Excise tax is the tax imperative that every organization, business, branch or business location must be declared and paid annually based on the regulatory capital or revenue. This type of tax has little value, but carries important implications in determining the status of legal activity of the business before the tax administration.

However, in fact, many businesses, especially new businesses established, still embarrassing when accounting for excise from the time recorded, the account to reflect on the ledger. If you recorded the wrong time or confusion between “free” and “slave free sex lessons”, the business can be misleading financial statements or risk when tax settlement.

Therefore, understand the rules along the way accounting license tax standards not only help businesses comply with regulations of The state but also ensure transparency, good cost control, at the same time support the financial planning more effective. The same Lac Viet Computing find out details in this article.

1. Tax what is? Subject to the payment of excise tax

1.1. The concept of tax

Excise (from the year 2021 is to change the official name is the fee in this book) is the collection of mandatory every year for the organization, business, household, business or individual has manufacturing operations – business. According to the Decree 139/2016/ND-CP and circular 80/2021/TT-BTC, the revenue is determined based on the regulatory capital recorded on the registration certificate, business, or revenue of the year preceding that.

In other words, tax is a fixed cost that a business must pay to maintain the legal, valid, similar to the “free maintenance operations” in administrative management. For accounting, the accounting charges of belonging to the group expense manager enterprise (TK 642), should be recorded in the correct accounting period to reflect the honest financial situation.

For example: company A has a chartered capital of 5 billion, according to the regulations will have to pay the fee is vnd 2,000,000/year. The accountant should record the cost of this at the beginning of the accounting period the fiscal year, whether the payer practice can take place then.

1.2. Object, the excise current

According to circular 42/2023/TT-BTC, the following subjects must pay a fee of:

- Enterprises, economic organizations, branches and representative offices, business locations;

- And personal business;

- Organizations and individuals foreign trade activities in Vietnam.

The fee for this current is divided by the charter capital or capital investment as follows:

| Tax base | The fee for this (year) |

| The charter capital of 10 billion | 3,000,000 |

| Charter capital from 10 billion or more at | 2,000,000 |

| Branches and business locations, representative | 1,000,000 |

In addition, established business, new is free of tax in the first year of operation (according to the Decree 22/2020/ND-CP), help reduce the burden of the original cost. However, accounting still needs reflection account for this in the book as “tax exemptions” to ensure transparency, easy collated upon finalization later.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- How accounting tax contractor according to standard circular 133 & circular 200

- Guide accounting of import tax & how to calculate tax details

- Accounted amount for late payment of VAT, PIT, CIT, according to the new rules

2. Principles of accounting tax according to TT 200

Follow Circular no. 200/2014/TT-BTC, thuế môn bài (hay còn gọi là lệ phí môn bài) được xếp vào nhóm chi phí quản lý doanh nghiệp.

Nguyên tắc cơ bản trong hạch toán lệ phí môn bài gồm:

- Recorded costs in the correct accounting period: The tax must be recorded at the beginning of the financial year or as soon as business is issued a certificate of business registration. Despite the fact the taxpayer can take place later, accountants still need to reflect the cost at the time the obligation arises. For example: company B established in march 01/2025, limited license tax is the day 30/01/2025. Although not yet paid the money, the accountant must still recorded account of this tax to the cost January 1 to reflect the true financial situation.

- Fully reflects the obligations, stock from paying taxes: When arising of the obligation to pay, recorded at TK 3338 – Taxes, fees and other fees. When payers, accounting reduce the account to pay this. This helps financial statements clearly expressed the tax debt, and easily collated with the tax authority when needed.

- Compliance with accounting standards, the provisions current tax: Businesses need to ensure vouchers include: declaration fee, license tax receipts electronically, the decision for reduction (if any). This voucher is legitimate grounds to recognize valid cost when calculating the corporate income tax (CIT).

- Separate clearly the cost is free or does not arise: If the business is for tax the first year, accounting still need the notes in the ledger in order to ensure tracking and transparency on tax obligations.

3. The accounting entries are accounting tax in business

In accounting, each accounting accounting and tax reflects a different stage in the cycle of the implementation of tax obligations of the business: from the when arises, time to pay and handle special situations, such as adjustments or tax refund. Here is a detailed guide to each entry.

3.1 accounting entries recorded obligations tax year

As soon as you step into the new financial year, business is obliged to identify and recorded tax payable for the year, though has not made payment. Under circular no. 200/2014/TT-BTC, this is the cost of enterprise management arise periodically, which should be reflected soon to ensure accurate and complete cost.

Meaning of accounting: recording soon obligations tax help:

- Business faithfully reflect costs, financial obligations at the right moment arises.

- Accounting rational allocation of cost in accounting, assurance, financial statements accurately reflect the profit before tax.

- Support managers to plan and budget the first year more accurately.

How to account

- Debt TK 642 – Cost business management

- Have TK 3338 – Taxes, fees and other fees

Explanation: account 642 used to record the cost of management, while TK 3338 subject to tax obligations, incurred with The state.

Illustrative examples: Minh Phuc CO. has the charter capital of 6 billion, belonging to the fee of vnd 2,000,000/year. Date 01/01/2025, accounting recorded:

- Debt TK 642: 2.000.000

- Have TK 3338: 2.000.000

Meanwhile, the financial statements have reflected costs incurred, whether business has not yet submitted real money.

3.2 accounting accounting tax when business tax payment

After recording obligations, businesses need to complete the payment of money to the tax authority before the date 30/01 every year. This money is typically transferred to a bank account or electronic payment via Portal of e-Tax (thuedientu.gdt.gov.vn).

Meaning of accounting

- Shown finished business financial obligations with The state.

- Help eliminate the tax debt on account 3338, ensuring data accuracy when comparing with the tax authority.

- Create a legitimate basis for the storage of stock from the settlement of corporate INCOME tax.

How to account

- Debt TK 3338 – Taxes, fees and other fees

- Have TK 111/112 – Cash/bank deposit

Explanation: When businesses pay, the tax debt is reduced (debited TK 3338), and cash assets or deposits decreased (credited TK 111 or 112).

Illustrative example: a transfer fee of 2,000,000 on the date 15/01/2025. Accounting recorded:

Debt TK 3338: 2.000.000

Have TK 112: 2.000.000

Results: tax account no longer outstanding, show business has completed obligations.

3.3 adjustments, additions, or tax

In fact, there may arise situations business wrong, overpaid or refundable fee of policies for reduction. Meanwhile, the accountant should perform adjustments and to ensure data accuracy, compliance regulations.

Meaning of accounting

- Help correction of accounting errors on tax obligations.

- Ensure balance TK 3338 reflect the correct number of payable or refundable.

- Contribute to transparent and standardized financial statements, particularly when the audit or tax inspection.

How to account

Case 1: Business is a refund or reduce the tax

- Debt TK 3338 – Taxes, fees and other fees

- Have TK 711 – other income

Case 2: Business noted the lack to additional tax liabilities

- Debt TK 642 – Cost business management

- Have TK 3338 – Taxes, fees and other fees

Illustrative example

Tax refund: branch Minh Phuc company overpaid fee of 500,000 due to wrong the charter capital. When to take the decision to complete tax, accounting record:

- Debt TK 3338: 500.000

- Have TK 711: 500.000

Additional: company ABC detect cute 1,000,000 fees anal lesson by opening more locations business. Accounting records:

- Debt TK 642: 1.000.000

- Have TK 3338: 1.000.000

3.4 accounting accounting and tax for branch locations, business

Depending on the active form of branch (accounting dependent or independent), the business will be how to handle tax different post. Identifying the correct object of the declaration helps to avoid duplicate tax obligations to ensure the validity when drawing up financial statements consolidated.

Meaning of accounting

- To help you analyze the tax obligations accurately between headquarters and the dependent units.

- Support synthetic data tax for the entire enterprise system.

- Minimize errors in the declaration, avoid penalties declaration or omission.

How to account & illustrative example

Case 1: accounting branch depends

The entire fee of of branches was recorded at headquarters.

The account:

- Debt TK 642 (at headquarters)

- Have TK 3338 (at headquarters)

For example, joint STOCK company, Vietnam has branches dependent accounting in Quang Ninh, the excise tax is 1,000,000. Headquartered in Ha Noi declaration and accounting of the full cost of this.

Case 2: branch independent accounting

Each branch self-declaration, filed and recorded own expense.

The account:

- Debt TK 642 (at branch)

- Have TK 3338 (at branch)

For example: Da Nang branch of An company LIMITED has separate financial statements. When filing fee of 1,000,000, accounting branch recorded the cost at the unit.

Case 3: business Locations of the same province, with headquarters

- Be this in the first year according to the Decree 22/2020/ND-CP.

- Not going to expense, but accountants need notes in the track to serve as reference later.

3.5 accounting penalties for late payment of fees anal lesson

If the business filing fee in this after specified time limit, will be penalties for late payment in accordance with the Law on Tax Administration 38/2019/QH14 and Decree 125/2020/ND-CP.

The penalty consists of 2 types:

- Money for late payment: calculate 0,03%/day on the amount of tax paid.

- Fines for administrative violations: purchase behavior, usually from 2 – 25% of the tax payable.

When the accountant should record other expenses not accounted for in cost management (because not reasonable cost when calculating the corporate INCOME tax).

Meaning of accounting

- Reflect expenses incurred, in addition to the plan due to violation of tax rules.

- Help distinguish reasonable cost (tax), the cost is not reasonable (violations).

- Is an important base when drawing up financial statements and payment of corporate INCOME tax, because this penalty will be excluded.

How to account

When the recorded amount of the fine payable:

- Debt TK 811 – other Expenses

- Have TK 3339 – Fees and accounts payable other

When payment of fines into the state budget:

- Debt TK 3339 – Fees and accounts payable other

- Have TK 111/112 – Cash or bank deposits

Illustrative example

Hoang Long CO., payment of fees in this delay of 20 days, is the tax penalty:

- Penalties for late submission: 60,000 vnd

- Administrative penalty: 500,000

Total fines: 560.000 dong

Accounting recorded:

- Debt TK 811: 560.000

- Have TK 3339: 560.000

When pay the fine:

- Debt TK 3339: 560.000

- Have TK 112: 560.000

→ Expense 560.000 this not be included in deductible expenses, when calculating corporate income tax.

4. The time recorded and note when accounting tax

Determining the right time recorded excise tax is a key factor to help businesses accurately reflect the cost and tax obligations in the accounting period. As prescribed in circular no. 200/2014/TT-BTC, the cost of tax must be recorded when the obligation arises, does not depend on the time of actual businesses pay money to ensure financial reporting is that the activity and to comply with the provisions of the tax authority.

4.1. Time recorded

For business is active, the excise tax is expense is recorded at the beginning of the accounting period fiscal year (usually October 1 of every year). Although the term fee payment in this prescribed as the day 30/01, but accountants need accounting cost this immediately at the start of the new year, because the obligation to pay the tax arose from that point.

For new business establishment, the time recorded is the date of the certificate of business registration and tax code. If established after the date 30/6, you only need to pay 50% of the excise of the year, the accountant should be noted that this cost corresponds to the actual amount payable.

For example: company LIMITED, You are licensed to day activities 10/7/2025 charter capital 5 billion → the fee payable is 1,000,000 (50% of the 2,000,000). Accounting recorded:

Debt TK 642 – Cost management business: 1.000.000

Have TK 3338 – Taxes, fees and other charges: 1.000.000

If the business recorded the wrong time, the cost will not reflect the correct accounting period, affecting reported results, business define income subject to corporate INCOME tax. The slow noted also can cause figures on accounting system deviation than data, electronic tax administration, causing difficulty for reference or inspection.

4.2. Note when accounting

To ensure accuracy and transparency in accounting filed tax accountant should note the following points:

- Check and store electronic documents valid: the Entire receipts license tax today are released through the electronic Portal of the General department of Taxation. Accountants need to download full archive this receipt with proof of payment (UNC or payment receipt) based bookkeeping.

- Distinguish between tax and registration fees business: Many businesses are often confused between the two types of costs. Excise tax is the financial obligation every year, while fees for business registration arises only once when established. The wrong can make cost excluded when tax settlement.

- For projector periodically with the tax authority: the End of each accounting period, the accountant should collate TK 3338 – Taxes, fees and other fees to the data on the system for electronic tax administration to insure no longer owe excise tax backlog. This step is important helps to avoid false reports, the risk of administrative fines.

- Track the private cost is free or tax refund: in case your business is tax-free license according to regulation (for example the first year of operation), accounting should still open the window track separately to ensure transparency when drawing up financial statements.

- Automate accounting, warning obligations tax: With the development of the accounting software today, many businesses have switched to accounting fees, anal, articles automatically to reduce errors and save time.

Solutions such as accounting software, LV-DX Accounting of Lac Viet allows accounting set up calendar alerts periodically, automatically recorded and collated obligations accounting free license according to each branch or place of business. Thanks to that, the business not only ensure compliance but also save time, cost and personnel.

5. Handle the special case when accounting fees, excise

Not any business also perform accounting and tax in the same way. Depending on the stage of operation and specific situations, accountants need to have a plan to handle appropriately in order to ensure the validity of transparency in the books.

5.1. Business establishment is new for tax year beginning

According to the Decree 22/2020/ND-CP, small business, super small or new business establishment is free of tax in the first year has manufacturing operations – business. Although does not have to pay, accountants still need notes account for this in windows to ensure monitor transparent when juxtaposed with the tax authority.

- How accounting: Not recorded cost, but open the window track private “tax exempt” in the accounting records.

Help enterprises easily determine the back tax obligations upon the expiration of the term for avoid missed or wrong pay period of the following year.

For example, The electronics company founded on 15/3/2025 and subject to the fees in this first year. Accounting notes “For tax year 2025, according to a Decree 22/2020/ND-CP”, and track time incurred the obligation to pay from 01/01/2026.

5.2. Business ceased to operate or dissolution

Business case temporarily deactivated, accountants need to distinguish the following two situations:

- If the declared tax before pause: Businesses still have to pay tax.

- If the notice suspend operations due to the tax: Business be exempt from the obligation to pay excise tax in the year pause.

When business dissolution, accountants need to revise the entire public debt tax value-added collated with the tax authority and perform pen payment clear the debt after the decision to terminate the tax code.

Debt TK 3338 – Taxes, fees and other fees

Have TK 111/112 – Cash/bank deposit (if filed additional)

Or Have TK 711 – other income (if tax refund)

The accounting exactly help businesses avoid arrears or penalty due declaration of false tax obligations. This is also the last step in the treatment process accounting fees, so you only when businesses cease to operate.

6. Application software accounting LV-DX Accounting in accounting free sex lessons

Software, LV-DX Accounting company Lac Viet development is the accounting system business is built according to the standard circular no. 200/2014/TT-BTC, fully meet the regulations on accounting – tax-current. This solution supports the accounting manager, the accounts and track the entire process of accounting of tax, from the declaration notes to financial statements.

Highlight features:

- Auto-fee license is based on the declaration of the charter capital, type of business, data years ago. System pen payments “Debt 642 / There 3338” in the correct accounting period, to help accountants do not miss or recording the wrong time.

- Direct connection to the port tax declaration (electronic thuedientu.gdt.gov.vn): allow business filing, payment, reconcile receipts right in the software, reduce data discrepancies between the accounting and tax data.

- Track obligations tax under each branch place of business: in accordance with the model company, multi-units or have representative offices in many provinces.

- Automatic updates rates, tax policy latest: the software is synchronized regularly with the legal databases, ensure accounting always comply with current regulations.

- Establishment and tax reporting – financial instant: in just a few taps, accounting can extract the report “list of obligations tax”, “Total case fee per unit”, “Border counterparts TK 3338”...

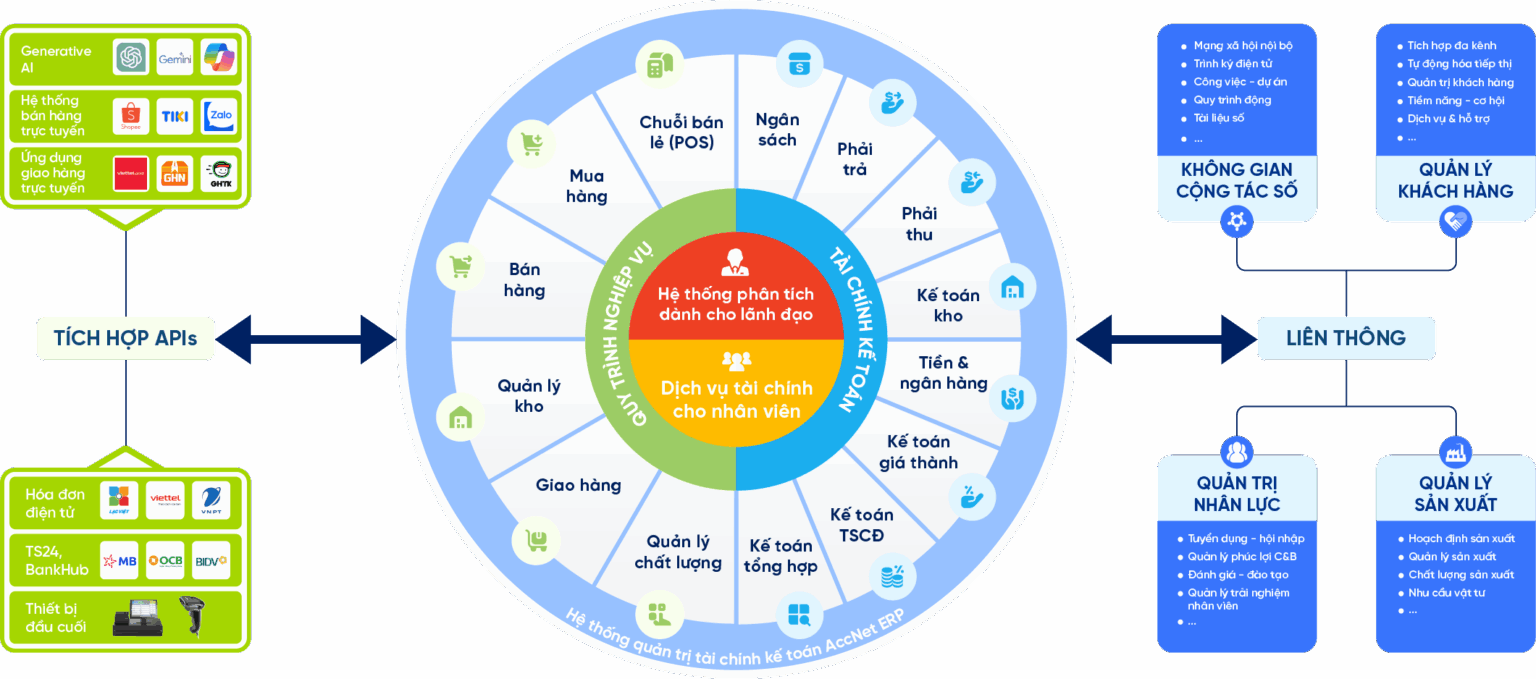

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

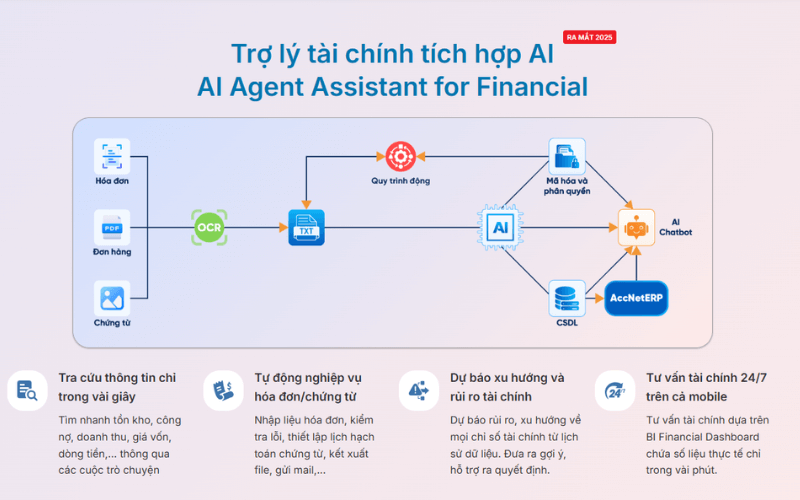

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Sign up free demo accounting software, LV-DX Accounting today to automate the entire process of accounting for excise tax with the accounting profession tax other. Help your business operate transparency, accuracy, compliance completely legal regulation.