In the digital era, data is a strategic resource to help businesses make decisions more accurate. However, the extraction of financial data in an efficient way is still the problem unsolvable for many businesses due to the volume of information, giant tits, high complexity and requires in-depth analysis.

LV Financial AI Agent out life as a groundbreaking solution to help businesses leverage the power of AI to automatically analyze financial statements, forecast trends, support decisions based on data. Instead take hours or even days, to general report, enterprises can access financial information, real-time analysis of key indicators, and get the optimal proposal in just a few seconds.

So LV Financial AI Agent to help business financial decisions, how effective? This article Lac Viet will analyze in detail the benefits that this solution brings to the problem decision based on the data of the business.

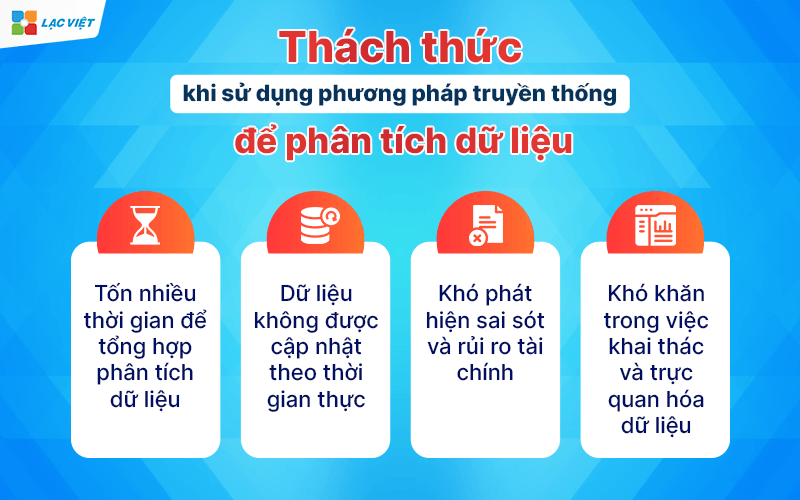

1. The challenge when businesses use traditional methods to analyze data

Although financial data are always available in the business, but the collection, processing data analysis in the traditional way encounter many challenges such as:

1.1. Spending a lot of time to aggregated data analysis

Most businesses today are still using Excel spreadsheet or accounting software conventional to synthetic data. This process requires multiple stages such as data entry, control, data, test errors,... lead to spending hours, even days, to complete a financial statement.

For example, A business wants to know the financial situation of months ago usually have to wait for the accounting department collects data from many different sources, processing, synthesis, and test data leads to bad financial decisions delayed.

1.2. Data is not updated in real time

Analyze financial data by traditional methods only provide perspective on the past, instead of reflecting the current situation. Businesses can make decisions based on the outdated material, reduce the accuracy of flexibility in business.

For example, A manufacturing company may not realize the amount of inventory is increasing rapidly due to falling sales, because financial statements are aggregated more slowly than it actually is. This can lead to a situation of inventory management is not effective, increasing the cost of storage is not necessary.

1.3. Difficult to detect flaws financial risk

When financial data is entered manually, it is difficult to detect errors immediately. A figure entered the wrong can completely change a financial report, leading to the wrong decisions such as investing in the wrong place, manage the cost of poor or cash flow forecast is not accurate.

For example, A company can predict false profits next quarter because of an important cost is not recorded in the financial statements the right time. This makes business decisions, expand the scale of which does not foresee the financial risk.

1.4. The difficulty in the extraction of data visualizations

One of the big problems when analyzing traditional financial is the data is not presented in a visually understandable way. Many business leaders do not have the financial expertise will have difficulty in reading out the data sheets dense.

For example, A CEO wants to know the business performance in each quarter, but to see dozens of pages of reports with numbers, dry, causing difficulty in making decisions quickly.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Core Banking is what? Solution upgrade the core system safety, speed, flexibility

- Convert numbers in the banking sector: The state, challenging & strategic solutions

2. Importance of decision making based on data in the enterprise

In the business environment of current decisions can no longer rely only on experience or feeling. Businesses need to rely on data to make accurate decisions, reduce risk and optimize performance.

The use of the data platform to help businesses capture the market trends, understand the situation, financial forecast, the potential risks, thereby making the appropriate strategy. A study of McKinsey for see, the business application decisions based on data, have the ability to improve business performance, up to 20-30% compared to the business not using data.

However, in order to take maximum advantage of the power of data, businesses need to have analytical tools powerful data handling fast, accurate, providing information useful in real-time. This is the reason ANYBODY becomes an important factor in the transition of the business, especially in the financial sector – where big data complex should be handled in a systematic way.

3. Decisions based on what is data?

In the past, business decisions are often based on experience, feelings or aggregated reports from multiple sources. However, this approach is no longer relevant in the digital age, when data become core elements to evaluate the effectiveness of business operations.

Decisions based on data (Data-Driven Decision Making – DDDM) is the process of using real data to analyze and evaluate the given business decisions instead of relying on speculation. This helps businesses minimize risk, optimize business strategy to increase operational efficiency.

For example, A retail chain wants to open new stores. If the decision based on gut feeling, businesses can choose the position according to personal evaluation. But if use data, businesses can analyze purchasing trends, population density, customer behavior, traffic flow, from which the selected location has the potential highest.

In the field of financial decisions based on data, especially important. Business leaders need to understand the financial situation in real time to be able to manage cash flow, optimize cost, performance reviews, business, anticipated financial trends. The application of technology WHO help businesses take corners look more accurate about the financial health of yourself.

4. What factors affect decision-making based on data

Although data brings many benefits, but not any data that businesses can correct decisions. A number of important factors affecting the decision-making process based on data including:

4.1. Data quality

Data is the foundation of every decision, but if the data is incorrect, incomplete or not updated, then decided to take out possible mistakes.

For example: A manufacturing enterprise would like to evaluate the performance of the production line. If the collected data is missing or has errors in data entry, business can put in place plans to invest in the wrong direction, wasting resources.

To ensure data quality, good business need:

- Collect data from multiple reliable sources.

- Filter cleaning data regularly to remove inaccurate information.

- Normalize data to ensure consistency in analysis.

4.2. Speed analysis data processing

In business, time is important factor. If the business takes too much time to aggregate data analysis, then the business opportunity may have passed.

For example, A business e-commerce needs analysis trend buy in the high season to take out strategic price match. If the analysis takes a few weeks, the data may be outdated, and businesses miss opportunities to optimize revenue.

This is why technology analyzes real-time data become an important part in the decision-making process.

4.3. The intuitive nature of the data

One of the biggest challenges of the analysis of the data is by presenting results. If the information only stop at the table of data barrenness, business leaders may have difficulty in capturing important information.

For example, A CFO would like to assess the financial situation of the company in the past year. If only based on the Excel sheet with thousands of lines of data, finding trends or unusual points will be very difficult. However, if the data is displayed in chart form dynamic model forecast, the CFO can quickly make a decision exactly.

4.4. App AI in decision support

AI not only helps in processing data analysis faster, but also can automatically detect trends, risk warning and proposed optimal scheme.

For example, A business can use AI to analyze cash flow forecasting, liquidity in the next 6 months. If SOMEONE finds signs of imbalance, cash flow, system will automatically alert the proposed scheme as to optimize costs, enhance debt collection or looking for capital replacement.

5. LV Financial AI Agent – solutions support decisions based on data

In the context of business is looking for the smart tools to enhance decision-making abilities, LV Financial AI Agent featured as a finance assistant, virtual help businesses analyze data, detect risks and making financial decisions accurately in real-time.

5.1. Ways LV Financial AI Agent activities in financial analysis

Automatically collected handle financial data in real time

One of the great challenges of business is the update financial data in a correct way quickly. LV Financial AI Agent to help businesses connect directly with the accounting system, ERP to collect information, revenue, costs, cash flow, debts and profits in real time. This helps businesses do not have to wait synthesis report from the accounting department that can access data at any time.

For example, A CEO wants to know the financial condition current of companies which does not require general accounting reports manually. With just a few taps on LV Financial AI Agent, the system will provide the right balance sheet latest accompanied by trend analysis, financial help CEO decision immediately.

Analysis of financial indicators important

Financial data is not just numbers, but also contains trends, unusual signs. AI can analyze data more deeply to help businesses identify the factors that impact profitability and cash flow.

- Cash flow: Identify business that are experiencing liquidity problems or not, forecasts, status, cash in next time.

- Profit: compare business performance according to each month/quarter/year, indicating the costs unreasonable.

- Public debt: track your accounts receivable, detect customers delay payments and the proposed plan debt collection.

- Inventory: Determine the inventory optimization to minimize the cost of storage while ensuring supply.

Use AI to predict financial trends

Don't just stop at the analysis of the current situation, LV Financial AI Agent can predict financial trends based on historical data. The system has the ability to:

- Forecast future revenues based on sales trends and market.

- Early warning of financial risks, for example, if operating costs tend to spike, WHO will report to the business can control schemes.

- The proposed financial plan, such as if the cash flow at risk of deficiency, WHO can propose the optimal scheme as relax the debt, cut costs, or search for new sources of capital.

5.2. Salient features of LV Financial AI Agent in decision support

Create financial reports automatically with high accuracy

- Instead of losing hours and synthetic statements, LV Financial AI Agent automatically generate reports in just a few seconds. Businesses can export reports like balance sheet, accounting, reporting, cash flow, profit and loss statement which does not need operation manually.

- For example: When need to present financial statements in the board meeting, instead of having to ask the accounting department to prepare earlier days, leaders can access data instantly from the AI system.

Forecast cash flow detection risk

- AI systems have the ability to detect trends in spending unusual predict fluctuations in cash flow, early warning of financial problems.

- For example: If the business risk of shortage of cash flow in the next 3 months, LV Financial AI Agent will propose the project as cost-cutting, optimal public debt or looking for loan deals.

Advice based on the data, propose optimal financial

- Don't just stop at providing data system analysis given specific recommendations.

- For example, If the system detects revenues signs of decline due to rising costs, WHO can suggest strategies such as cut the expenses not effective, optimal price sale or restructuring of the product portfolio.

Integrated AI behavior analysis, financial help detect trends unusual

- WHO can identify the anomalies in financial data to help businesses detect fraud and accounting errors or suspicious transactions.

- For example, If a spending account suddenly appear without previous history, the system sends immediate alert to help businesses check handled promptly.

Display visual reports with charts animal

- Instead of reading the data sheets, complex, businesses can see the financial statements in form of visual charts to help identify trends in an easy way.

- For example, A CFO would like to compare the revenue in each month of the year. Instead of reading Excel table, they can use LV Financial AI Agent to see the column chart or line chart, to help analyze more quickly.

6. Benefits of LV Financial AI Agent in making decisions based on data

6.1. Minimize errors, improve accuracy

One of the biggest challenges when business financial analysis is wrong data due to data entry or processing of complex reports. These small errors can lead to wrong decisions, cause financial harm, or affect the long-term strategy.

LV Financial AI Agent to help automate the process of collecting, synthesizing, analyzing data, mitigate fully the risks of errors due to human.

Besides, AI can analyze a series of financial indicators at the same time, helps enterprises with more holistic view of the financial situation which is not limited by the ability to handle data.

6.2. Increase the speed of decision making

In the environment of modern business, the speed of decision making is the key element to create competitive advantage. If businesses take daily, or even weekly to general analysis, financial statements, they may miss an investment opportunity, not to react ago, the market risk or making a decision is not timely.

LV Financial AI Agent to help businesses access to analysis of financial data in real time, providing reports in just a few seconds instead of hours.

For example, A retail chain wants to optimal amount of inventory before the peak season. If using the traditional method, they might have to wait for a report from each store, which leads to delay in the adjustment plan import. But with AI, sales data, inventory levels and the propensity to consume is updated immediately, to help businesses adjust plans to enter time, avoid excess inventory or shortage of goods.

In addition, WHO does not only provide data, but also can automatically aggregate information, detect trends, make forecasts help businesses make accurate decisions before the market volatility.

6.3. Support leaders in making strategic financial

One of the most important values of LV Financial AI Agent is capable of providing in-depth analysis about the financial health of the business, help leaders put out financial strategies based on data instead of hunches.

- WHO can compare financial performance over time, helps business to understand the growth in revenue, profits and expenses is important.

- Support rating the performance level of the investment, to help business decision should continue, expand or cut costs now.

- Trend forecasting, finance, thereby making the financial planning short-term/long-term in a more scientific manner.

For example, A technology company, is considering expansion into new markets. If only based on experience, leadership may have difficulty in assessing the financial capacity. But with LV Financial AI Agent, they can forecast cash flow analysis, investment costs and estimated profits from that given the decision to expand the market based on data instead of hunches.

6.4. To improve performance optimal budget

Many businesses experience problems in controlling costs, track budgets, and allocate resources effectively. If there is no clear data, businesses can spend wasted without realizing or not make maximum use of investments.

LV Financial AI Agent to help businesses monitor details all expenditures, analyze the performance and optimize the budget based on actual data.

- Specify the terms, inefficient spending, proposed cuts to save costs.

- Tracking cash flow in real time, to help businesses control over financial more closely.

- Optimal budget by allocating a reasonable cost, ensuring resources are used most effectively.

LV Financial AI Agent is not merely a tool of financial analysis, but also a smart assistant to help businesses decisions based on data a fast, accurate and optimal. Contact now to get a free DEMO!!!.