Salary is a key factor to decide the working performance of employees is also one of the major expenses of the business. Applying employee wage calculation accuracy, transparency in accordance with legal regulations not only ensure the benefits for the workers but also help enterprises manage the budget effectively and limit legal risks.

Understand the formula for calculating the salary from form of payroll over time, product to exchange or revenue will help medium businesses comply with the law, just optimal financial resources. More importantly, a mechanism pay reasonable to create a foundation for a long-term commitment between the employee and the organization from which promotes increased productivity competitive advantage.

The same Lac Viet find out details about the calculation of wages in the enterprise today.

1. Overview of wage & salary calculator in business

1.1 what's the salary?

Salary is the amount of money including salary according to work/titles, the allowance with the additional payments, if any, that the employer paid to the employee under the agreement to perform the job (or job title) is recorded in the employment contract or labor agreement. This is mandated benefits of workers and liabilities of the business according to The Vietnam Labor law.

Properly understand about salary right from the start is an essential step to business:

- Determine the exact account to be paid to the employee each pay period, avoid errors, violation of the law.

- As the basis of calculation of insurance premiums, personal income tax, other benefits.

- Reduce internal disputes about rights when the payment of the monthly salary.

A simple: salary is the reciprocal which workers receive money in exchange for time, talent and effort spent to perform work for the business.

1.2 The component structure of wages in the enterprise

To apply the formula for calculating the salary right business need to separate clearly the main component in wages:

- Salary under a contract or agreement: This is the most basic part, be clearly stated in the labor contract, usually monthly salary, wage day or hourly. This number reflects the main income based on duration or results that workers complete the work.

- Allowance: Is the account paid in addition to salary to compensate for factors such as location, work hard, working conditions, heavy lifting, the standard of living in the region,... For example: the allowance position level senior level of responsibility.

- The additional payments: includes the bonus according to performance bonuses for attendance reward according to KPI/OKR and possibly the account according to the internal regulations of other business if the agreement is clear.

- The mandatory deductions: Business must deductions by law, such as social insurance, health insurance, unemployment insurance, individual income tax. This is a legal obligation to ensure the long-term interests for workers, comply with tax regulations.

Clearly distinguish these components help your business payroll, transparent, accurate, full legal responsibility.

1.2. The legal basis of salary should comply with

How to calculate salary of business in Vietnam is governed by various legal documents, the most important of which is The Labour code 2019, Decree 145/2020/ND-CP and circular guide. These texts clearly stated principles, forms, pay, payment term, the obligations of the employer.

- According To Article 94 The Labour code 2019businesses have to pay directly, in full on time for workers, not be forced or delayed no reason. In addition, Article 90 also confirms the level of wages are not lower than minimum wages issued by The government.

- Decree 145/2020/ND-CP additional details about the construction of stairs, payroll, taxonomies, labor, and requires businesses to publicly these regulations to ensure transparency helps to limit labor disputes, strengthen the confidence of employees.

From the perspective of practicality, understanding the legal basis not only help businesses avoid the risk of sanctions (fines can be up to 100 million for violating regulations on paid according to the Decree 12/2022/ND-CP), but also create a platform to set the formula for calculating the salary transparent, easy to understand easy to apply for each group of employees.

2. The factors that impact the calculation of wages in the enterprise

The determination of the real wage paid to employees not only based on a fixed formula which depends on many different factors. Understanding these factors help businesses build wage mechanism suitable medium meet the demand for workers, while ensuring financial performance.

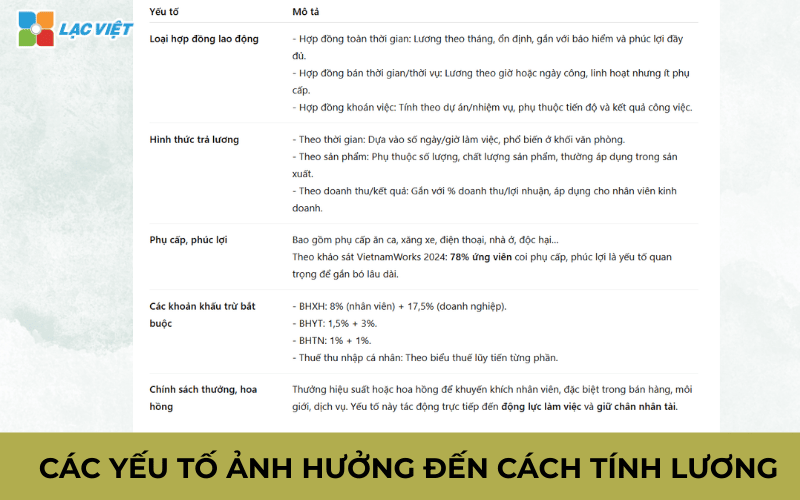

Type of contract labor

- Contract full-time regular apply how to calculate salary according to months, more stable and associated with the account, insurance, benefits in full.

- Contract part-time or seasonal, usually paid by the hour or by day work, flexible but less allowance than.

- Contract exchange applying for project or particular task, fastened with the progress and results of work.

Form of payroll

- From time to time: Based on the number of days/hours actually worked, commonly applied for office blocks.

- According to the product: Salary depends on the quantity and quality of the finished product, in accordance with the manufacturing enterprise.

- According to the revenue/results: Tied to the rate of % of revenue or profits, often used for business employees.

Allowance benefits

- Includes high level health care, gasoline, telephone, accommodation, toxic...

- According to the survey VietnamWorks 2024, 78% of applicants considered to allowances and benefits are important factors when decided to stick with the company long term.

The mandatory deductions

- SOCIAL insurance (8% from employees, 17.5% of the business), health INSURANCE (1,5% + 3%), UNEMPLOYMENT insurance (1% + 1%) according to the provisions of the Law on social insurance and Employment Law.

- Personal income tax according to the progressive tax each section.

Bonus policy roses

- Businesses often additional account performance bonuses, or commissions to encourage employees, especially in the areas of sales, brokerage, service.

- This direct impact on motivation and retain talent.

When fully incorporated elements on business will get how to calculate employee wages, flexible, fair in accordance with the peculiarities of operation thereby improving effective personnel administration, optimal wage costs.

3. The calculation of staff salaries popular with detailed recipe in business

In fact, every business will choose the method, recipe calculator, different salaries, depending on the particular industry, personnel structure and management objective. Choosing the right method not only ensures the accuracy, transparency but also contribute to improving motivation and retain talent optimal staffing costs.

8 How to calculate employee wages popular with detailed recipe in business

- How to calculate hourly wage the fact

- How to calculate wage mixture (combination of methods)

- Calculate salary based on work performance indicators (KPIs/OKRs)

- Calculate salary according to the 3P (Position – Person – Performance)

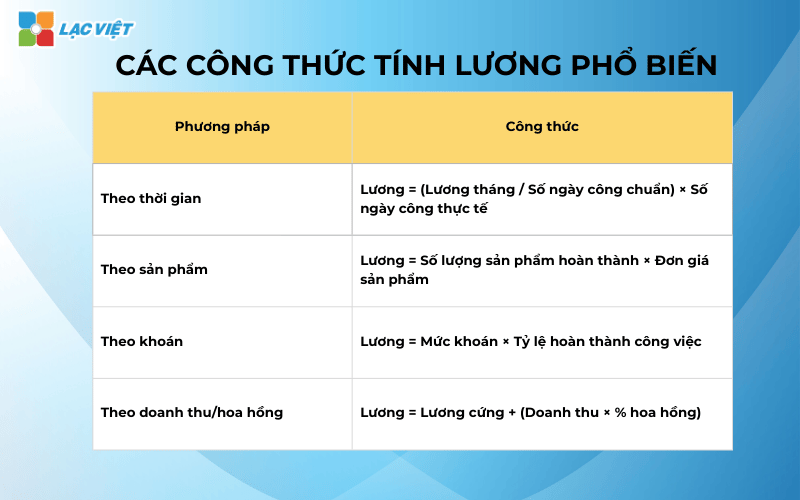

- How to calculate salary according to the time

- How to calculate salary according to the product

- How to calculate salary according to the revenue or commission

- How to calculate salary exchange

3.1. How to calculate hourly wage the fact

Principle

- Salaries are calculated based on the actual time the employee worked, instead of a fixed salary per month.

- In accordance with part-time employees (part-time), time service, or freelancer.

Formula: Wage = the Number of hours actually worked × Unit price hours

Unit price-hours = (month salary standard / Number of days the standard) / Number of working hours/day.

For example:

- Salary standard: 10.400.000 VND

- Date of prepared: 26 days/month

- Working hours standard: 8 hours/day

- Unit price hours = 10.400.000 / (26 × 8) = 50.000 VND/hour.

- Employees work 60 hours/month → Salary = 60 × 50.000 = 3.000.000 VND.

| Advantages | Cons |

|

|

Business application

- Restaurants, cafes, retail, services, events.

- The work time, such as PG, clerk occasion, staff input.

3.2. How to calculate wage mixture (combination of methods)

Principle

- Business combination at least two methods of calculating wages to ensure both stability and creating motivation for employees.

- Very popular because is suitable with the majority of industry.

Formula (depending on model)

Salary = basic Salary (for the time) + additional income (according to the performance/products/rose)

Some models frequently:

- Business – sales: Salary = Salary tits (time) + commission sales.

For example: Salary, hardcore 6.000.000 + 2% of revenue. Sales reached 200.000.000 → commissions = 4.000.000 → Wage = 10.000.000 VND.

- Production: Salary = basic Salary (for the time) + Money products go beyond the norm.

For example: basic Salary 7.000.000. The 500 products per month. Staff is 650 products, the unit price of 5,000/sp crossing → more Bonus 150 × 5.000 = 750.000 → Wage = 7.750.000 VND.

- Project management: Salary = fixed Salary + Bonuses according to the results of the project.

| Advantages | Cons |

|

|

Business application

- Business, commercial, retail, real estate, insurance (business).

- Production plant business plan to the clear product.

- Service units have a project, a contract under stages.

3.3. Calculate salary based on work performance indicators (KPIs/OKRs)

Principle

- The income of employees attached directly to complete level goals.

- This way just to ensure employees have fixed income, just create motivation to strive through rewards as a result.

Formula: monthly Salary = basic Salary + Bonus KPI/OKR

- Basic salary: Account fixed pay under the agreement, often accounting for 60-80% of the total income.

- Bonus KPI/OKR: Charged at the rate of goal completion.

For example:

- KPI reaches 100% → Get 100% bonus KPI.

- KPI reaches 80% → Get 80% bonus KPI.

- KPI exceeds 120% → can be rewarded excess (if business rules).

| Advantages | Cons |

|

|

Business application:

- Sales, marketing, customer care.

- Middle managers, senior with the goal of growth/sales/operational efficiency.

3.4. Calculate salary according to the 3P (Position – Person – Performance)

Principle: the wage System 3P ensure fair – competition – encourage:

- P1 – Position (job location): salary according to place value in the organization structure.

- P2 – Person (individual capacity): adjust to increase/decrease according to skills, experience, seniority.

- P3 – Performance (results of work): associated with the actual accomplishment through KPI/OKR.

Formula: Wage = P1 + P2 + P3

- P1 – Wage location: Business-frame construction salaries by job title, based on the value of the work compare to the market.

- P2 – Wage capacity: determined based on the frame capacity (skills, expertise, soft skills, certificates).

- P3 – Wage results: Calculated according to the level of complete KPI/OKR or performance.

| Advantages | Cons |

|

Complex systems, there should be:

Spending a lot of time and resources to deploy and maintain. |

Business application

- Corporations, companies, big businesses are switching models hr professional.

- Match areas to retain personnel good at: technology, banking and finance, FMCG, professional services.

3.5. How to calculate salary according to the time

Principle

- Workers are paid wages based on the time actually worked compared with standard regulations (days, hours, months).

- Suitable for work, high stability, less measured by the output product.

Formula

- Salary: a fixed level under the contract.

- The daily wage = Salary\the Number of days the standard

- Hourly wage = the Number of hours worked in the day * daily wage

Illustrative example

- Monthly salary under the contract: 13.000.000 USD.

- The number of days the standard in months: 26 days.

- Working hours standard: 8 hours/day.

- Staff to work full 24 days.

- Pay date = 13.000.000 / 26 = 500.000 VND.

- Real wage = 500.000 × 24 = 12.000.000 VND.

| Advantages | Cons |

|

|

Business application: Office, administrative, corporate, professional services, state agencies.

3.6. How to calculate salary according to the product

Principle

- Income depends on the product quantity or volume of work completed.

- Matching job can specify the level of measurement by the specific number.

Formula: Wage = the Number of finished products * Single-product price

Illustrative example

- Single product price: 20.000 VND/sp.

- Staff completed a 600 products/month.

- Salary = 600 × 20.000 = 12.000.000 VND.

- If company rules more quality award (for example reached 98% product standard is plus 500.000 VND) then income can be 12.500.000 VND.

| Advantages | Cons |

|

|

Business application: Industry, manufacturing, textile, mechanical, electronic, arts and crafts.

3.7. How to calculate salary according to the revenue or commission

Principle

- Employees are paid based on revenue or contract value that they bring to the business.

- Goal: encourage sales, increase sales, create competition in business team.

Formula: Salary = Salary plus (commission Rate * revenue or contract value)

- Revenue rose: need to specify is the revenue front/ rear, BLACK, obtained money or only based on the contracts signed.

- Commission rates: can be fixed or by level progressive.

Illustrative example

- Sticky wages: 6,000,000.

- Commission: 2% on the revenue has contracted.

- Sales in January: 300.000.000 USD.

- Commission = 300.000.000 × 2% = 6,000,000.

- Total salary = 6.000.000 + 6.000.000 = 12.000.000 VND.

Case apply progressive:

- 2% for revenue ≤ 200.000.000.

- 3% for revenue > 200.000.000.

- Business number 300.000.000 → commissions = (200.000.000 × 2%) + (100.000.000 × 3%) = 4.000.000 + 3.000.000 = 7.000.000 VND.

| Advantages | Cons |

|

|

Business application: Industry, sales, real estate, insurance, broker, trade – in service.

3.8. How to calculate salary exchange

Principle

- Business and labor agreement a salary exchange fixed for a work items, or certain projects.

- Income does not depend on working time, which depends on the finished result.

Formula: Salary exchange = Level of exchange fixed (According to the quantity or value of work)

- The exchange can according to the product/project/job specific.

- Can any reward if ahead of schedule or better quality requirements.

Illustrative example

Exchange by volume of work:

Exchange input 10,000 records at 5,000 VND/profile.

Salary = 10.000 × 5.000 = 50.000.000 VND.

Exchange according to the project:

- Construction items build: value exchange 200.000.000 VND.

- Completed on schedule, right quality → Get enough 200.000.000 VND.

- If ahead of schedule 10 days → added bonus 10.000.000 VND → 210.000.000 VND.

| Advantages | Cons |

|

|

Business application

- Construction, production according to orders, project services (cleaning, data entry, outsourcing).

- The short-term project or subcontract.

4. The distance calculator special pay: overtime, overtime, holidays

4 How special pay: overtime, overtime, holidays

Summary salary increase of ca according to the law

| In case of more | The rate of pay minimum wage |

| Normal days | 150% |

| Night day usually | 130% |

| Overtime, night-day, often | 150% + 30% + 20% = 200% |

| Weekly holidays (T7, CN) | 200% |

| Holidays, new year, paid holidays | 300% + salary holidays |

Note when applied in business:

- Must be based on the unit price of the actual (calculated from the monthly salary and the number of hours of the standard).

- Can pay higher law regulations, but should not be lower than.

- Need clearly stated in the agreement of the collective labor, the regulation of wages and bonuses to avoid disputes.

4.1. How to calculate salary increase overtime shifts day

Legal basis: Article 98 of The Labour code 2019.

Principle: workers overtime (beyond the frame 8 hours/day, 48 hours/week) will be entitled to wages at least 150% compared to the unit price of wage-hour work days normally.

Formula:

Wage overtime = overtime hours * Unit price hours * 150%

In which:

- Unit price-hours = Salary / (Number of days the standard × Number of working hours/day).

- Number of overtime hours = extra Time beyond regulation.

Illustrative examples:

- Monthly salary: 10.400.000 VND.

- Date of prepared: 26 days, 8h/day → 208 hours/month.

- Unit price-hours = 10.400.000 / 208 = 50.000 VND/hour.

- Employees work an additional 4 hours on normal days.

Apply the formula:

4×50.000×150%=300.000 VND4 \times 50.000 \times 150\% = 300.000\ VND4×50.000×150%=300,000 VND

→ Employees get 300.000 VND for overtime.

4.2. How to calculate overtime pay at night

Legal basis: Article 98 of The Labour code 2019.

Rules:

- Night time: from 22h to 6am the following morning.

- Workers work night to be paid at least 130% compared to the unit price of the ordinary.

- If you just increase the ca night (just overtime, just the night), then in addition to the level of 150% of salary do more normal days + 30% of the night is plus 20% of the daytime hours.

Formula:

- Making night normal (non-overtime): Wage the night = the Number of hours the night * Unit price hours * 130%

- Overtime at night (overtime night): Salary = Number of overtime hours the night * Unit price hours * (150%+30%+20%) = 200% wage hours.

Illustrative examples:

- Unit price hours: 50,000 VND.

- Employees 2 more hours at night (the day usually).

Apply the formula:

2×50.000×(150%+30%+20%)=2×50.000×200%=200.000 VND2

→ Employees get 200.000 VND for overtime night.

4.3. How to calculate overtime pay on weekends (Saturday, 7-Sunday)

Legal basis: Article 98 of The Labour code 2019.

- Workers do more on weekends will be paid at least 200% compared to the unit price hours of the day usually.

- Case do at night vacation days, plus 30% of the hours of the day usually.

- If you just do more in the night, just beyond now, plus 20% of the hours of the day.

Formula:

In overtime pay last week = Number of overtime hours * Unit price hours * 200%

Illustrative examples:

- Monthly salary: 13.000.000 USD.

- Date of prepared: 26 days × 8 hours/day = 208 hours/month.

- Unit price-hours = 13.000.000 / 208 = 62.500 VND/hour.

- Employees added 8 hours on Sunday.

Apply the formula:

8×62.500×200%=1.000.000 VND

→ Employees get 1.000.000 VND overtime Sunday.

4.4. How to calculate overtime pay on holidays, new year, holidays paid

Legal basis: Article 98 of The Labour code 2019.

- Workers do more on holidays and new year be paid at least 300% of the normal days, not to mention wages, holidays, new year, that EMPLOYEE still enjoy enough under the contract.

- If you do at night → plus 30% of hourly wage the normal.

- If you just do more night, just passed hours → plus 20% of the hours of the day.

Formula:

Wages do more mass = Number of overtime hours * Unit price hours * 300% + Salary holidays under the contract

Illustrative examples:

- Unit price time: 62.500 VND/hour.

- Salaries normal day: 500.000 VND.

- Employees add 8 hours to the day 1/1 (new year's day).

Apply the formula:

(8×62.500×300%)+500.000=1.500.000+500.000=2.000.000 VND

→ Employees get to 2,000,000 VND for the holidays can do more.

5. The account mandatory deducted from staff salaries, the need to note

When payroll employees, in addition to determining the income-based formula for calculating the appropriate wages, businesses still have to make submit the account is mandatory under the salary prescribed of the law. This is supposed parallel of all workers (EMPLOYEES) and the employer (ER) aims to ensure the rights of social security for employees, compliance with the law.

| Deductions submit | Content extract submit |

| Social insurance (SI) |

|

| Health insurance (health INSURANCE) |

|

| Unemployment insurance (UI) |

|

| Personal income tax (PIT) |

|

Illustrative example: An employee has a salary of SI is 20,000,000:

- Quote from wage EMPLOYEE: SOCIAL insurance (1.600.000) + health INSURANCE (300.000) + UI (200.000) = 2.100.000 copper.

- Business to close more: SOCIAL insurance (3.500.000) + health INSURANCE (600.000) + UI (200.000) = 4.300.000 copper.

Understanding properly apply this ratio to help businesses calculate the exact cost of personnel, at the same time avoid the risk of penalties for violating the provisions quotes submission. According to the Decree 12/2022/ND-CP, the penalty can be up to 150 million if the business is no SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance for full staff.

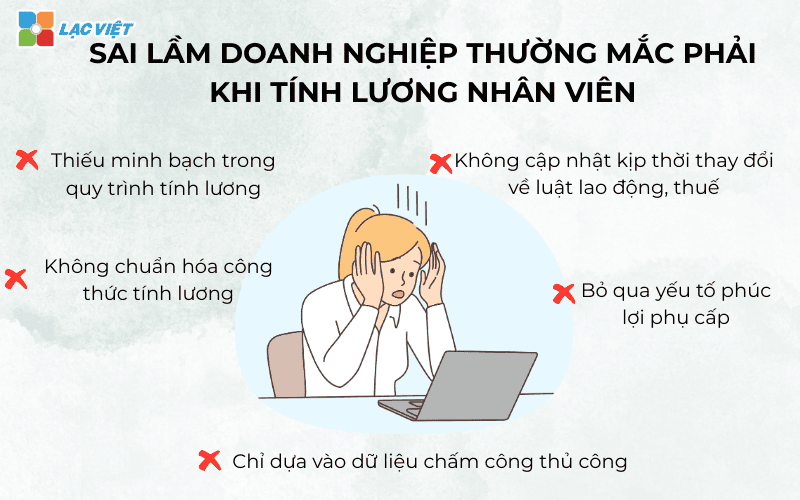

6. Mistakes businesses often make when payroll hr

In fact deployed, many businesses still encounter these errors seemed small, but big influence on the accuracy and satisfaction of employees.

Some common mistakes include:

- Just based on attendance data crafts: The gathering working hours from timesheets Excel file to develop confusion, lead to false results and payroll. This error usually affects the formula for calculating the salary, the real incomes of employees, causing loss of confidence and increase the rate of quitting.

- Not timely updates of changes to the labor law, tax: The provisions of the insurance, personal income tax, the minimum wage often change. If no updates, business violation of the law or subjected to administrative penalty.

- Skip elements welfare allowance: Some businesses only base salary, but forget or false allowances, bonuses, overtime. This is not only false labor contracts, but also directly affect the rights of workers.

- No standardized formula for calculating the salary: Business applied multiple ways to calculate salary between different parts or branches, leads to a lack of consistency, hard to control, time control.

- Lack of transparency in payroll process: When employees do not understand how to calculate salary to arise doubts, queries reduce mental work.

According to a survey by PwC 2024 (source), 42% of employees said that transparency and accuracy in payroll is the leading factor affecting the long-term commitment to the business. This shows that, process optimization, payroll is not only technical issues but also the strategy to retain personnel.

- Lac Viet SureHCS C&B paid by the customized products according to specific business

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

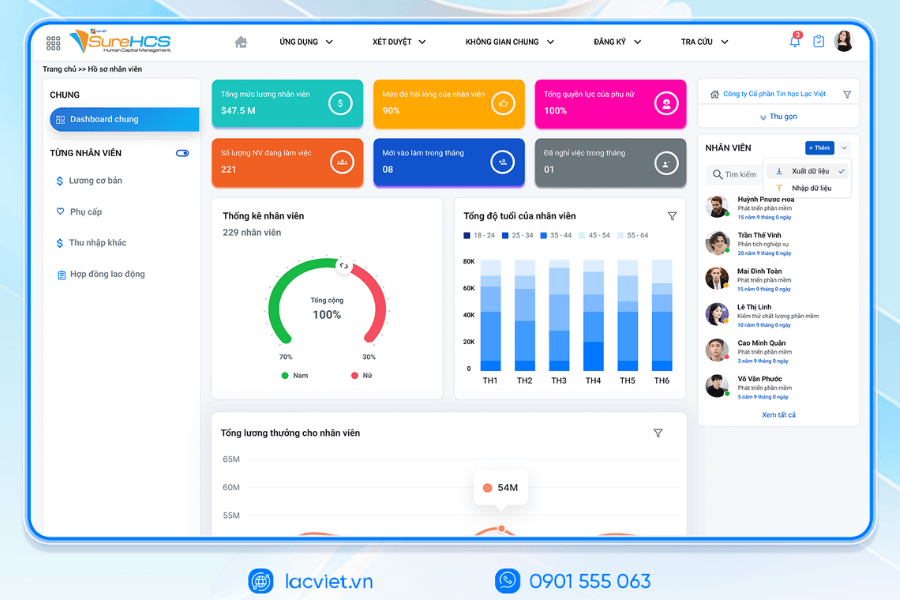

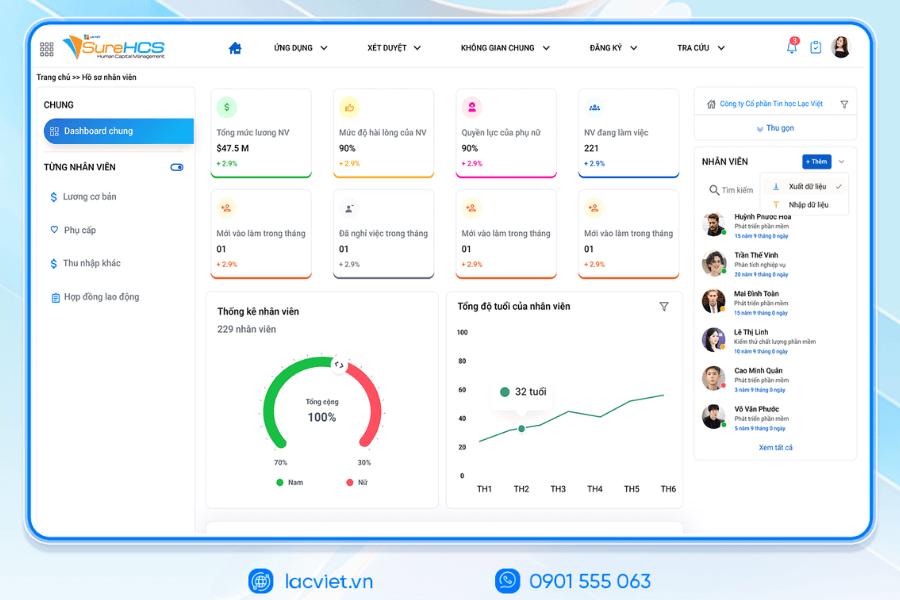

7. Software application LV SureHCS HRM to optimal payroll hr

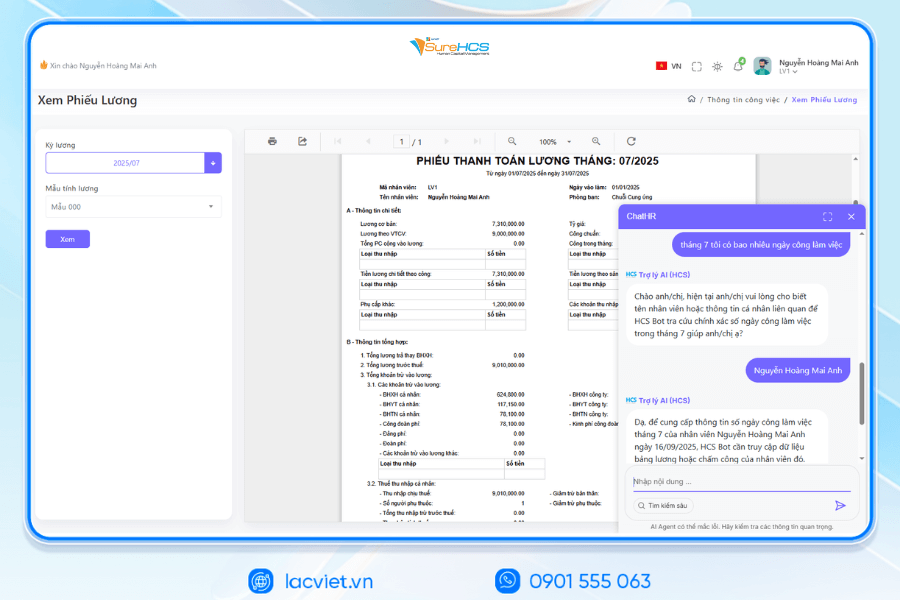

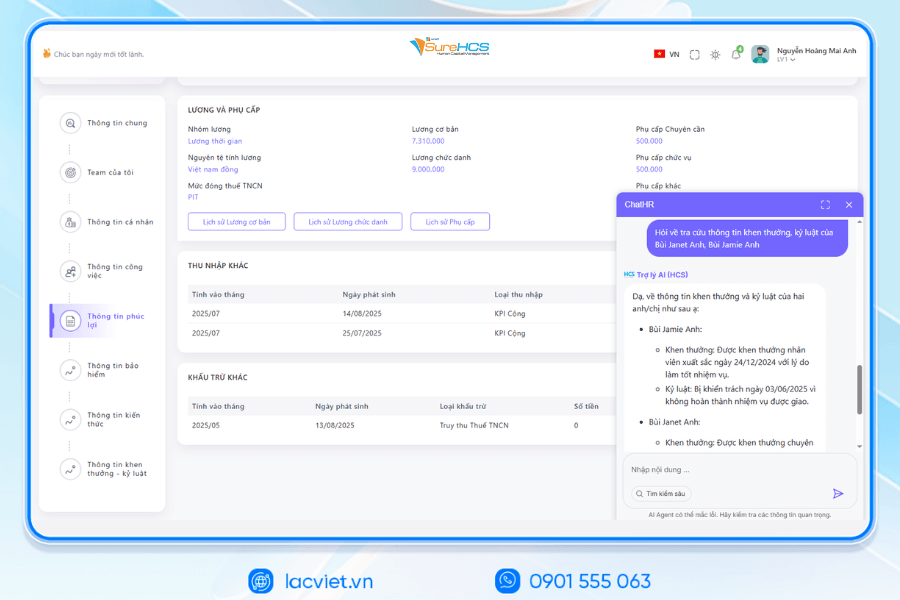

Management software hr LV SureHCS of Lac Viet is designed to radically solve the limitations that the business is experiencing. Not only automate processes, payroll software from Vietnam SureHCS longer guarantee the accuracy, transparency, compliance with the law.

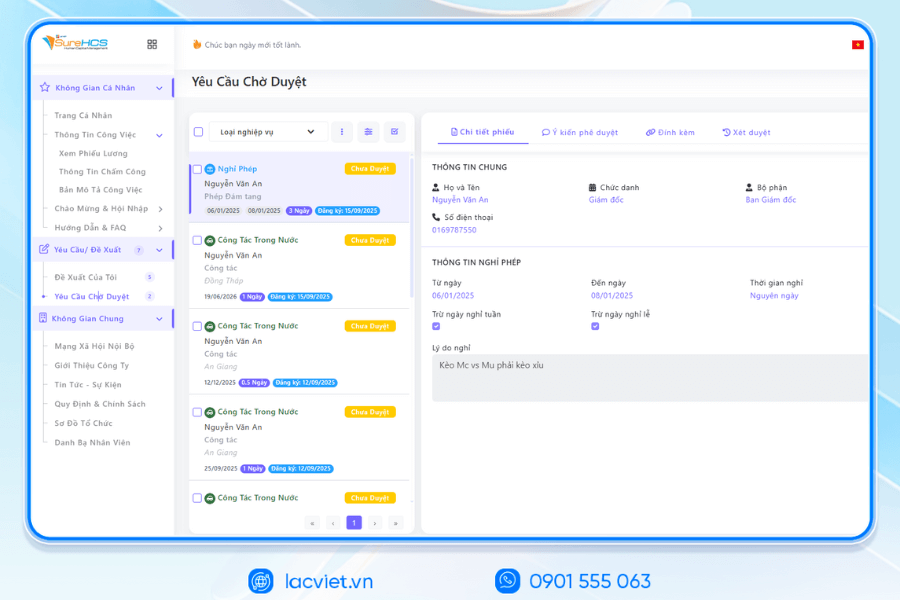

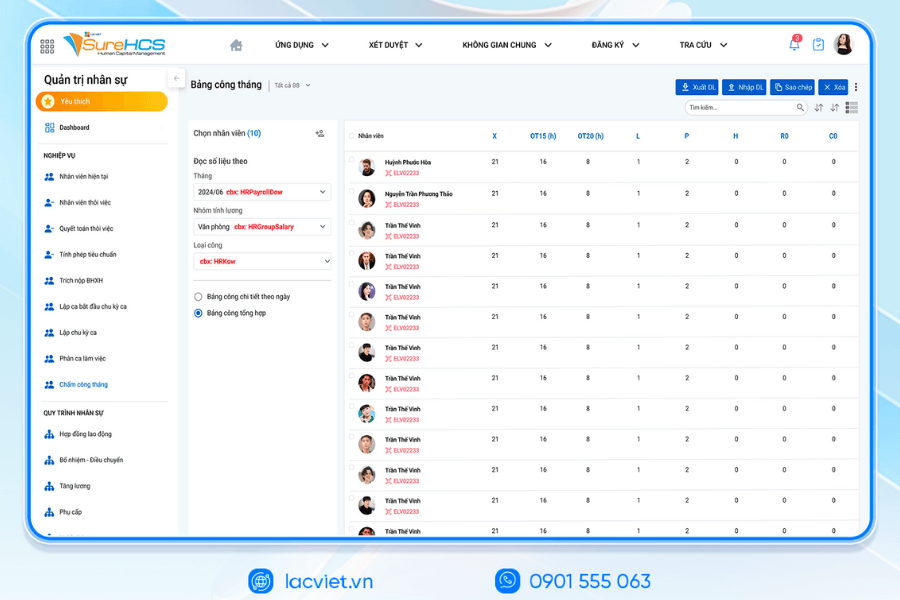

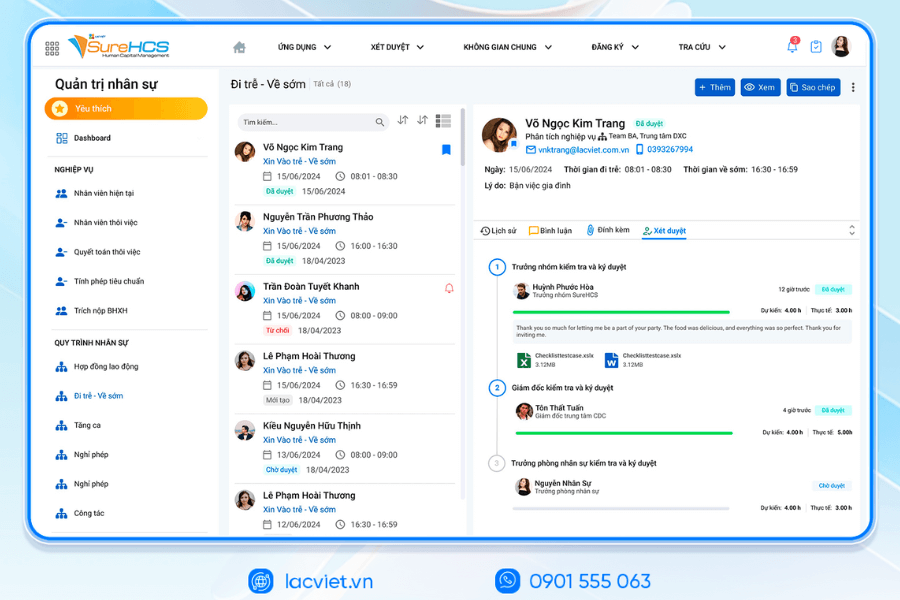

- Automate the entire process: From data entry, attendance, apply formula calculator, salary calculator, tax – insurance until cumshot payrollall done on a single platform to help reduce up to 80% processor time compared to doing it manually.

- Updated labor law, tax rules latest: System software HRM always be updated automatically according to the circular, the new decree, help businesses avoid legal risks and ensure the correct rules.

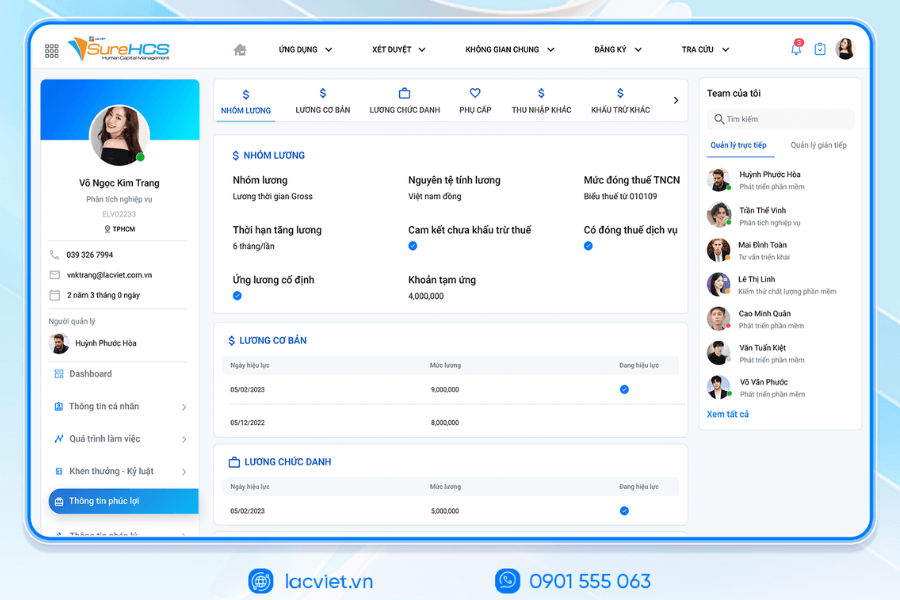

- Customizable recipe salary calculator: Business can set up the calculation of different salaries by department, location, shift or privacy policy that still ensure consistency and easy to control.

- Data integration attendance and welfare: LV SureHCS direct connection with attendance system and benefits manager ensure all allowances, bonuses, overtime hours are calculated exactly.

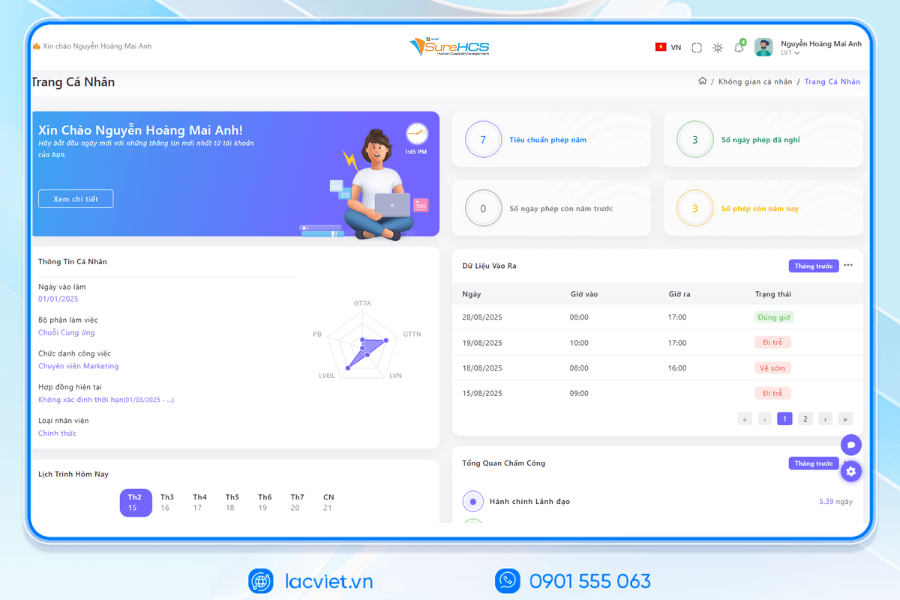

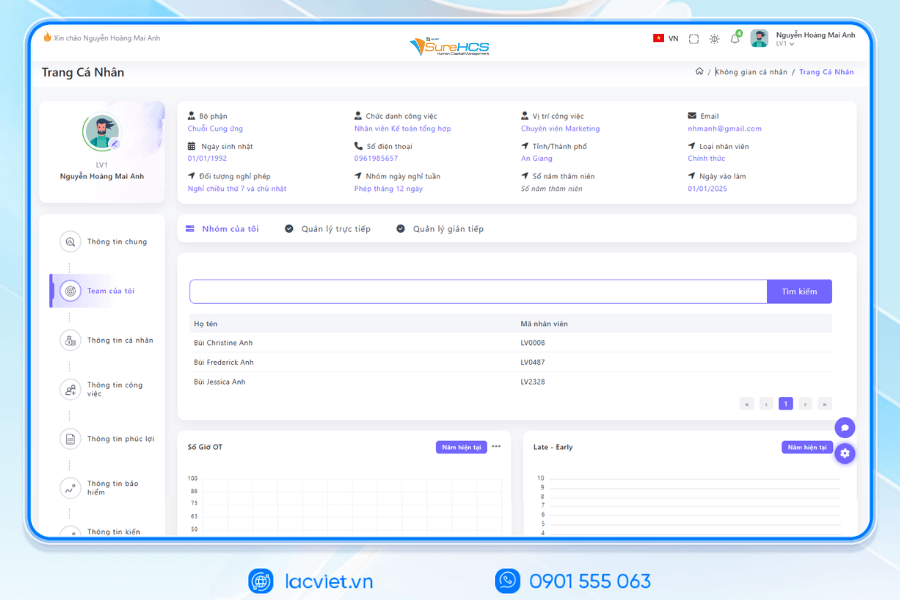

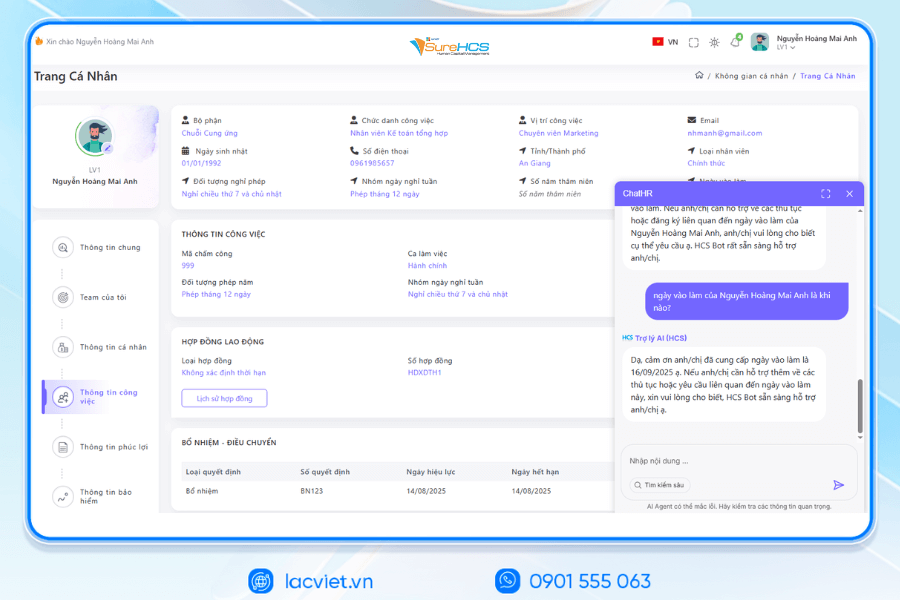

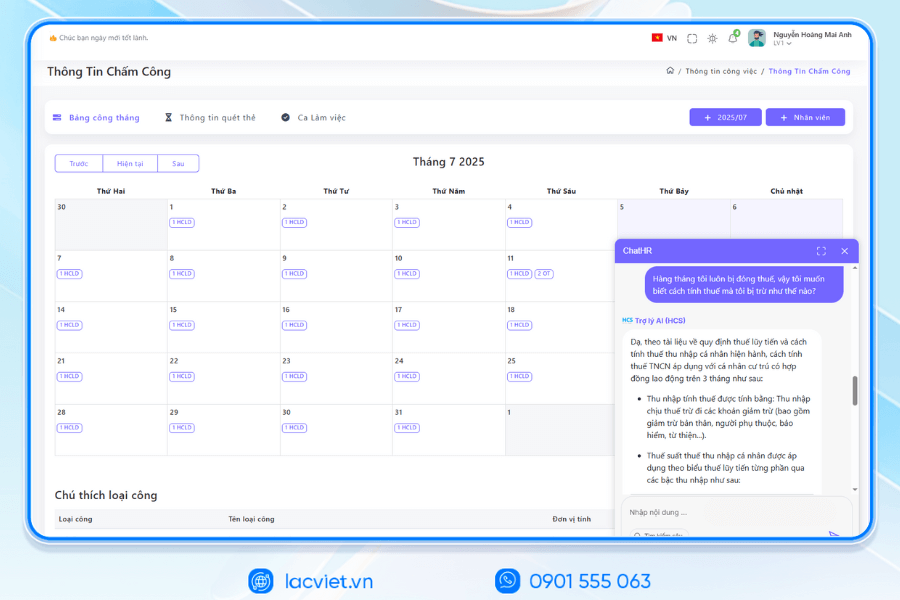

- Provide payroll transparency for employees: Employees can check the payroll history, income, how to calculate the details through the portal self-service (Self-service Portal), the maximum reduction in inquiries and complaints.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

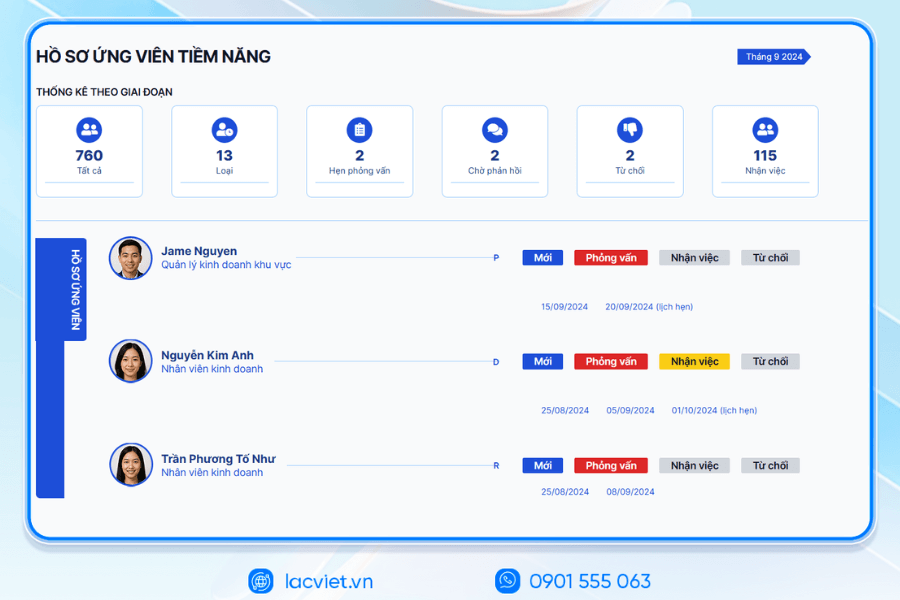

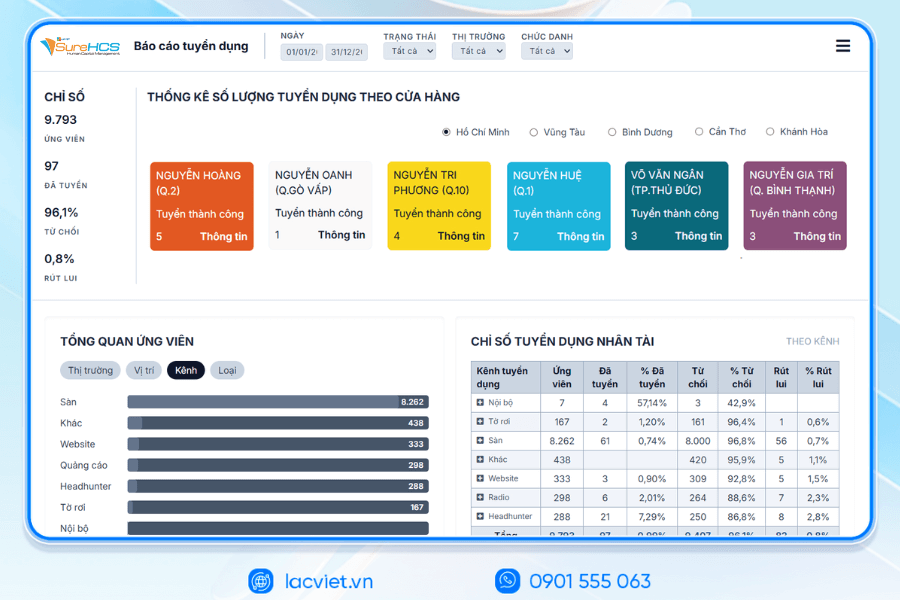

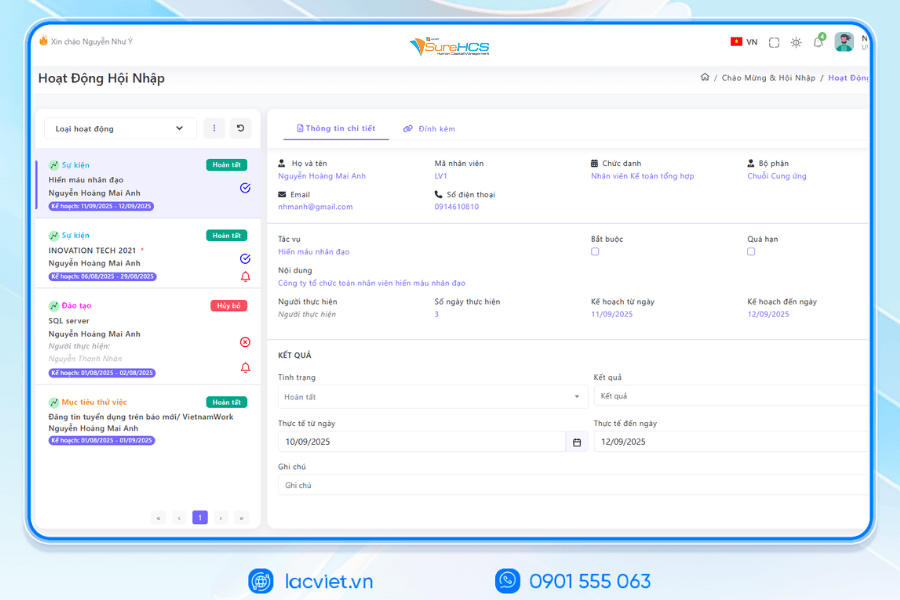

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

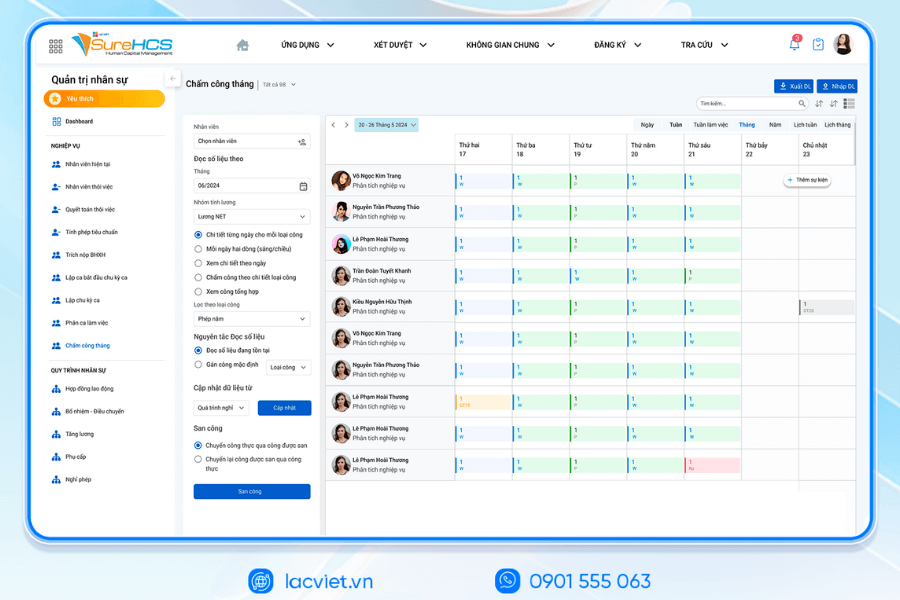

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

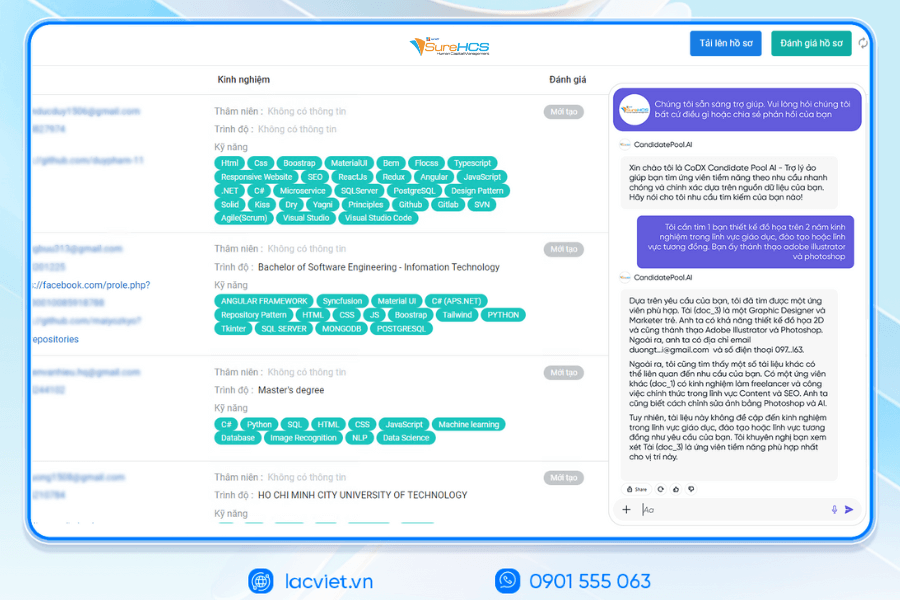

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

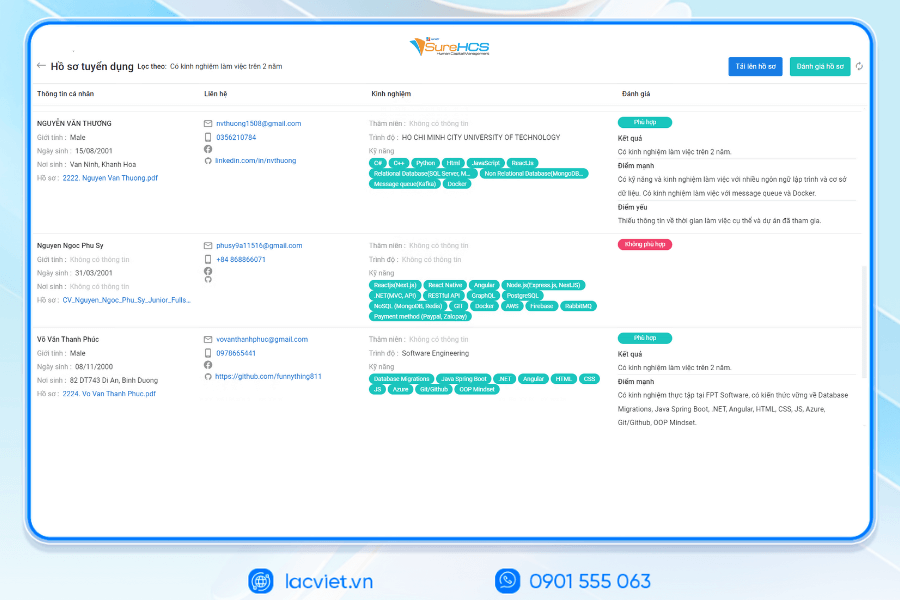

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Properly applied, payroll staff, not only to ensure the rights of workers but also help construction business photos professional reputation. A payroll process clear, accurate, compliance with the law will limit the risk of dispute, at the same time enhance the cohesion, motivation of the team. To optimize efficiency, enterprises should combine between formula for calculating the salary standards of the same tools modern management, automate processes, and reduce errors. Not only is this step strategy in human resource management which is also a solid foundation to help business sustainable development.

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD