Accounting for import tax is accounting record as well as manage the taxes arising from the operation of import of goods. This process helps businesses comply with the law, control the exact cost at the same time decision support, audit transparent. When applying accounting software for modern businesses can automate accounting, data connection, customs – import documents, reduce errors, and shorten the processing time.

However, many businesses, especially those new units start importing, often have difficulty in the pen math import tax, from the determination of the time recorded, the account to reflect on bookkeeping. The accounting mistakes or omissions can lead to cost is calculated wrong, affect financial statements increases the potential risks when settlement or tax audit.

Therefore, understand the regulations on import tariffs at the same time perform accounting standards are necessary conditions for business to control costs, optimize cash flow aims to ensure transparency of financial statements. The same Lac Viet Computing learn in detail about the steps noted import duties, principles, calculation, as well as important note, to help businesses make professional, accurate and efficient.

1. Find out about import tax

1.1 import Taxes, what is?

Import tax is the tax that businesses have to pay when importing goods from abroad into Vietnam. The purpose of taxes is not only a source of revenue for the budget, but also the tools to regulate commerce, as well as protect the manufacturing industry in the country. Understanding import tax help business cost estimation accuracy, optimize cash flow and avoid risks violation of the law.

All import taxes downloads:

- Import duties typically: Apply according to the tariffs of common, calculated based on the CIF (Cost + Insurance + Freight) of goods.

- Import tax incentives: Applicable to goods imported under the trade Agreement (FTA) or preferential policies of The state, to help reduce the import costs and increase competitiveness.

- Special consumption tax (if applicable): for some items such as cars, alcohol, tobacco. The aim is to regulate consumer and regulate market behavior.

1.2. Accounting tax what is the import?

Accounting for import tax is the process of recognition, management and reflect the taxes arising from the import of goods into the business. This is an important profession in accounting import, help businesses accurately control the associated costs as well as ensure compliance with tax laws.

The main role of the noted import duties:

- Compliance with law: accounting of the exact help businesses to declare and pay the tax on time, avoiding the risk of administrative penalty or tax arrears.

- Cost management import efficiency: The accounting details for each account, tax help, accounting and business management understand the actual cost of goods, from which cost estimation, profitability analysis, as well as optimize cash flow.

- Decision support, audit – financial analysis: accounting full, accurate help businesses easily collate evidence from imports, reporting costs, and provide transparent information for internal audit or tax authority.

The organizations and enterprises are finding out information about the record business, import tax will see that the administration of the tax imported not only help comply with the law, but also for decision support business intelligence, optimize costs, improve cash flow and minimize risk of errors in the process of import of goods.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- How accounting tax contractor according to standard circular 133 & circular 200

- Accounted amount for late payment of VAT, PIT, CIT, according to the new rules

- The full accounting accounting and tax with time & note accountants need to know

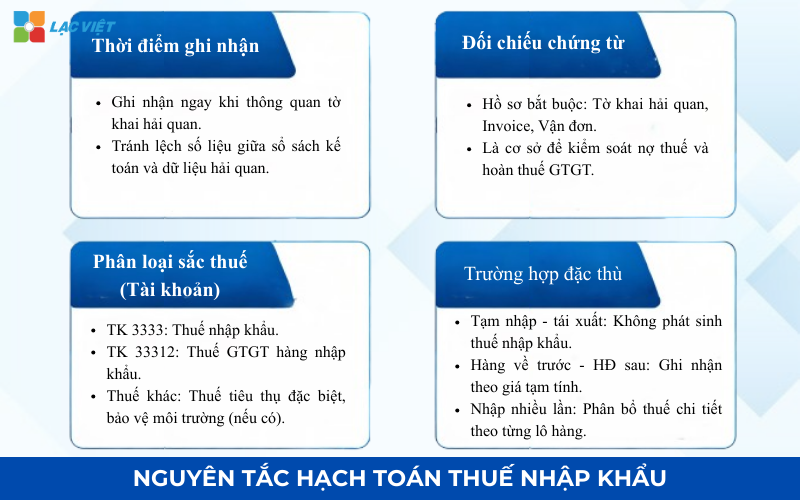

2. Principles of accounting import tax According to the circular 200

Accounting tax imported not only is recorded tax obligations, but also the tools to help businesses control costs, optimize cash flow while reducing risk tax inspection. To ensure accuracy and compliance, the accountant should comply with the following principles:

- Recorded right time arises tax obligations: obligations import duties incurred at the time specified on the declaration customs clearance. When are tax notice, a business must be recorded on the ledger immediately, to avoid deflection of material between the books and the customs data.

- Collated evidence from in full: Every professional import tax must be based on valid documents: customs declaration, invoice, bill of lading, delivery notes, minutes of receipt of goods. These comparisons help to control the exact amount of data on the account 3333, 33312 well as the cost of imported goods, at the same time as the base serves declaration and refund of the VAT on imported goods.

- Correct classification of taxes: Businesses must separate each type of tax according to the regulations:

- Import tax (TK 3333)

- VAT on imported goods (TK 33312)

- The excise tax or environmental protection tax (if have)

- Note the special cases:

- Goods temporarily imported for re – export: does Not arise import tax; only recorded related costs.

- Back – vouchers on the following: allowed recognized provisionally calculated according to the rate temporarily at the day receive the goods, then adjust when enough stock from.

- Many times imported under a contract: Tax must be allocated according to each lot entered, make sure the cost reflects the true reality.

Compliance with the above principles to help businesses perform accounting of import tax standards, avoid risk, tax inspectors and ensure transparency in the accounting system.

3. Guide accounting import taxes standard circular 200

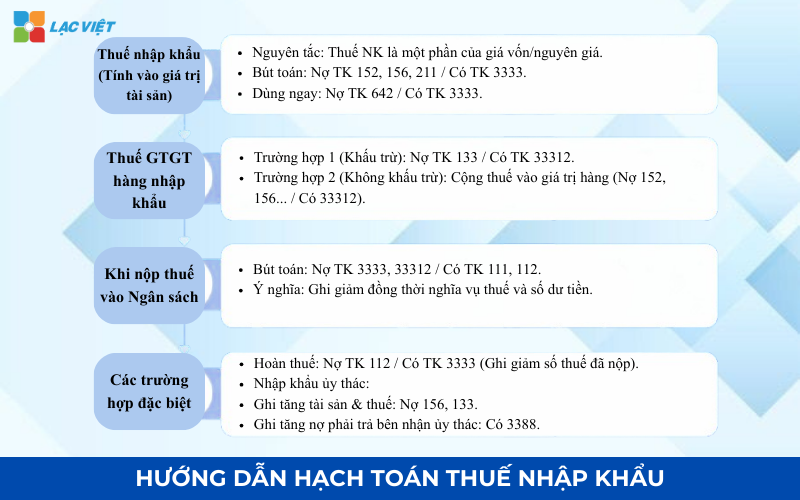

3.1. Recorded service tax on imported and calculated on the value of the property

Import tax is an expense mandatory incurred to bring the property/merchandise into a state ready to use (or sell). According to the principle of the original price, this tax must be calculated on the value of the property/merchandise purchased in.

The account:

- Debt TK 152, 156, 211... (Increase of property value): Record increase in value of Raw materials, commodities, fixed Assets (fixed assets). This amount is Import Tax payable (which has been calculated on the Customs declaration).

- Have TK 3333 (Increase obliged to submit): Record the obligation to submit The state budget on import Tax.

If goods imported are used for management activities (for example: stationery, office supplies retail consumer all in the states) that does not cross enter the warehouse, this tax may be accounted straight to cost (Debt TK 642).

For example: importing Business 1 batch raw material taxable value: 200,000,000. Import tax rates: 10%

- Import duties payable = 200.000.000 × 10% = 20,000,000

The account:

-

- Debt TK 152: 20.000.000

- Have TK 3333: 20.000.000

- If materials are used for parts office:

- Debt TK 642: 20.000.000

- Have TK 3333: 20.000.000

3.2. Accounting for VAT on imported goods have to pay

VAT on imported goods is input VAT. The accounting depending on the method of calculation of VAT of business:

| Case | Accounting principles | The account |

| Deductible (Business apply the Method of deduction) | VAT is considered as input VAT is deductible, NOT on the value of the property/merchandise warehousing. |

|

| Not Be Deducted (the Direct Method or the goods are not in active service taxable) | VAT must be considered as a cost factor, CALCULATED on the value of the property/merchandise warehousing (capital price/original price). |

|

For example:

- Case 1: Business is VAT deduction value VAT: 200,000,000. VAT rates: 10%

VAT payable = 20,000,000

The account:

-

- Debt TK 133: 20.000.000

- Have TK 33312: 20.000.000

- Case 2: Business is not VAT deduction

Suppose goods for parts not subject to VAT, VAT must be added to the value of:

-

- Debt TK 156: 20.000.000

- Have TK 33312: 20.000.000

3.3. Accounting when to submit taxes to the state budget

Record the obligation to pay when the business made paying taxes into The state treasury.

The account:

- Debt TK 3333, 33312 (the obligation to pay): reduced the Import Tax and VAT were determined in items 4.1 and 4.2.

- Have TK 111, 112 (Lose money): Record the decrease in cash or bank deposits.

For example: Business taxpayer NK and VAT NK

- Import duties payable to: 20,000,000

- VAT on imported goods must be paid: 20.000.000

- Payment by bank transfer.

- Debt TK 3333: 20.000.000

- Debt TK 33312: 20.000.000

- Have TK 112: 40.000.000

3.4. Accounting for import tax in special cases (for Refund of tax and trusts)

- Accounting for import tax refund: Applied when a business is customs/tax approved a refund of tax paid (for example: goods have to pay tax, but then was re-export goods duty-free, but has filed mistaken...).

The account (When the refund on account):

| Profession | The account | Notes |

| When tax money is returned (based on The paper of the bank or receipt of cash) |

|

Record the amount of business and reduced taxes overpaid/be completion of the current year or the previous year (the obligation to pay tax/number of already submitted). |

Note: If there is an account receivable on taxes from The state, accounting can Debit TK 133 (other receivables of The state) before the money on.

For example: Business is import tax refund 10,000,000.

Debt TK 112: 10.000.000

Have TK 3333: 10.000.000

If the tax authority decisions refund but the money hasn about:

Debt TK 1388: 10.000.000

Have TK 3333: 10.000.000

When the money back then:

Debt TK 112: 10.000.000

Have TK 1388: 10.000.000

- Tax accounting in the Import Trustee (the transferor trustee): the transferor trustee is the party responsible ownership and accounting final assets, including all taxes. The entrustee only is the implementation procedures.

The account (When delivered in property and stock from):

| Profession | The account | Notes |

| When receiving the handover of the property and stock from |

|

|

For example: value goods after conversion: 100.000.000

Import tax: the 10,000,000

VAT: 11.000.000

The transferor has advance vnd 80,000,000 for the entrustee.

- Recorded when the settlement:

- Debt TK 156: 110.000.000 (value + Tax NK)

- Debt TK 133: 11.000.000 (input VAT)

- Have TK 3388: 121.000.000

- If the advance vnd 80,000,000 earlier → longer have to pay 41.000.000

4. The important note when accounting and tax import

Accounting tax imported not only the book but also a tool to manage costs as well as risk control. To ensure the process of accounting accuracy and optimized for business, need to note the following points:

- Store stock from full – on time the law: All professional services related to tax imports must be supported by evidence from the French: import bills, customs declaration, bill of lading attached receipt row.

- Collated evidence from the states between the parts: accounting accuracy depends on the synchronization of information between accounting, warehouse and purchasing department. Comparing periodically to help detect early flaws, avoid data entry lack, or excess, at the same time support management accounting VAT on imports effective.

- Control risks flaws – fraud in the tax declaration: Businesses need to establish processes, cross-check, make sure the numbers on the invoice, customs declaration and bookkeeping match. Not only does this avoid the risk of administrative fines, but also well prepared for the accounting of import tax refund, especially with the goods having preferential tax rate.

- Timely updates of changes to tax rates – the import tax – preferential FTA: Tax rates, as well as preferential policies may vary according to each period or according to trade agreements freedom. Business accounting to be followed and constantly updated to ensure the accounting entries reflect actual costs.

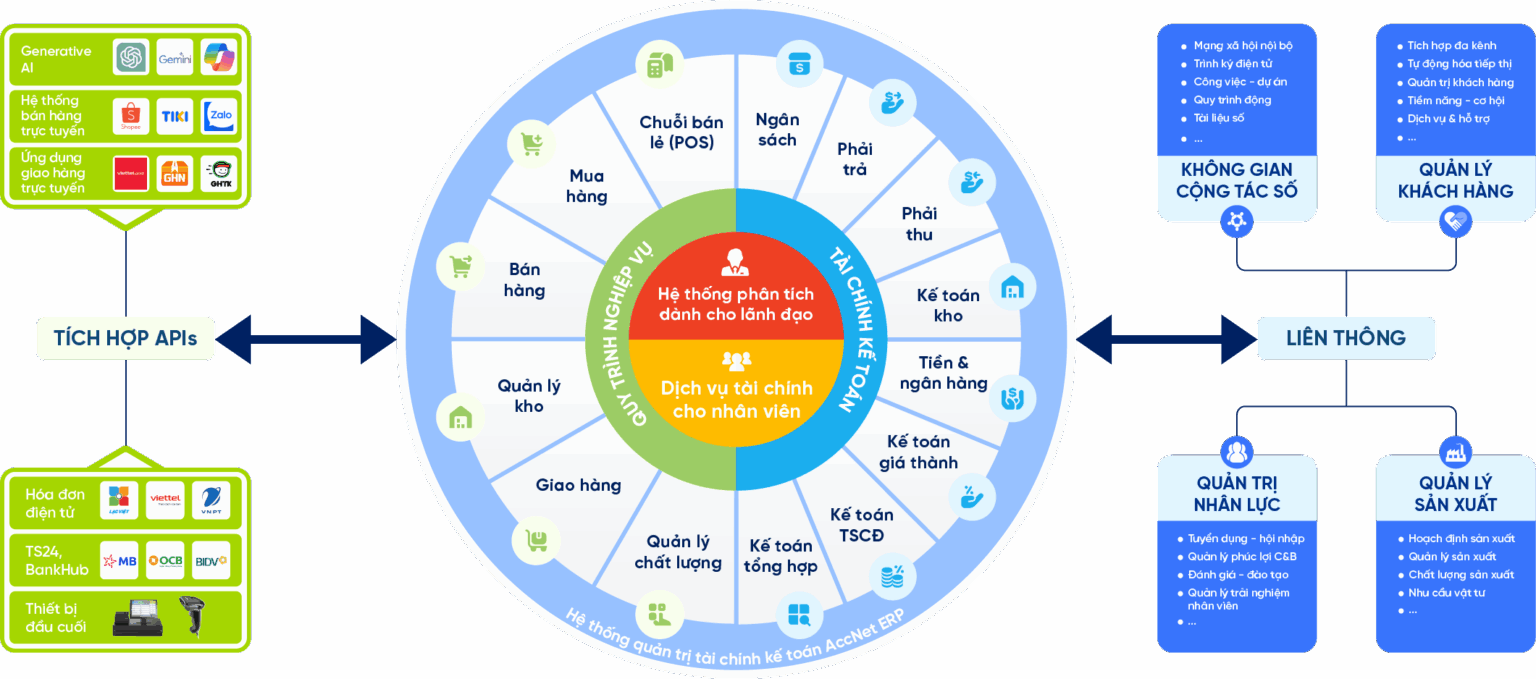

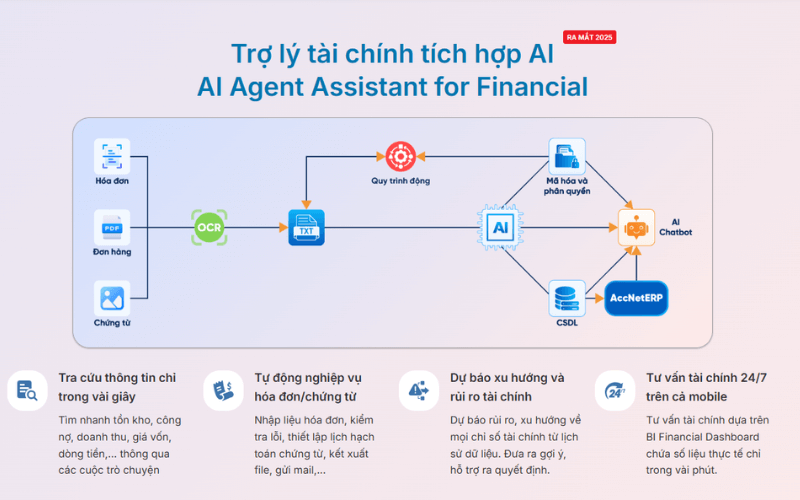

5. Management solutions accounting software Accnet ERP

Software Accnet ERP provides comprehensive solution to help businesses effectively manage the import taxes, reduce errors and improve the efficiency of financial management:

- Automated pen math import tax: the System automatically recorded the import taxes and VAT input based on the invoice, customs declaration, bill of lading, help reduce errors due to input manually, ensure the accuracy.

- Connect customs data – import documents: sync information from customs declarations, invoices and bills of lading, helping to collate evidence from fast, transparent, as well as standardized processes accounting.

- Track debt & refund: System, management accounting, tax, VAT, import-support track the amount of tax deductible or the account, accounting, tax import is finished, alerts when there are deviations, help businesses implement business, law and optimize cash flow.

- Detailed reports, accurate: provides aggregated reports and detailed analysis about, import tax, VAT input, as well as the tax refund, support, accounting, procurement, and leadership decisions smart governance.

- Compliance with accounting standards – legal: Help businesses implement noted professional import tax according to the right circular 200/2014/TT-BTC & Circular 133/2016/TT-BTC, ensure financial reporting transparency and accurate.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The accounting import taxes are important steps to help businesses control costs of the import, optimize cash flow while ensuring compliance with tax laws. To comply with the accounting, collate evidence from adequate, as well as timely updates of changes to tax rates will minimize the risk of errors, avoid administrative fines in order to support tax refund when eligible. Besides, the classification of tax clearly and accurately recorded each account tax help business improve transparency in financial reporting.