Convert numbers in the banking sector is becoming the main motivation to help financial institutions enhance competitiveness, optimize costs, improve the customer experience. In Vietnam, the level of readiness for the switch number is rated in the high group of the region, the demand for online transactions increased sharply and the bank continuously invest in technology, AI, eKYC, cloud computing, process automation, digital bank comprehensive.

Businesses and financial institutions in Vietnam are actively learn the new direction to optimize processes, reduce risk, speed up transaction processing aims to build the ecosystem services more flexible. Convert numbers not even a choice, which is the journey mandatory for banks to adapt to market digitized growing. The Lac Viet learn in detail in this article.

1. The status transition of the banking sector

1.1 conversion of bank what is?

Convert number in bank is the application process digital technology, to a comprehensive change to the way banks operate, customer service, risk management. Instead of relying on the process or papers, the bank uses the technologies such as AI, process automation (RPA), eKYC, AI OCR (optical character recognition intelligence) to handle data more quickly, reduce errors and increase customer experience.

For example:

- AI OCR to help extract information from documents such as identity, the loan contract in just a few seconds, instead of entering data manually 5-10 minutes.

- eKYC help customers open accounts online without the need to counters.

- Chatbot AI consulting support 24/7, reduce the load for the total station.

Thanks to these technologies, the process becomes seamless, secure fit the needs of modern users.

1.2 The status transition of the banking sector in Vietnam

- According to data 2025more than 87% of adults in Vietnam has paid account at the bank showed the extent of covered services, the bank has a very wide

- Many credit institutions are handling more than 95% of transactions through digital channels instead of at a traditional.

- Payment system non-cash flourish: payment channels via the Internet, Mobile banking, QR-code has increased dramatically in both number and value of transactions

These numbers reflect that transformation of banking in Vietnam was no longer a trial that was indeed the reality: customers, individuals and businesses are familiar with the transaction online payment, cashless, and use of banking services instead of traditional ways.

2. The difficult transition of the banking business are met

Although the chance of big banks – especially fast-growing – still face many challenges:

- System old technology: Many banks use core system has operated more than 10-15 years, difficult to integrate with new technology. The upgrade usually more costly risks.

- Security and compliance: the Banking industry is resistant very high requirements for information security. The expansion of digital services means expanding attack surface, which increases the cost of investment security.

- Lack of data standardization: AI and data analysis works only effective when the data is clean full. However, many banks still stored data scattered in multiple systems, causing difficulties when integrated.

- Lack of manpower technology: human Needs-savvy AI, data, cyber security in the bank rose sharply, but the supply is not enough to meet.

- Cost of initial investment: although conversion of bringing big benefits in the long term, but the investments in infrastructure, security, Cloud and software initially quite high.

Practical example: According to the report of HSBC 2024, about 60% of banks in Asia have trouble integrating the new system due to the limited infrastructure of old; while Techcombank each share that the customer is step consumes a lot of resources, the most in the transition of their number.

These challenges cause many banks to find solutions capable of deployment flexibility, ease of integration, especially the platform AI OCR, process automation, bank of new generation.

3. Transformation strategy of the bank in Viet Nam

3.1 building the vision, roadmap convert numbers overall

A conversion strategy of success must start from the long-term vision, rather than focusing only digitized each single procedure. The bank should clearly define the goal: enhance competitiveness, improve customer service or optimal operating costs. This vision needs in accordance with standard safety information, standards, Basel II/III and the pattern bank open (Open Banking).

Practical example: A bank indexation account opening process without investing in data infrastructure of the entire system will have difficulty when deploying eKYC advanced scoring credit by AI or automation of transaction processing.

Benefits for business:

- Reduce investment risk in the wrong direction.

- Optimal cost when every technology project is located within an architectural unity.

- Ensure the ability to expand in the future as customer needs change.

This strategy is particularly important for the organizations and enterprises are read information on trends in transformation of in the banking industry to build appropriate orientation, avoid the status of “investment fragmented”.

3.2 Take the customer as the center with pattern Omni-channel Banking

Omni-channel Banking is a model that allows clients to trade seamlessly on all channels: mobile app, website, counters, total station or ATM. Whether clients start trading, where data is synchronized, the experience is always unity.

In other words, if the customer filing loan online in the morning, they can come to the branch afternoon and staff will see full of information, do not ask to do again from the beginning.

For example easy to understand:

- Banking application of auto-suggestion savings match based on the spending behavior of customers.

- Customer open account on application, increase credit card limit through the chatbot, AI are 24/7 support that is not up to the counter.

3.3 data strategy: Data Governance – Data Lake – AI Decisioning

- Data Governance – data Governance: data Governance is the principle of ensuring data is collected, stored, used properly. When data is not standardized, AI will give misleading results. For example, the Same customer, but the information is located in the 5 different systems will do wrong index scoring credit.

- Data Lake – data Warehouse focus” Data Lake is a storage platform the entire data of the bank in the form, no processing. Allows the integration of data from multiple sources and supports advanced analysis, it is imperative in the transformation strategy of the bank.

- AI Decisioning – decision by AI: AI Decisioning is the use of AI algorithms to make decisions faster, more accurate, such as loan approval, detect abnormal risks or suggestion financial product personalization.

Practical example:

- AI analysis, transaction history, identity fraud in just a few seconds.

- System approval auto credit risk assessment based on hundreds of variables, instead of employees analysis crafts.

3.4 application AI, process automation

Hyper-automation is the strategy combines AI, automation, RPA, AI, OCR, chatbot and data analysis to automate the entire process from beginning to end.

- AI OCR – Recognition automatic document: AI OCR help convert your paper documents into digital data in just a few seconds. For example: to extract information from the ID/CCCD, contract, loan statement.

- RPA – Robotic process automation: RPA perform repetitive tasks such as data entry, data transfer between systems, for control transactions.

- Chatbot AI assistant transaction: Chatbot AI can handle 60-70% of the common questions your customers help reduce the load personnel and increase speed of service.

- AI Risk Scoring – AI scoring risks: Help the bank assess the ability of credit or fraud based on big data.

Practical benefits:

- Shorten the approval time profile from few days to few minutes.

- Reduce operating costs by 20-30% (According to McKinsey).

- Increase the accuracy and transparency in risk management.

3.5 development of ecosystem – cooperation in fintech and model BaaS

Of ecosystem allow the bank to open the financial services to external partners from the electronic wallet application, e-commerce to big business.

Model Banking-as-a-Service (BaaS) allows business use API bank to integrate financial services directly into their platform.

Illustrative examples:

- App ecommerce integration, fast loans, installment payment directly from the bank through the API.

- Business Fintech use the API identifier eKYC of the bank to authenticate customers.

Actual value:

- Increased revenues from digital services.

- Increase the pace of expansion in markets that are not open branches of physics.

- Enhance the experience and convenience for our customers.

4. Tendency to convert numbers in the banking sector

4.1 AI created the shift comprehensive

AI is becoming the “growth engine” of the bank, not only helps automate business but also change the way banks make decisions. International banks use AI to credit rating, fraud detection, and analysis of customer behavior based on real-time data.

The three most important applications include:

- AI in credit approval: AI has the ability to analyze hundreds of variables about transaction history, income, spending behavior to make lending decisions faster, reduce human errors.

- AI OCR in the handle profile: AI OCR help “read” papers as CCCD, statement, contract and transfer of data in just a few seconds. This helps businesses save many hours of data entry, manually reduce the risk of errors.

- AI forecast customer behavior: AI can identify spending patterns unusual, the forecast capability leaving service or product suggestions tailored to each customer. Instead of sending the same products for all customers, the bank can personalize each proposal.

Actual values bring:

- Accelerate transaction processing, record.

- Improve accuracy in decision-making.

- Reduce operating costs and risks.

- Creating competitive advantage ahead of the bank model number.

4.2 eKYC and identity the customer does not contact

eKYC (Electronic Know Your Customer) is a method that can identify customers by technology, face detection, check the “liveness detection” (verified true), lets open the account without the need to counters.

Benefits for the bank:

- Reduced operating costs thanks to cutting processes.

- Reduce the risk of fraud thanks to collate multiple layers.

- Bring a seamless experience for customers, especially when online registration.

This is the trend that the organizations and enterprises are read information on trends in switch number in the banking sector priorities, as eKYC is the foundation of all financial products of modern.

4.3. Open Banking and API

Open Banking is the model allows banks to share data and services (control, according to the consent of the customer) for the Tuesday as fintech, e-wallets, floor, e-commerce, insurance... through the API. In simple words, the bank “connection open” to financial services can be embedded on any platform which number.

If for bank as “the repository of financial services”, then API key is “small door” to help partners get the right data or functionality they need – quickly, safety standard unification.

Practical application

- Customers can register consumer loans, opening accounts, billing, purchasing, insurance, etc. right in the app ecommerce without switch to app bank.

- For electronic use the API identifier (eKYC) to authenticate clients in just a few seconds, instead of asking for paper crafts.

- Retail business API integration-payment to users pay a one-touch.

- The accounting platform API account bank to control the money flow in real time.

4.4. Process automation using RPA + AI (Hyperautomation)

Hyperautomation is the combination of RPA, AI, OCR and data analysis to automate the whole chain of services – from data collection, processing profile to a decision.

Difference of hyperautomation compared to traditional automation system is the ability to “get to know – to understand – learn”, not only according to the scenario fixed.

Explained in easy to understand:

If RPA is “virtual employee, follow the procedure,” then AI plays the role of “thinking”, to help robots handle all the complex situations such as reading record loan, collate data, non-standard, identification fraud.

Practical application in bank

- RPA for automatic control daily deals, send reports to control without manual manipulation.

- AI OCR to read the loan contract, payroll, star, statistics, automatically extract information, and then push up the core banking system.

- ONE analysis suggested a limit, risk assessment, loan; staff only check the last step.

- Automation system, comprehensive tracking status record, reminder, check-compliant.

4.5. Cloud computing (Cloud-first) in the bank

Cloud-first is a strategic priority infrastructure deployment, the application on the cloud environment right from the start. As the volume of transactions increased rapidly, the demand data processing increasingly large cloud become a platform optimized to help the bank expand flexible but not too much investment for physical servers.

Three deployment models downloads

- Private Cloud: Infrastructure, private cloud, control absolute security, in accordance sensitive data.

- Public Cloud: expanding fast, low cost, ideal for application to handle seasonal or mutation.

- Hybrid Cloud: a combination of both, consistent strategy of many banks as want flexibility while ensuring compliance.

4.6. App Blockchain in payments, anti-fraud

Blockchain is considered as one of the technology platforms are created step dramatic transformation in the financial sector – banks. The ability to transparently encrypts data, can not edit, trace the entire transaction history help blockchain specifically tailored for the profession requires higher reliability such as payments, international money transfer, for control and fraud control.

Blockchain problem solving nothing in the bank?

- Payments cross-border slow, high cost: The international transaction network SWIFT tradition can take 2-3 days, with free time. Blockchain shortened down to just a few seconds or minutes.

- Risk data editing, internal fraud: The dispersion and the “cannot modify” (immutable) help limit the manipulated data.

- Process for control of spending a lot of time: All parties in the value chain (banks, suppliers, partners, intermediaries) have a common transaction log.

Practical examples, easy to understand: A payment transaction on international platforms such as RippleNet takes place as follows:

- Bank A money transfer request.

- The transaction is checked immediately by the consensus of the blockchain.

- Recipients in other countries to receive money almost instantly, no need through 3-4 bank intermediaries, such as traditional.

RippleNet is now one of the payment network, blockchain is widely used in many banks the Asian region and Europe.

4.7. Bank zero branch (Digital-only Bank)

Digital-only Bank is the banking model works perfectly on environment number, no branch of physics, not the counters. All services such as opening accounts, payments, savings, investments... are done through the app, website or chatbot.

In Vietnam, this model has been implemented by many banks first as Timo, TNEX, Cake by VPBank, brought drastic change in the habit of using financial services of young customers.

Outstanding benefits to customers

- Open account 100% online: Thanks to eKYC, the user only needs 3-5 minutes to subscribe.

- Lower cost: Bank cost savings branch should be able to offer preferential pricing, refunds, better interest rates.

- Seamless experience: the App is designed with focus on the journey user help transaction fast, easy-to-follow.

Value for banks and other organizations, businesses, research this trend

- Sharply reduced operating costs: No need investment in people, infrastructure and physics.

- Accelerated market expansion: the Bank can nationwide coverage with just one application.

- Easily test new products: Digital Bank allows deployment services according to the pattern “test – measurement – optimization” constantly.

- Optimal service with AI: from behavior analysis to hint financial personalize.

4.8. Security – Cybersecurity – Zero Trust Architecture

In the context of transition of going strong, ecosystem, banks increasingly open (API, connection, multi-platform payment number), the risk of network attack increase exponentially. So security is not just technical requirements that became a survival strategy.

Zero Trust is a security model “don't believe the default”. Whether employees, internal systems or devices were logged, and all access must be checked, verified, monitored continuously.

Simple example: Even if you were to be based bank, you still can't access store room stock from if there is no right – there is Zero Trust in the digital world.

Why banks to priority Zero Trust?

- The number of online transactions rose sharply after the pandemic.

- Open API makes the bank more connected system over, increasing the risk score.

- Financial fraud more sophisticated thanks to AI and deepfake.

- Regulations comply with increasingly tight (Basel, PCI DSS, NIST).

Many banks in the world use a combination of:

- Multi-layer authentication (MFA).

- Separate access according to role.

- Monitoring unusual behavior by AI.

- Data encryption in the state to stay and transmission.

- Protected API gateway integration.

5. The technology solution application in the conversion of the bank

In the context of the organizations and enterprises are read information on trends in transformation of the banking sector, the selection of the right technology is the determining factor helps to save operating costs, shorten time transaction processing and improve customer experience. Here are the core technologies that most bank pioneer are deployed.

5.1. AI OCR – digitize paper records

AI OCR (Optical Character Recognition integrated artificial intelligence) is a technology to convert image documents such as ID card, CCCD, contracts, vouchers... of data to import directly into the banking system.

If the former employee must enter information from paper to the system, then AI OCR help “read – understand – extract” is almost instant. AI technology will automatically handwriting recognition, classification, form, and fill in the correct data into the information school.

The actual value for the bank

- Shorten 70 – 90% of the time processing the customer profile in the service to open accounts, disbursements, appraisal.

- Reduce input errors crafts – especially important with the evidence from legal as credit contracts, notice free form KYC.

- Standardized input data to serve analysis, credit scoring, customer.

- Optimal staffing costs in the context of the volume of transactions increased rapidly.

5.2. Automation of business processes (Workflow Management + RPA)

Workflow Management system is to manage the flow of work number, the longer the RPA (Robotic Process Automation) is a technology robot software implementation task repeat as for data projector, check customer information, to send notifications.

Can visualize the RPA as a “virtual employee”, working 24/7, don't stay, make no mistake, handle the repetitive steps in the process that the business has set.

The actual value for the bank

- Reduce errors in the service as important as for control transactions, statements, data entry.

- Shorten processing time credit profile from a few days to a few hours for the bank number.

- Automatic approval according to standard procedure, the risk of omission step check or violation of internal regulations.

- Speed up customer service in the peak season, without increasing personnel.

5.3. Management system document number DMS

DMS (Document Management System) is a storage system, decentralization, search, and manage electronic records.

Instead of saving tens of thousands of paper records in stock, DMS help the bank save the entire document in digital form, can search in just a few seconds, similar to the “Google Drive enterprise edition, there is high security”.

The actual value for the bank

- Standardized data warehouse focused, not misplaced records.

- Speed up lookups, particularly in audit and transaction investigation or legal claim.

- Reduce operating costs, archive paper, such as rent, personnel warehouse, the shipping profile.

- Ensure compliance with security standards prescribed by the SBV and ISO.

Example common system

- SureDMS (Vietnam)

- IBM FileNet

- OpenText Documentum

5.4. Data analysis & forecast by AI

AI help banks analyze customer behavior, demand forecasting, risk assessment, and improve credit decisions.

AI will aggregate the data from the transaction history, loan, consumer behavior in order to “predict” the reliability of customers and suggest products fit.

Practical application

- Credit Scoring (scoring credit) based on big data rather than completely handmade.

- Analysis, Customer Insight, predict the demand for loans, savings.

- Anomaly detection in transactions to prevent fraud.

Value for the bank

- Shorten the time of approval of the loan from several days down under 30 minutes with a number of banks number.

- Reduce the rate of bad debt thanks to automatic scoring more accurate.

- Increased revenue from cross selling products.

5.5. System security enhancement

In the banking industry, security is the absolute priority. The popular technology today, including:

- MFA (multi-layer authentication): users must pass through at least two layers of security such as password + OTP + biometric.

- Fraud Detection using Machine Learning: Systems, behavior tracking transactions in real time, discovered the unusual form, such as logging in from an unknown device, the transaction value suddenly.

The actual value for the bank

- To minimize risks of fraud, protected customer account.

- Increase the level of trust when dealing number, especially for customers with older or less tech savvy.

- Compliance with the provisions of The state Bank and security standards international.

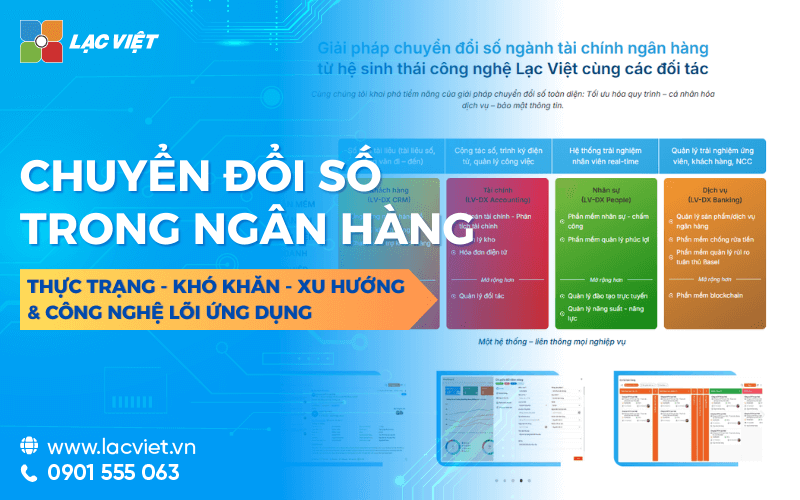

6. Solution digitized data and processes for the banking sector from Vietnam

In the context of the organizations and enterprises are to find out information about conversion trends of demand digitized data fast, accurate safety is becoming a strategic priority, particularly in areas requiring process control closely as banking, finance, insurance or production. Instead of depending on manipulation craft time-consuming to errors, businesses today need a synchronization solution helps automate the full life cycle materials from stitch digitized, stored for up to operate the process.

Solution digitized data with AI technology, OCR of English is designed to meet that demand.

- Platform AI OCR new generation allows to convert images, documents, contracts, forms... to digital data has a structure with high precision, at the same time automatic classification of records and put directly into the data system business.

- When combined with storage system, electronic document SureDMS, the entire material has been digitized to be stored centrally, ensuring safe – lookup-fast responsive control standards comply with that many businesses are directed to.

- Finally, the data of clean, full this is put into system management process of LV-DX Dynamic Workflow allows businesses to automate the approval process, rotation records, shorten the processing time and significantly reduced operating costs.

The combination of AI OCR – document storage smart – process management of business not only optimal resources but also create a data platform for the strategic transformation of the long-term. This is also the direction that many business pioneers options to enhance the operating speed, increase competitiveness, build ecosystem data safety and sustainability.