In the process of operating the business, financial reporting is one of the most important tools help to assess the financial health, business efficiency and possibility of sustainable development of the organization. This is supposed to follow the rules of the governing body, are grounds for business for internal passport, cost control, financial planning, loan access, building trust with investors.

However, in fact many businesses, especially small and medium enterprises are still perplexed in selecting the sample financial statements excel suitable not understand the difference between circular 133 and circular 200, or just report in a way a form to “cope” with an audit or tax authorities, which has not yet fully exploit the value of in internal administration.

In this article, along Lac Viet learn:

- Any business needs financial reporting?

- Distinguish between the sample statements according to circular 133 and circular 200

- Solution financial reporting fast, accurate, transparent

1. Any business needs financial reporting? The role of practical value

Sample financial report is a collection of the standard forms issued by the Ministry of Finance, used to reflect the comprehensive situation of assets, liabilities, equity, revenue, expenses, cash flow of the business during an accounting period.

In other words if for business is a living organism, then financial statements is “health records” periodically demonstrate clear business are strong or weak, operating effectively or are showing signs of risk.

Under the provisions of the law on accounting and Vietnam, almost all the business is active legal must prepare financial reports, including:

- Private enterprise, LIMITED company, joint stock company, business FDI

- Business production, trade services, import export, logistics...

- The businesses are small and medium scale (apply circular 133)

- The big business or have the required audits, financial transparency (apply circular 200)

Note: The selection of circular apply does not depend on the home, which should be based on the size, industry, level of required financial transparency.

The establishment report form properly prepared not only to meet legal requirements but also bring more real value for business:

- Transparent with agency management: financial statements are important bases to the tax authority, the state auditor or the bank reviews the financial capacity of the enterprise.

- Support analysis, decision-making, internal: Leaders can rely on reports to track business performance, control costs, identify strong and weak points of financial, from which adjust strategies accordingly.

- To attract investors, partners: A set of clear statements, sample standard express the professionalism and transparency important factors that help enterprises build trust and expand cooperation.

- Assistance in obtaining loans and financing: Banks, credit institutions, always requires businesses to provide financial statements when making borrowing record. A set of standard reports will help expedite the review process, raising the possibility is approved.

In summary, sample financial statements are strategic tool in managing and developing business. Understanding proper use of the report template according to circular 133, 200 will help businesses save time, reduce errors, enhance credibility, increasing the ability to adapt to increasing requirements in business activity.

- Financial statements, what to include? 5 Types of financial statements company 2025

- Financial statements consolidated what is? Instructions for setting up and reading effective for business

- Guide to writing a financial report according to circular 200 details for the business

- Guide how to read financial statements easy to understand for business want to manage financial efficiency

2. Template financial statements excel file FULL circular 200 and 133

Properly understand the structure and function of each report template to help businesses ensure compliance with regulations, mining is the maximum value analysis, control, financial planning. The circular 133, circular 200 are specified in the form obligatory, however there are certain differences in number, level of detail, the practical application.

2.1 Sample financial statements according to circular 200 applied to large-scale enterprise

For large enterprises or business can demand transparency high financial need to prepare report service, audit, banks, or investors. Circular 200 rule 4 report template financial situation with content more detail:

- Balance sheet

- Report results of business activities

- Statements of cash flows (for the direct method or indirect)

- Notes to financial statements

In addition to the nature of legal systems form in TT200 also the basis for enterprises to deploy in-depth analysis than about cash flow, expenses, profitability, capital efficiency.

DOWNLOAD FULL SAMPLE FINANCIAL STATEMENTS ACCORDING TO CIRCULAR 200 HERE

Sample financial statements for the year – DOWNLOAD 1 FILE FULL

| STT | Model name report | Sample FINANCIAL statements |

| 1 | Balance sheet | Model number B 01 – DN |

| 2 | Report results of business activities | Model number B 02 – DN |

| 3 | Statements of cash flows | Model number B 03 – DN |

| 4 | Narrative report financing | Model number B 09 – DN |

Sample financial statements interim – DOWNLOAD 1 FILE FULL

| STT | Model name report | Sample FINANCIAL statements |

| 1 | Balance sheet accounting interim | Model number B 01a – DN |

| 2 | Report results of business activities between the | Model number B 02a – DN |

| 3 | Statements of cash flows interim | Model number B 03a – DN |

| 4 | Narrative report financial select filter | Model number B 09a – DN |

Sample financial statements interim summary – DOWNLOAD 1 FILE FULL

| STT | Model name report | Sample FINANCIAL statements |

| 1 | Balance sheet accounting interim | Model number B 01b – DN |

| 2 | Report results of business activities between the | Model number B 02b – DN |

| 3 | Statements of cash flows interim | Model number B-03b – DN |

| 4 | Narrative report financial select filter | Model number B 09a – DN |

2.2 Sample financial statements according to circular 133 apply for small and medium business

In accordance with the small business & medium are applicable accounting regime according to Circular 133/2016/TT-BTC.

Circular 133 rule 4 report template financial base, to form present simple, easy to set up, easy to understand:

- Balance sheet

- Report results of business activities

- Statements of cash flows (usually set according to the direct method)

- Notes to financial statements

This is the form that is minimalist in accordance with capacity limited accounting of the business at the same time still make sure provide sufficient information for the financial analysis at a basic level.

DOWNLOAD FULL SAMPLE FINANCIAL STATEMENTS ACCORDING TO CIRCULAR 133 HERE

Sample financial statements for small and medium business, continuous operation – DOWNLOAD 1 FILE FULL

| Model name report | Sample FINANCIAL statements |

| Report on the financial situation (required) | Model number B01a – DNN or Model number B01b – DNN |

| Report results of business activities (mandatory) | Model number B02 – DNN |

| Narrative financial statements (mandatory) | Model number B09 – DNN |

| Statements of cash flows (Recommended setting) | Model number B03 – DNN |

| Balance sheet account (mandatory) | Model number F01 – DNN |

Sample financial statements for small and medium enterprises do not operate continuously – DOWNLOAD 1 FILE FULL

| Model name report | Sample FINANCIAL statements |

| Report on the financial situation (required) | Model number B01 – DNNKLT |

| Report results of business activities (mandatory) | Model number B02 – DNN |

| Narrative financial statements (mandatory) | Model number B09 – DNNKLT |

| Statements of cash flows (Recommended setting) | Model number B03 – DNN |

Sample financial statements for business super small – DOWNLOAD 1 FILE FULL

| Model name report | Sample FINANCIAL statements |

| Report financial situation | Model number B01 – DNSN |

| Report results of business activities | Model number B02 – DNSN |

| Narrative report financing | Model number B09-DNSN |

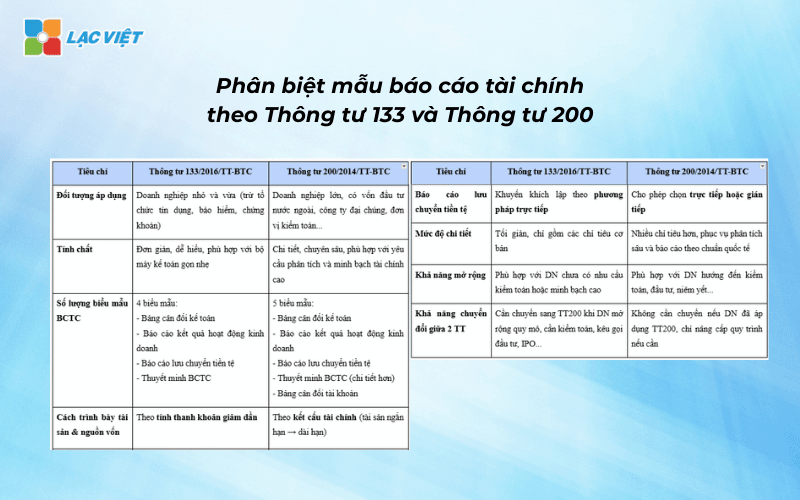

3. Differentiate report template financial situation, according to circular 133 and circular 200

Currently, the accounting system business in Vietnam is regulated mainly by two circular: circular 133/2016/TT-BTC, circular no. 200/2014/TT-BTC. Both have specific instructions about template financial statements, but markedly different in subjects applied, the level of detail, the way presented. Choosing the right circular in accordance with the scale, demand will help businesses save time, ensure compliance with regulations and extraction of maximum value management from the report.

| Content | Financial statements according to circular 133 | Financial statements according to circular 200 |

| Applicable objects | Circular 133, specifically designed for small and medium enterprises (SMES), active in all areas, except credit institutions, insurance, securities.

The presentation simple, minimize the content is not required, in accordance with the accounting machine compact and lightweight, less hr professional. |

Circular 200 applied to large-scale enterprises, enterprises with foreign investment, company, mass, or unit needs to audit, financial transparency at a high level.

High level of detail, more targets, more form, navigate to the ability to analyze financial depth to meet the reporting standards of international finance. |

| The number of the form | Circular 133 consists of 4 basic template: The balance sheet reports the results of operations, business reports, cash flows, notes to financial statements. |

Circular 200 includes 5 samples, which have more balance sheet accounts, explanations more detailed to help managers clearly see the financial picture overall. |

| Presentation of assets and capital | TT133 sort by liquidity descending (cash – public debt – inventory...) | TT200 arranged according to the financial structure, i.e. short-term assets before – long-term assets after (according to the logic of international accounting) |

| Statements of cash flows | TT133 encourage establishment under the direct method, more simple, more understandable for SMES. | TT200 allows businesses to choose between the direct method or indirect, in accordance with the requirements of the audit. |

Note: A business use TT133 will not have the complete target depth as business user TT200. If the business is in the process of development and has the direction of extension, the active acquainted with TT200 early will help easily integrated to meet the requirements of audit, investment cooperation in the future.

4. When business should switch between the two circular?

The selection or convert between circular 133, 200 should be based on the following factors:

- Business growth on the scale, there are many professional financial services more complex.

- Businesses need to audit financial statements (as required by the investors or foreign partners).

- Businesses want the financial transparency to borrow capital, calling for investment or IPO.

- Request from the board or shareholders about the upgrade system report.

To ensure conversion favorable business should:

- Consider using accounting software integrates the two systems of the form (as AccNet or LV-DX Accounting), allowing for automatic pick and conversion appropriate report form.

- Leverage the support tools of financial analysis in-depth as LV Financial AI Agent to compare indicators between the two systems, assess the level of ready conversion.

The clear distinction between reporting form circular 133, and 200 to help businesses choose the plan that fits with actual operation. More importantly, this also is a step strategies in building management system, financial transparency, efficiency, availability, long-term development.

5. Manual report form efficiency in business

Financial reporting the correct form is the first step, but use them effectively to serve operators, decision making, developing new business is the core objective. Here are three common ways businesses can apply to optimize value from the template financial statements excel circular 133 and 200.

5.1 financial reporting using Excel

For small businesses with no conditions, implementing accounting software specialist, Excel is still the familiar tools easy to reach. The preparation of financial statements in Excel are often based on:

- Data from bookkeeping records or file discrete

- The calculation formula is set according to the report template of circular 133 or 200

Note when using Excel:

- Check out the recipe periodically, especially the function calculates the sum function, the link between the sheet

- Limited operation copy – paste to avoid false data between states

- Setting process to cross-check the internal ago when submitting reports to the management

Actual value:

- Solution save the initial cost for new business establishment

- Easy to edit, update when new

- However, should only be used for the first stage, when the data volume is not big, complexity is not high

5.2 Using accounting software support statements automatically

When business grows, the number of transactions increase, the scale of assets, financial obligations expansion, the establishment of financial statements in Excel is prone to errors, time consuming. At this time, use accounting software dedicated is more optimal solutions.

AccNet and LV-DX Accounting are two typical software is designed for businesses in Vietnam, with the ability to:

- Automatically aggregate data from the journal, ledger, balance sheet account

- Reporting in accordance with the form prescribed by circular 133 and circular 200

- Warning skewed data, cross check before printing or submitting reports

- Custom form as required audit or internal report

Enterprise value received:

- Save time reporting bank

- Minimize the risks of errors in stitches calculation, presentation

- Easy collation, storage, retrieval when the need to check, explanations

Increase the level of professional, financial transparency when working with investors or banks

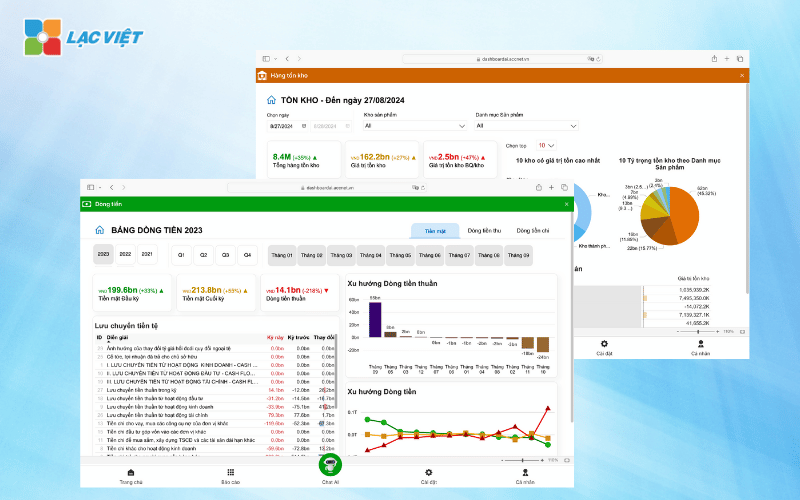

5.3 Leverage financial statements to analyze and forecast

A common mistake in many businesses is the only set of financial statements to file that does not exploit information in which to serve internal analysis. In fact, each sample reports are bring in data, strategy, help in business:

- Evaluate business performance according to each states

- Cost control, determine the point of losing balance cash flow

- Analysis of profitability, financial leverage, capital efficiency

To improve the quality of analysis, the business should be combined with the tool support smart as LV Financial AI Agent – platform integrated artificial intelligence AI in financial statements.

LV Financial AI Agent brings the outstanding value as:

- Automatically read the accounting data, calculate the financial indicators as important as ROA (return on assets), ROE (return on equity), profit margin, inventory turnover...

- Compare data by industry, by states, or according to your goals, help leadership detect trends unusual

- Hint financial action reasonable, for example: adjust operating costs, reduce risk, cash flow, or increase the effectiveness of investments in working capital

Benefits for business:

- Don't need a financial expert can still understand the “financial situation, really”

- Decision-making faster and more accurate in terms of volatility

- Variable financial statements from “mandatory” tools, financial management, strategy

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

In summary, the model financial statements do not just form administration, which is the “key” to business performance management, risk control, plan for your future. Business should choose the right solution with resources, but need to proceed to the automation, analysis, decision-making based on financial data to really leverage the power of the system this report.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)