Each latch salary is a big pressure for the accounting department personnel C&B. Just flaws in the work, overtime, allowances or deductions insurance can also lead to complaints from workers, affecting corporate reputation and take a lot of time reviewing and adjusting.

Many businesses today are still using Excel as a calculator salary. However, when the scale hr increases wage policy is increasingly complex, with multiple shifts, allowances, bonuses and penalties, and other deductions vary, Excel gradually revealed many limitations. The input crafts, linking multiple files, lack of version control that risk flaws increasingly high, especially in the period of settlement tax, insurance.

Businesses not only need a spreadsheet to heighten that need a solution capable of automation, accurate processing, service, salary at the same time help accounting C&B, pressure drop, time-saving control data more effectively. The same Lac Viet learn effective tools for existing business.

1. Payroll craft to bring more trouble for the business

Although Excel is still widely used by many businesses as a familiar payroll calculation tool, in reality, this method carries many risks as the size of the workforce and salary policies become increasingly complex. The following common problems are the reasons why businesses need to turn to automated payroll calculation tools.

Incorrect work hours, incorrect overtime, incorrect allowances.

Data payroll is usually synthesized from many different sources, such as file register overtime, board allowances by location or project. When handling manually on Excel, just a little mistake in data entry, recipe links, or copy the data can also lead to false results salary.

This not only causes the contact for the employees but also increases the volume of the revision and correction of the department of accounting and C&B.

It's difficult to manage multiple salary policies simultaneously.

Many businesses apply in parallel many food policy for different groups of workers such as office block, production, sales, time service or labor under shifts.

With Excel, managing multiple pay scale, multiple ways to calculate OT, allowances, bonuses and penalties, often lead to file payroll complex, difficult to control, to develop error while updating the new policy.

Risks of false personal income tax and insurance

Calculate personal income tax, deductions and payment of social insurance requires high accuracy to update timely according to the legal regulations. When done manually, accounting very easy to see errors in the application of progressive tariff, covered the ceiling or handle the case of arrears, access field. These errors can cause legal risks directly affect corporate reputation.

Time-consuming synthesis for control data

Process payroll manually is often prolonged due to aggregate data from multiple Excel file in different cross-check between the department and handle the situations that arise. Make time latch salary is elongated, creating pressure for accounting hr C&B, specially at the end of the month or any settlement.

Difficult to trace, the control history

When using Excel, the store multiple file versions different in each pay period makes business difficult to trace the change history data. In case you need to explain to employees, board of directors or governing body, the revise causes wage adjustments become out of time, lack of transparency.

This is the limited core, causing many enterprises realize that Excel no longer fit to handle professional salary in the long term, and the use of tools, payroll automation is the inevitable trend.

2. Tool payroll what is? Used to do what?

Tool payroll system is a business support automatically handle the entire business related to wages from synthetic attendance data, calculate the income, deduction, tax and insurance, to the establishment payroll reports service management.

Others with a salary tools salary calculator is built based on the rules of standard recipe helps to reduce errors, ensuring consistency in each pay period.

In hr management, modern tool payroll not only serve the goal of “right – gay enough”, but also plays an important role in the transparency policy, payroll, cost control, personnel, contribute to improving the experience workers.

When deployed properly, this is no longer a spreadsheet support, which is the system processing, wage help the business operate, professional, law-abiding and willing to expand in the long term.

A tool payroll efficiency not only helps in parts C&B significantly reduced the volume of work but also ensure:

- Accuracy: minimize errors due to input manually.

- Transparent easy check: Easy to use salary calculator ensures employee benefits.

- Legal compliance: automatically update the new regulations on social insurance and personal income tax.

- Save time cost: concentrate resources on activities, hr strategy instead of handling the administrative duties repeat.

3. The tool payroll common hr C&B or taking now

Currently, the tool payroll for staff to be deployed in many different forms, in accordance with the scale, budget, and administrative needs of each business. Choosing the right tool wage not only help to calculate the exact income, ensure compliance with legal provisions on wages, taxes, insurance, etc., but also contribute to improve the experience, staff, optimal resource management.

Here are 3 popular tools:

3.1. Tool payroll online transfer Gross to Net

Usually the platform online which allows the business or employees to enter the parameters such as basic salary, allowances, tax rates... to quickly calculate income actually received.

| Advantages | Restrictions |

|

|

Useful for the company, service, or parts personnel when you need quick lookup or preliminary advice to candidates on the expected income.

General List website, payroll, online quick detail:

- Direct HR Vietnam — Vietnam Salary & Income Tax Calculator: Calculate the salary actually received, the total cost for the employer, the insurance & tax for employees. Easy to use updates according to law 2025 Direct HR.

- Adecco Vietnam Salary Calculator: easily convert gross salary to net calculator, health insurance/unemployment according to the specified region adecco.com.

- TopCV — calculator salary Gross/Net online: clearly Explain concepts, helping you to understand in detail the deduction under the provisions 2025 TopCV.

- KenAI — Gross ↔ Net calculator: Calculate correct insurance, personal income tax, update the minimum wage the latest KenAI.

- Nhansu.vn — tool convert Gross & Net: Similar to KenAI, additional instructions clear formula, updates in accordance 2025 Hr.

- High Five, Vietnam Salary Calculator: Estimate food get the following except the IRS, SOCIAL security, UNEMPLOYMENT INSURANCE; show contributions both workers and users (Employee ~10.5%, Employer ~21.5%) High Five.

- RecruitGo — Vietnam Gross to Net Salary Calculator: Calculate the total cost, food receiving, appropriate to evaluate personnel costs Viet Nam, at the same time detailed analysis of the employer/employee contributions RecruitGo.

- Terra-plat.vn — Gross ↔ Net Salary Calculator: user-friendly interface, supports transfer wages gross or net, showing clearly the composition deductible according to law terra.

3.2. Tool payroll using Excel file

Payroll in Excel is a familiar choice of many small or new business established. Businesses often make available an Excel file with formulas basic math calculator to add, subtract, multiply, and divide the pay, allowances, deductions, insurance, personal income tax...

Use a spreadsheet like Excel or Google Sheets to import and handle data-based pay recipe payroll independent.

| Advantages | Restrictions |

|

|

When should I use: Business below 20 hr, the volume of payroll simple, budget restrictions.

3.3. Tool payroll table professional software

This solution is designed for professional payroll services, can be implemented as directly installed on the internal server (on-premise) or use through the internet (cloud). Drecognizing calculator this salary is often a subsystem in system HRM or overall administration business ERP, sync data from attendance, contract management, benefits to financial statements.

| Advantages | Restrictions |

|

|

When should I use: medium and large Businesses, there needs personnel management – integrated financial or orientation switch of the interface.

4. Tool payroll should have what function?

A tool payroll effective't just stop at the “out numbers at last,” that need full support transactions in real operating business. Below is the group of core functionality that businesses need to consider when choosing a tool to calculate monthly salary.

4.1. Automation salary calculator

Automation is the first requirement, the most important of a tool payroll modern. Instead of handling on multiple Excel file discrete, the system should have the ability to automatically aggregate and process data input.

- General attendance data: tool payroll connection or import data directly from the timekeeping system, including fingerprint time attendance, magnetic card, face recognition or file timekeeping synthesis. The automatically retrieve data helps to reduce errors, and data entry, ensuring data – stay – late – early recorded correctly.

- Calculator OT, night shifts, holidays: In fact, every business has different rules about the number of overtime, night shifts, working holidays. Tool payroll needs allows flexible setting these rules, automatically calculated according to the right time frame, the object and the time arises, instead of handling each case.

- Processing allowance, reward – and-punishment: The allowance position, responsibility, diligence, gasoline, telephone or other account bonuses and penalties, according to performance, discipline should be systematized, automatic plus/minus in the pay table. This helps to ensure consistency and transparency between the pay period.

4.2. Right – fully in accordance with the law

A tool payroll only really worth while ensuring full compliance with the legal regulations related to labor, tax/insurance.

- Personal income tax schedule is progressive: The tool should support PIT in the correct progressive tariff each part, automatically apply the deductions circumstance, reduced insurance earnings taxable. This helps accounting minimize the risk of errors when tax settlement.

- Social insurance, health, unemployment: the calculation of the deductions pay SOCIAL security, UNEMPLOYMENT INSURANCE should be taken exactly as salary, insurance, rate quote and ceiling rules. Tools wage calculation should allow for flexible configurations to suit each group of workers, each period policy.

- Handle lương gross – net: Many businesses apply parallel gross salary and net salary. Tool payroll need support automatic switching between the two forms of this business to easily manage cost, ensure the rights of workers.

- Arrears access field: In the case of salary adjustment retroactive arrears insurance or field income, the tool needs to allow for processing quickly and clearly express the transparency on the pay table of each states.

4.3. Flexible according to enterprise policy

Every business has the organizational structure, policies, different salaries, so tool payroll need to have the ability to customize high.

- Manage multiple pay scale: tools need support to setup multiple pay scale for the position, various ranks, at the same time allow for adjustment when the business policy changes or restructuring.

- Handling multiple groups of workers: Businesses often have many groups of workers such as office block, production, sales, seasonality, labor, according to ca. Each group has how to calculate salary allowances own, require a tool payroll must be sufficiently flexible to meet without complex operation process.

- Manage multiple branches, units: enterprises With many branches or member companies, tool payroll need to allow centralized management, but still separates the data according to each unit, ensure it is both convenient synthetic, moderately easy to control.

4.4. Reports & data control

In addition to salary calculator, the tool also plays an important role in the control of data transparency.

- Payroll report details: the System should provide the payroll report in detail according to individual employees, departments, branches, help business easy to control and cost analysis, personnel service of the administration.

- Hosted stain, history correction: Any changes related to payroll data needs to be saved history edit, help accounting and hr C&B easy to trace, the explanation when there are questions from the labor or request a check.

Decentralized data security: Salary is sensitive data, so the tool payroll need to have decentralized mechanism clear, ensure each user is accessible only true range of his work, at the same time enhance the security for business.

5. Compare tool payroll Excel and payroll software

When choosing tools, payroll, many businesses wondering between Excel and payroll software professional. The comparison table below to help businesses easily recognizable difference between these two forms.

| Criteria for comparison | Tools salary calculator in Excel | Payroll software professional |

| Accuracy | Much depends on the input formula; easy to errors when editing, copy data | The official rules are pre-set, automatic processing, ensure consistency between the states |

| Handle complex business | Hard to manage when there are multiple shifts, OT, allowances, bonuses and penalties; file to become bloated | Good handling multiple work shifts, overtime, allowances, many policy salary parallel |

| Manage multiple policies, wage | Difficult to maintain when there are many pay scale or more groups of workers | Allows flexible configuration, multiple pay scale, labor groups, branches |

| Compliance with the law (tax, insurance) | Businesses have to update formula according to the new rules, the risks of false law high | Designers keep abreast of legislation, support, personal income tax, SOCIAL insurance, health INSURANCE, accurate |

| Handle lương gross – net | Often have to design recipes, crafts, easily confused | Support automatically switch gross – net, reduce errors |

| Duration pegs salary | Take a lot of time synthetic test, for control data | Process automation, significantly shorten the duration pegs salary |

| Scalability | Restrictions when business scale-up hr | Easy to extend, while increasing the number of personnel branch |

| Reporting & analysis | Mainly reports crafts, hard, synthetic, compare | Provided salary reports detailed synthesis according to the departments, branches |

| Control & traceability data | Difficult to manage file versions, difficult to trace the history edit | Have hosted stain to change, easy to explain or control data |

| Data security salary | Prone to expose data as file sharing, hard stools rights | Stool clear access, data security salary better |

| Relevance | Fit small business services salaries simple | Fit medium business and large wage policy complex |

In summary, Excel is suitable only as temporary solution for small business with professional salaries simple. For growing business, there are many policies, payroll, required compliance with the law closely, payroll software is sustainable options more secure in the long term.

6. Any business should use the payroll professional?

Not every business needs to invest a tool payroll professional. However, in actual operation, there are very clear signs for file Excel or how to calculate salary craft was no longer suitable. Below is the enterprise group should consider seriously the use of tools, payroll automatically.

6.1 Business from a scale of certain hr and above

When the number of personnel increased, the volume of data need to be processed in every pay period also increased exponentially. With business there from a few dozen to hundreds of hr, the payroll in Excel often began to arise problems such as:

- File payroll increasingly complex, many recipes overlap

- Difficult to control errors when editing or updating data

- Duration pegs wage lasts, depend on an individual

In this case, the tool payroll professional to help businesses standardize processes, reduce dependence on manipulation and ensure stability when the scale personnel continue to expand.

6.2 Business has many shifts, overtime, form flexible working

The business of manufacturing, retail, logistics, services, etc. often apply multiple work shifts, overtime, regular, night work, holidays, or holidays. This is the group business is very easy to encounter mistakes when payroll crafts do:

- Coefficient OT, night shift, different holidays

- Provisions salary depends on the time frame, objects of labor

- Attendance data complex, difficult to sum up exactly

Tools professional payroll allows to pre-set the rules shift, OT, automatically applied according to data timekeeping fact, help to significantly reduce risk, wrong, wrong salary and complaints from workers.

6.3 Business to adopt many policies pay allowance

Many businesses today not only is there a formula fixed salary that applied in parallel with several different policy for each group of workers such as:

- Office block, block production business cube

- Hr official, seasonality, try the

- Salary according to the time, wages in output, wages according to KPI

When the number of policies, wage increases, Excel becomes difficult to control to error. Tool payroll professional to help businesses configure multiple pay scale, many ways different on the same system, ensure consistency, easy to adjust when the policy change.

6.4 Business need tight control personnel costs

With respect to leadership, wages and other account benefits is always one of the biggest expenses in the structure of operating costs. However, if only payroll in Excel, enterprises often encounter difficulties in:

- Keep track of total payroll costs by departments, branches

- Compare the cost of personnel between the states

- Analysis of the impact of policy changes the salary to the budget

Tools professional payroll not only help payroll accurately, but also provide aggregated reports, business support, cost control, staffing, better, decision management in a timely manner.

6.5 Business focus on legal compliance, risk management

The business long-term operation, it is usually special attention to compliance with regulations on labor, tax, insurance. The payroll craft potential risks wrong PIT, wrong insurance premiums or handling is not properly the case of arrears, access field.

Tool payroll professional to help businesses minimize risk, legal support, accounting and hr C&B greater peace of mind in the process of operation, especially in the inspection, investigation or settlement.

In summary, businesses should use tools professional payroll when the scale hr increases wage policy become more complex, requires compliance with the law need to control personnel costs all the way. This is not just math technology, which is significant step forward in the process of professionalization of human resource management.

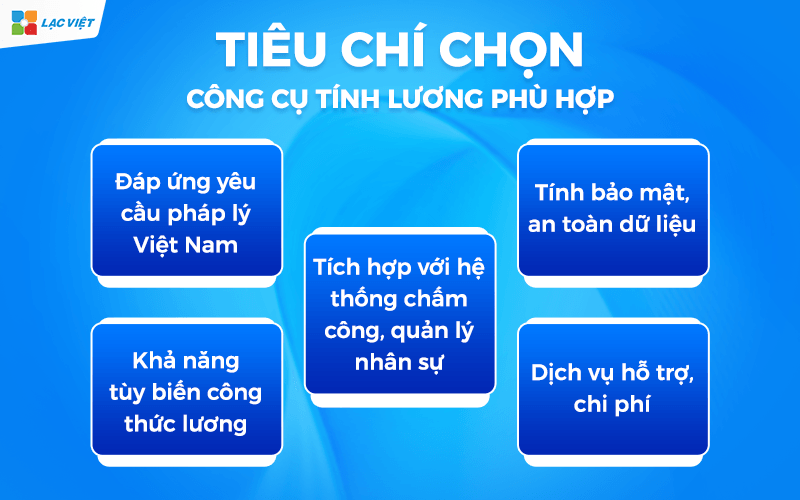

7. Criteria to choose a tool payroll suitable

The selection tool payroll not only based on the price factor or software interface, which is more important than the level to meet the actual needs of the business and the ability to go a long way. A suitable tool will help reduce legal risks, optimize resources, improve operational efficiency.

7.1. Meet legal requirements, Vietnam

Tool payroll needs in full compliance with the current regulations on wages, social insurance (SOCIAL insurance), health insurance (health INSURANCE), unemployment insurance (UI) and personal income tax (PIT). This is especially important because only a small flaws in the calculation of the deduction or insurance premiums can also lead to the business being arrears or penalty.

For example, software or payroll should auto-update when the minimum wage or the rate of SOCIAL change, to avoid the situation of having to adjust it is time-consuming easy to confuse. According to the report of the General department of Taxation, every year there are thousands of businesses fined for declaration PIT incorrect, part of the reason came from the payroll system is not updated timely.

7.2. The ability to customize the wages

Every business has a structure different salary includes basic salary, allowances, bonus according to performance, sales commissions, overtime... tool payroll need to allow custom formulations to meet internal policies without rewriting the entire system.

For example, a manufacturing company may need to calculate salary according to the output, while the business service leave paid by the hour worked. The ability to customize help tools become versatile, suitable for multiple business model, easy to adjust when the policy change.

7.3. Integration with time and attendance system, hr management

A tool payroll efficiency should be connected directly to attendance system (fingerprint scanner, magnetic card, mobile application) and software personnel management (HRM). This integration helps data move seamless, stress-free operation input crafts limit errors.

For example, data days, overtime, vacation is automatically switched to tools salary calculator to calculate immediately, significantly shorten the processing time payroll.

7.4. Confidentiality, data security

Salary information is sensitive data, is directly related to employee benefits and financial business. So, tool payroll must have a mechanism multi-layered security: authorized access, data encryption, secure storage, backup periodically.

A leaked salary data not only cause loss of confidence in the internal, but also can lead to complaints or labor disputes. Businesses should prioritize the solution has reached the security certificates such as ISO/IEC 27001 or comply with standard network security in accordance with the law of Vietnam.

7.5. Service support costs

In addition to features, support services from suppliers play an important role. A good tool should have a team of technical support ready to answer, troubleshooting and user guide when there is a change in wage policy.

About the cost, the business should consider the total cost of ownership (Total Cost of Ownership – TCO), including free deployment, annual maintenance fee, free upgrades, personnel training. Sometimes, choosing the cheapest solution, but lack of support or non-responsive long to be more expensive later.

8. Instructions how to use the tool payroll efficiency

A tool payroll only exert maximum value when the business know how to operate properly process and exploit all the features. This not only saves time but also ensures the accuracy of transparency, the ability to retrieve information when needed.

Step 1. Prepare input data

Before starting the payroll, the business needs to collect standardized entire related data, including:

- Timesheets: the Number of days worked, overtime hours, vacation days, sick leave.

- Information contract labor: the basic Salary, pay grade, the form of payment of wages.

- Allowances, additional terms: lunch allowances, gasoline, telephone, responsibility, rose.

- Deductions: SOCIAL insurance, health INSURANCE, personal income tax, other deductions (if any).

The help system payroll processing faster reducing the risk of errors.

Step 2. Configure the wages and policies

Tool payroll needs to be set the correct formula based on internal policies and legal regulations. For example:

- Formula calculate salary according to the time = (basic Salary / Number of days the standard) × Number of days the reality.

- Formula to calculate overtime according to Vietnam Labor Law, (150%, 200%, 300% depending on the day).

When configured properly right from the start, the business avoids having to manually edit the monthly. For the modern software, the administrator can create many different recipe for each group of personnel from that meet the diverse needs change rapidly when you have the new policy.

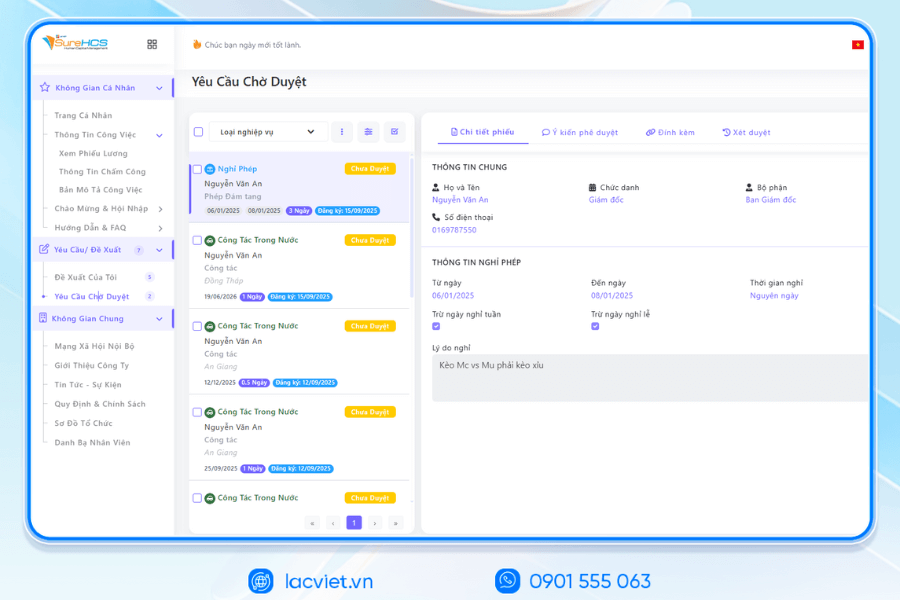

Step 3. Check to confirm the results

Whatever tool payroll automatic high precision, still need to step check before closing the pay table. Parts C&B should be:

- Compare the results with data attendance contract.

- Verify the bonuses, benefits or special deductions.

- Check the correct application of the tax insurance under current regulations.

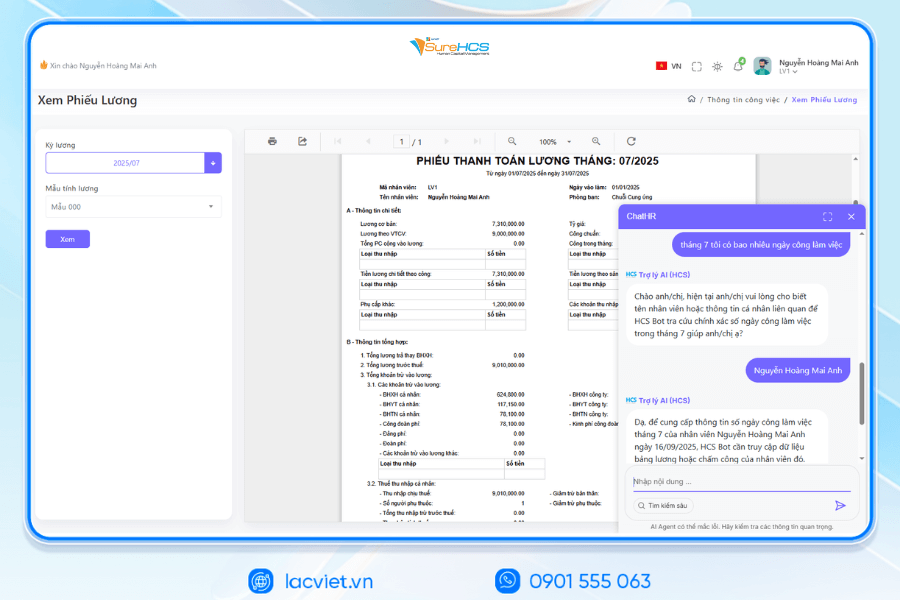

Step 4. Storage & reporting

After confirmation, pay tables need be, secure storage, easy access when the need for reference or inspection. Most of the tools payroll modern are supported:

- Stored on the platform in the cloud with access rights division.

- Report payroll costs by month, quarter or year.

- Trend analysis salary to support planning, personnel budget.

Visual reports serve not only the legal requirements but also help leaders take strategic decisions. For example, the data may indicate which parts are incurred cost the unusually high to adjust timely.

- Lac Viet SureHCS C&B paid by the customized products according to specific business

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- File excel payroll according to the products & how to calculate standard SMV company may, production

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

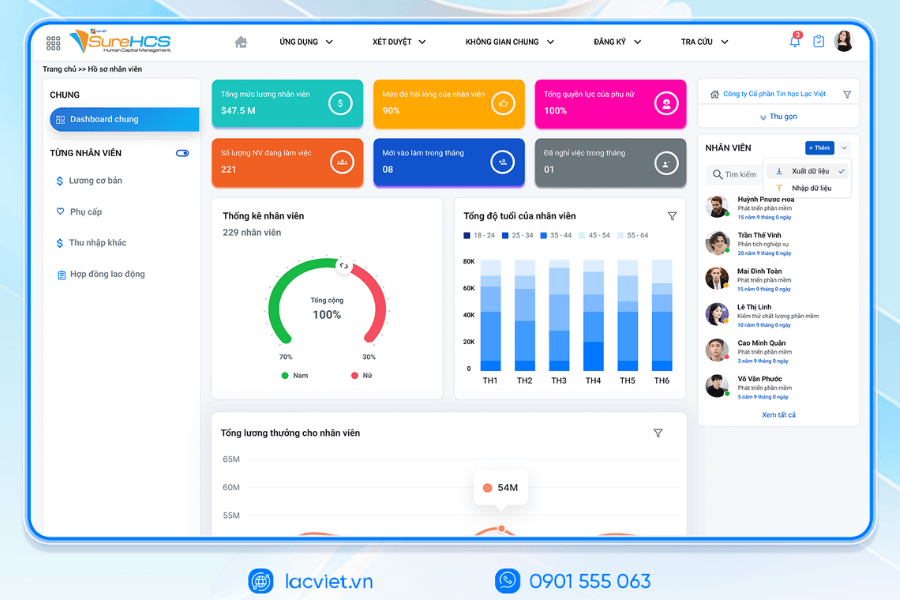

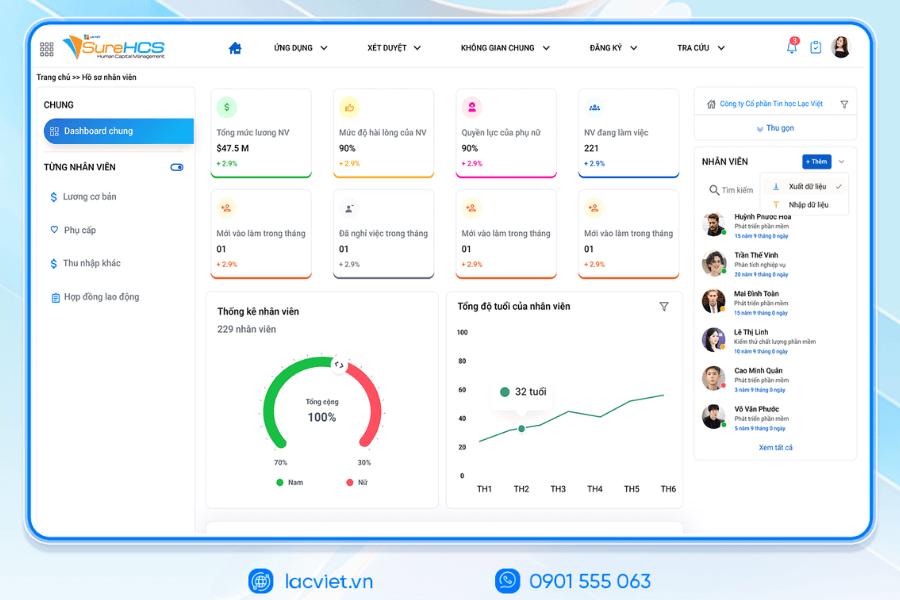

9. LV SureHCS C&B to help optimize workflow management payroll hr

Process management-timekeeping traditional common potential risks such as errors when entering data manually, difficult to control real-time data, and time-consuming synthesis report. This is the reason why many businesses faced with state payroll slow, inaccurate affect directly to the experience of staff and the reputation of the hr department.

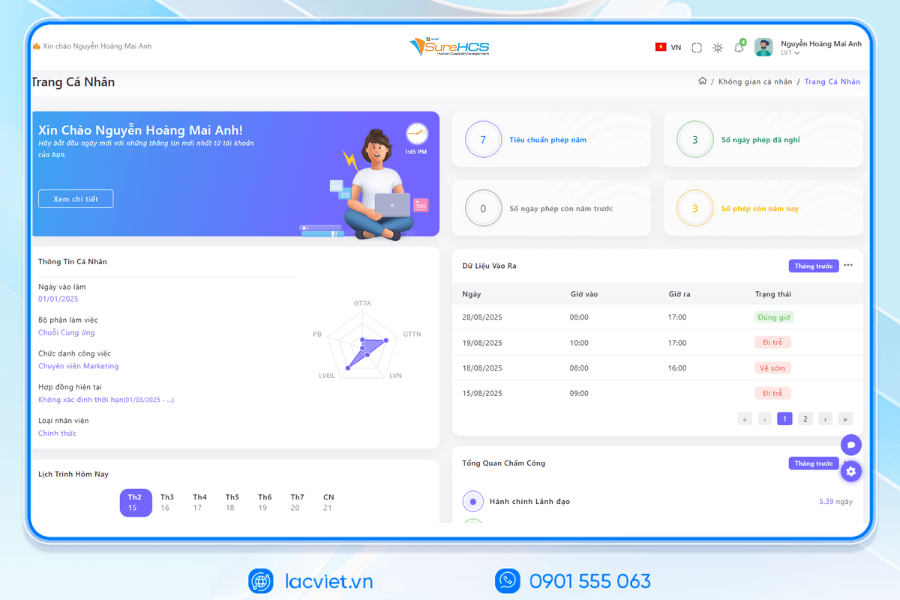

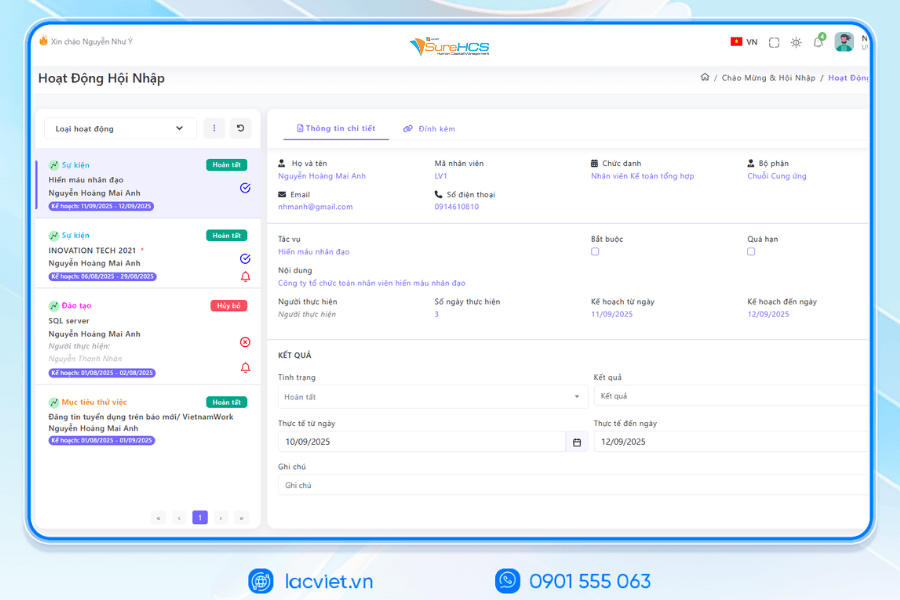

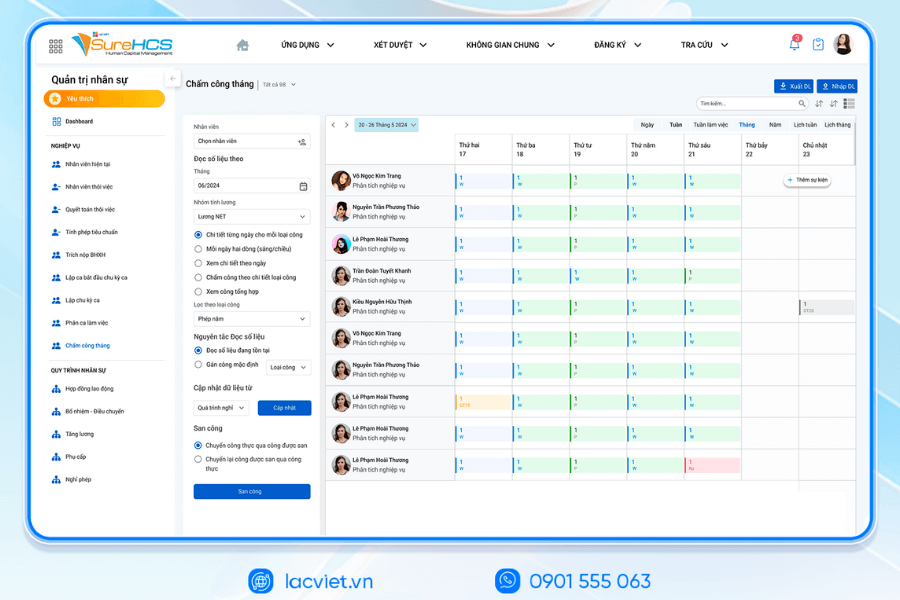

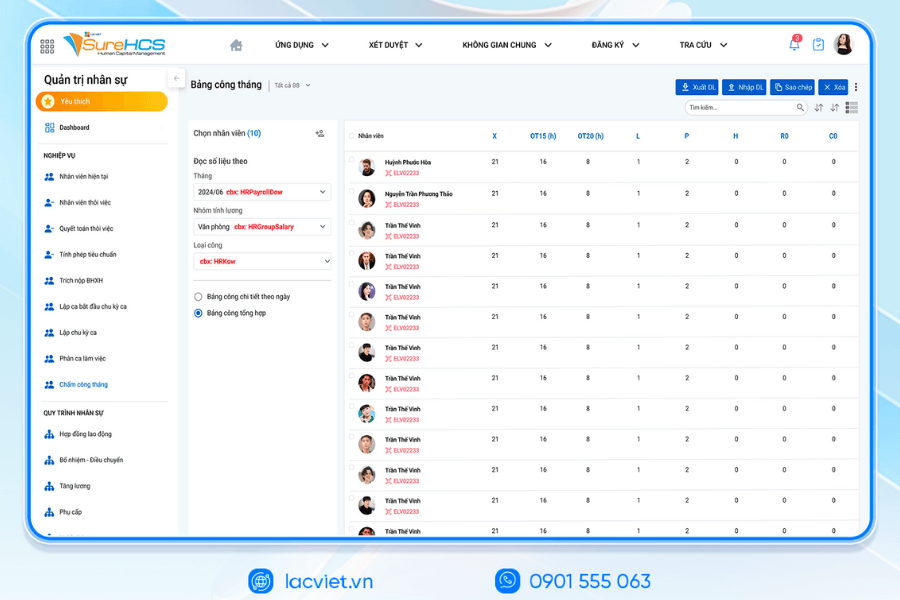

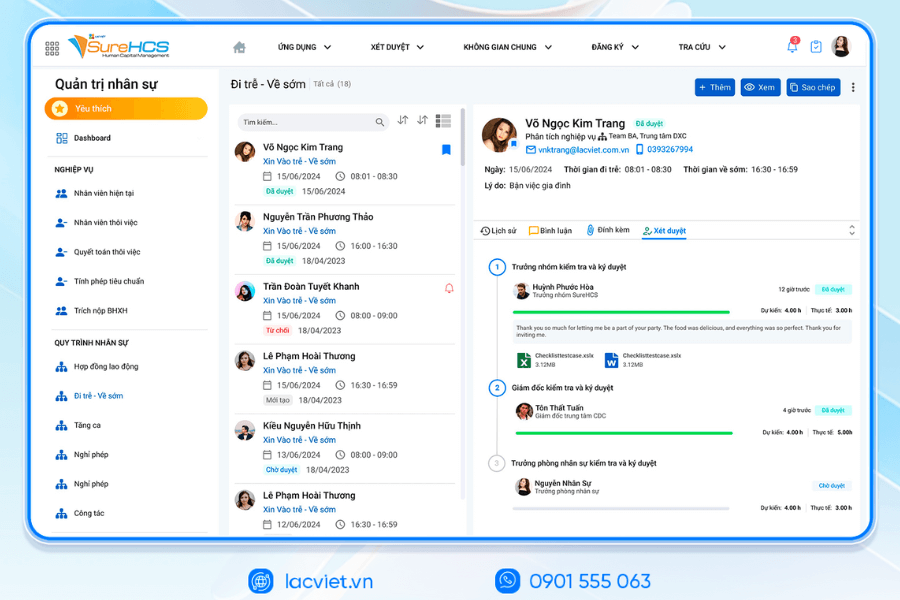

Management software hr LV SureHCS designed to radically solve the this problem by automating the entire process, timekeeping, and payroll. Instead of losing hours and check out the paper or Excel file, the business can sync data from the timekeeper, equipment, face detection, magnetic card or attendance app mobile system in just a few seconds.

A number of outstanding value that LV SureHCS bring:

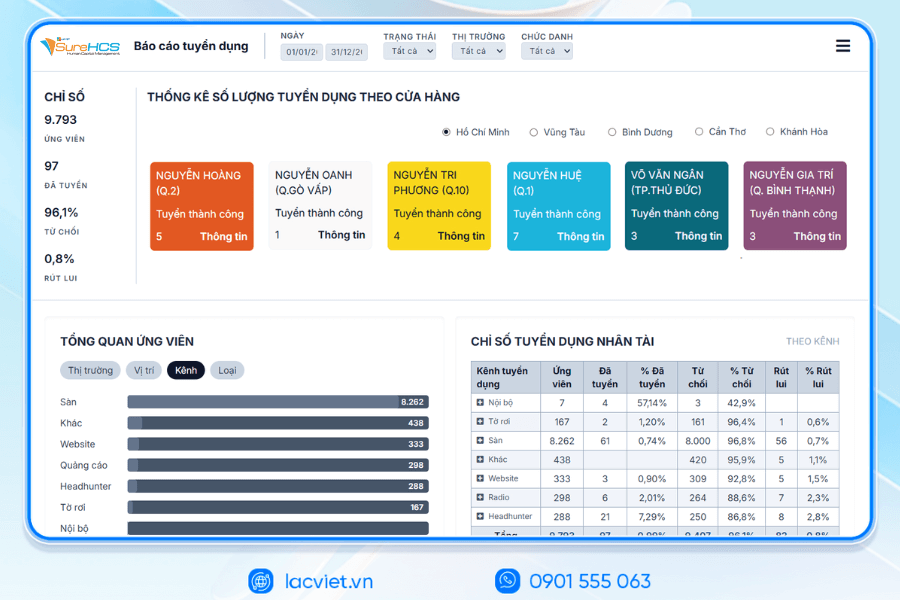

- Up to 80% processor time table to automatically aggregate, collate data from multiple sources.

- Accuracy almost absolute when completely remove steps to enter manually, limiting the maximum errors.

- Support flexible attendance for many models work: office, factory, staff work remotely or work in shifts.

- Provide reports, in-depth analysis about productivity rate, tardiness, overtime... help leaders have the data to make decisions.

- Data security standards ISO/IEC 27001, ensure employee information is always safe.

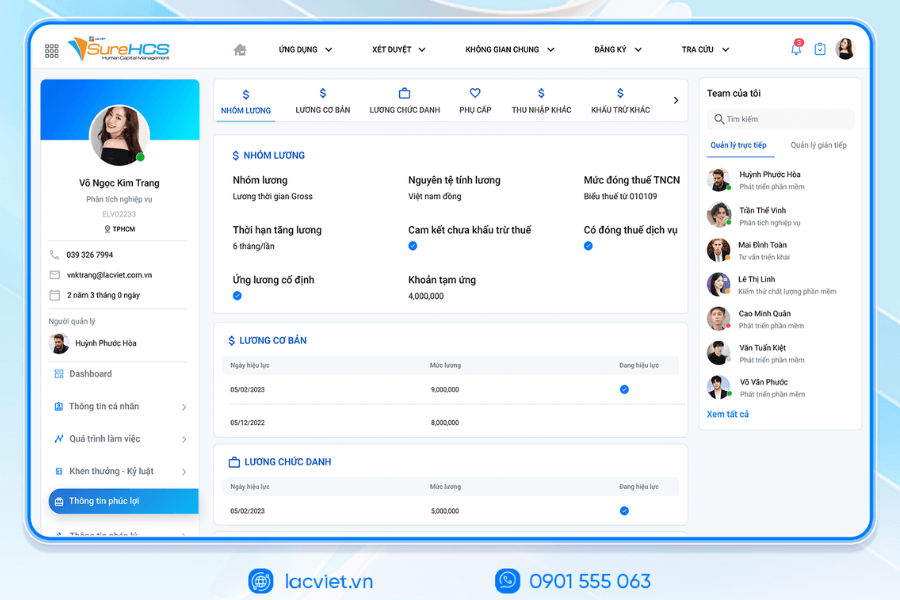

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

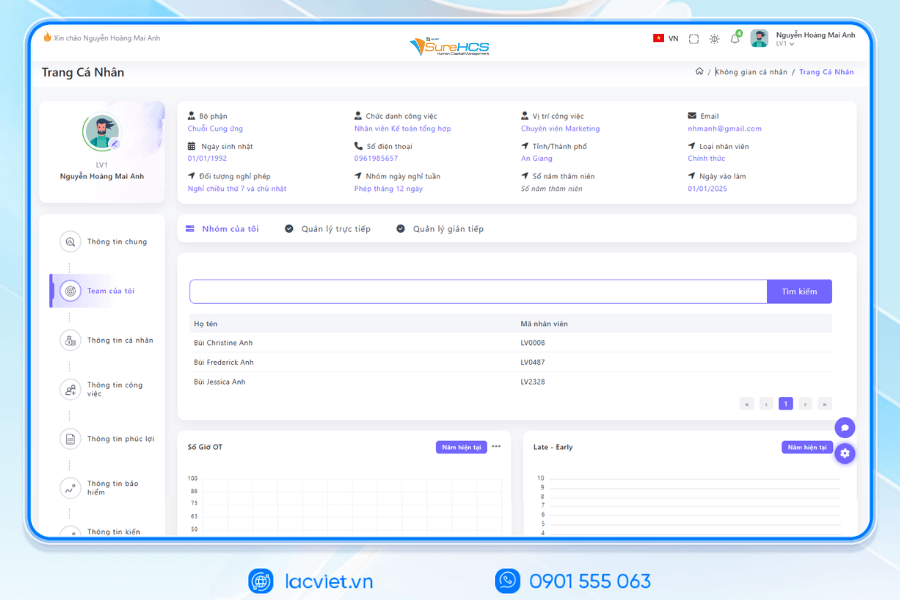

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

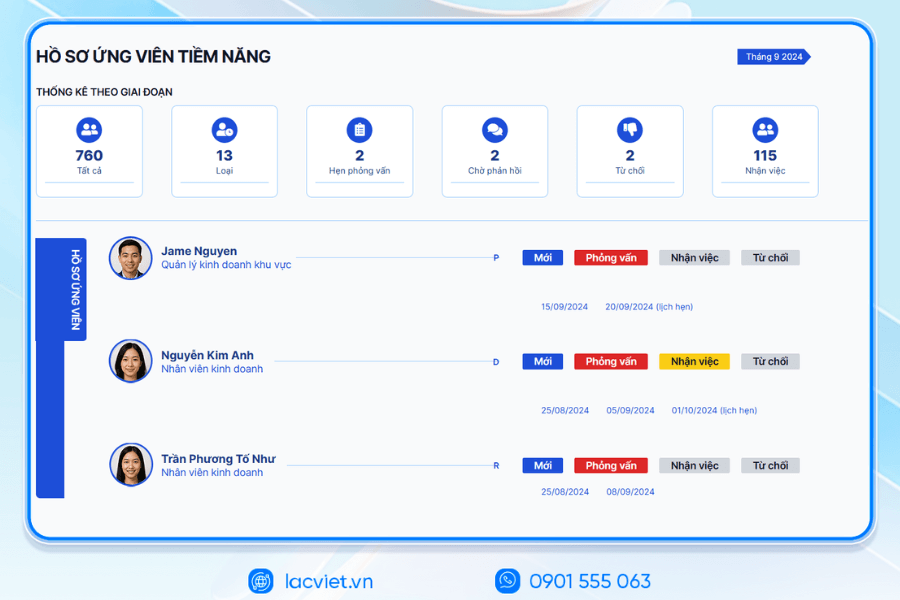

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

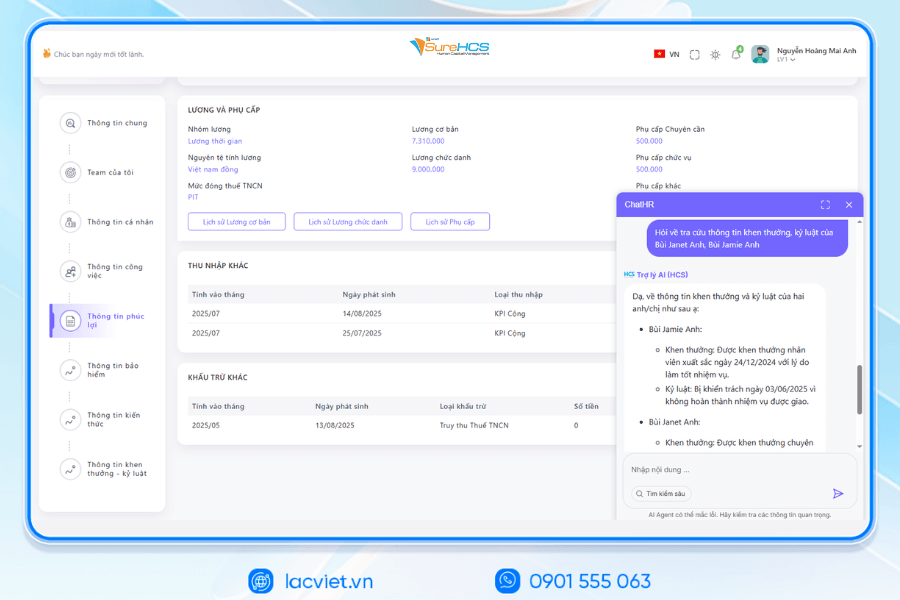

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

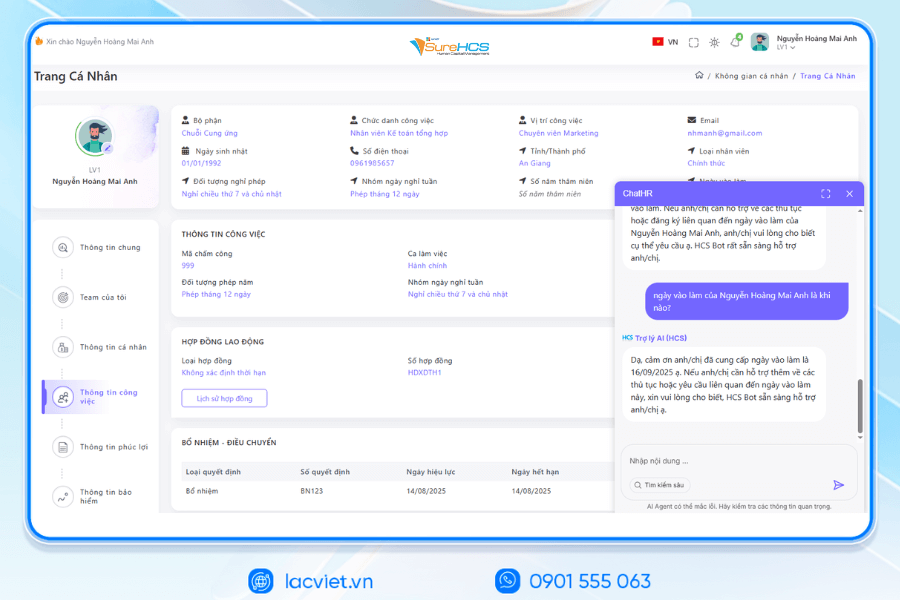

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

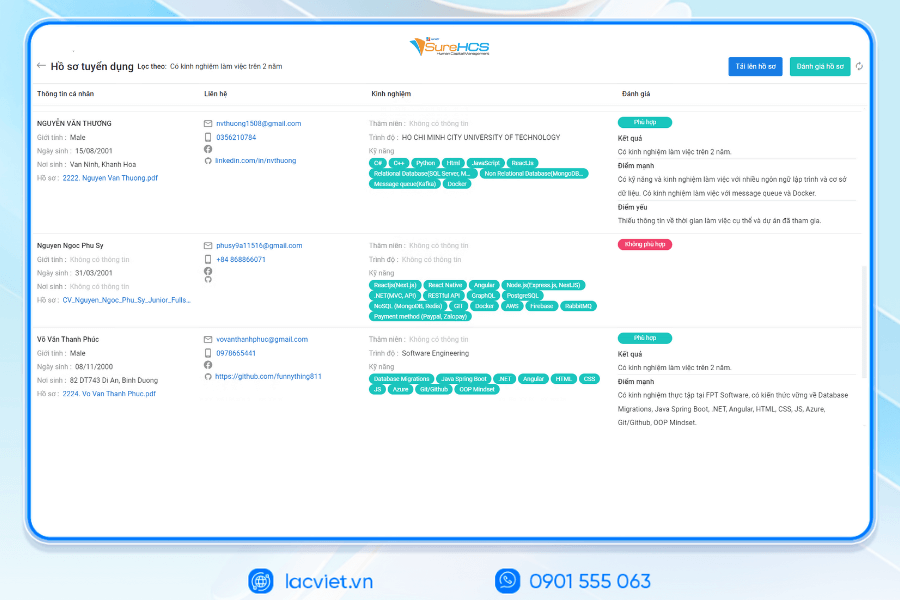

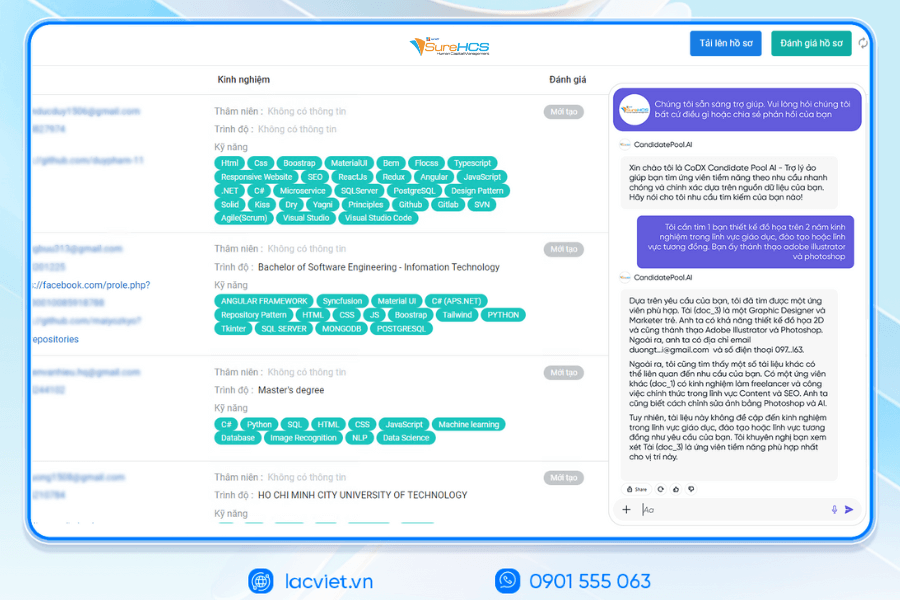

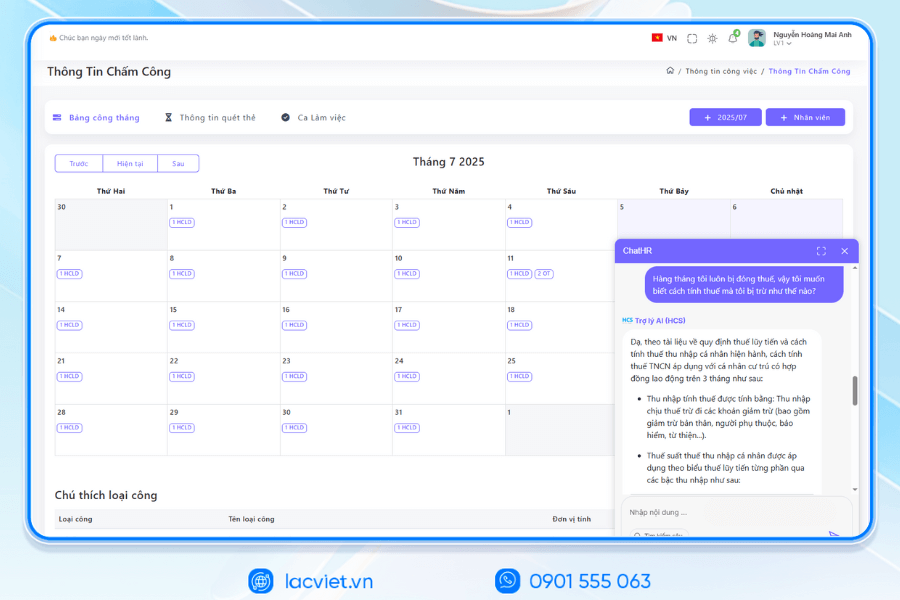

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

With LV SureHCS, business not only save operating costs, but also the built environment, working professional, fair, transparent.

In the context of business need to process optimization, management, guarantee the absolute accuracy in salary calculator salary plays a pivotal role to help save time, reduce errors and increase transparency. If your business is looking for a solution management software resources just professional and easy to deploy, integrate, consider the particular software from Vietnam SureHCS to automate, standardize and elevate payroll process in a sustainable way.

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD