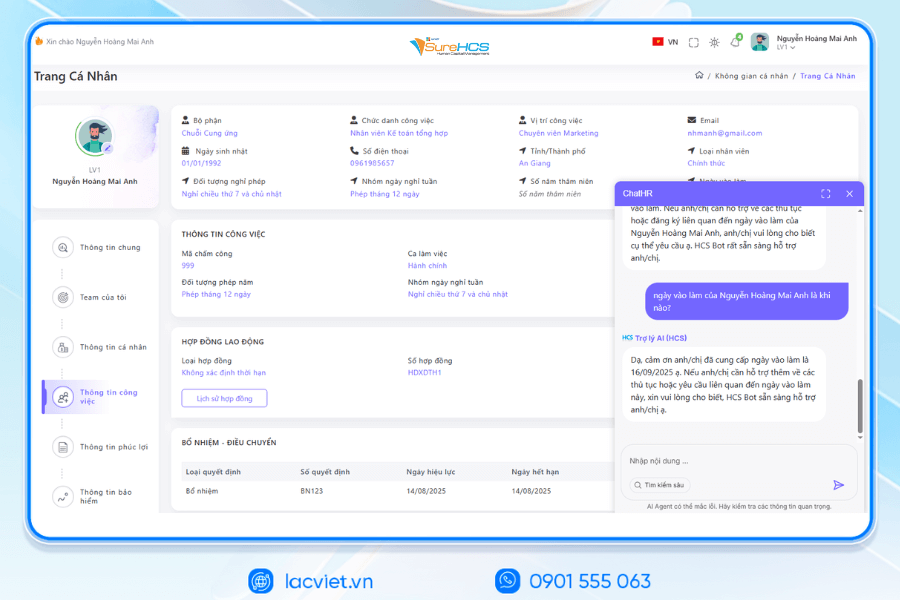

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

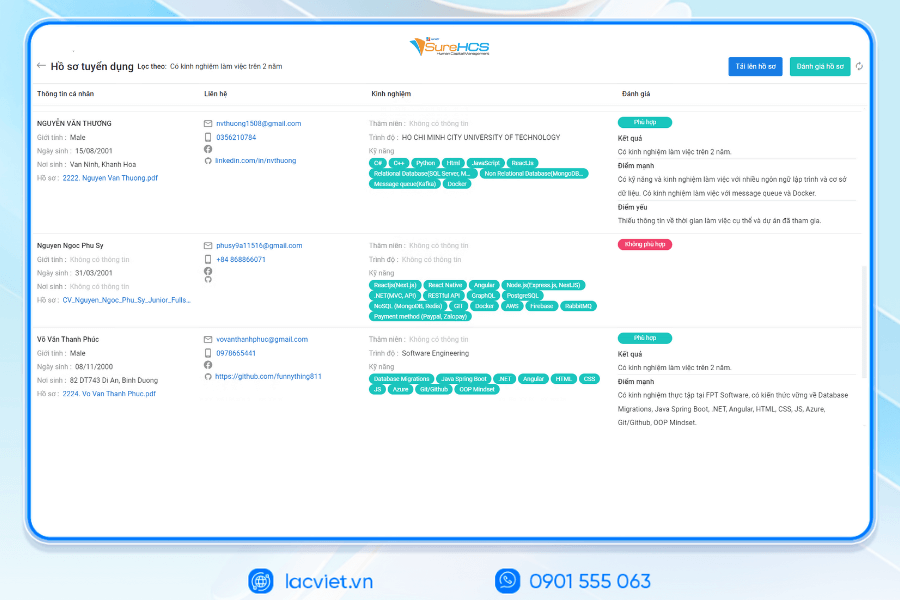

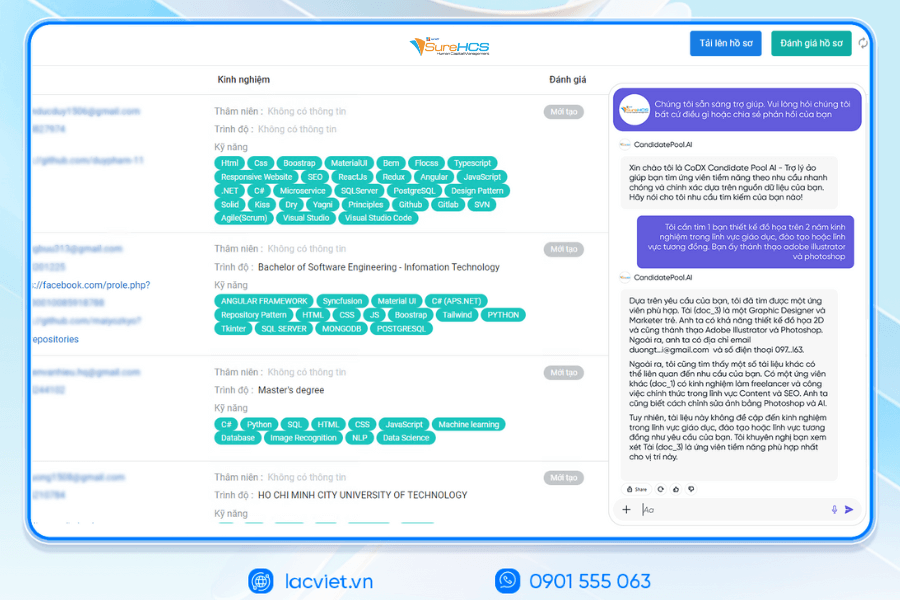

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Một mẫu bảng lương chuẩn được quản lý hiệu quả sẽ mang lại nhiều lợi ích thiết thực: đảm bảo tính chính xác, tuân thủ quy định pháp luật, tiết kiệm thời gian, nâng cao trải nghiệm nhân viên. Dù doanh nghiệp đang sử dụng Excel hay phần mềm chuyên dụng, điều quan trọng là cần xây dựng bảng lương theo cấu trúc rõ ràng, dễ kiểm soát và phù hợp với đặc thù hoạt động. Nếu muốn tối ưu quy trình, giảm rủi ro sai sót nâng cao tính minh bạch, doanh nghiệp nên cân nhắc áp dụng giải pháp software HRM như LV SureHCS để biến công tác lập bảng lương từ nhiệm vụ thủ công tốn kém thành quy trình tự động, nhanh chóng chính xác.

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD