Accounting for the cost of shipping is the process of accounting recognition, classification and calculation of expenses incurred in moving goods (from supplier to warehouse or from warehouse to customer) on the accounts of accounting appropriate (such as TK 156 – inventory, TK 641 – Cost of sales, or TK 642 – Cost enterprise management) to accurately determine the cost of inventory as well as prices of products directly affect the financial reporting and corporate profits.

In fact, many new business start deployment professional shipping, often have difficulty in determining the time recorded, allocation of costs on the price of capital or cost of sales, as well as reflect on bookkeeping.

Therefore, mastering the rules and principles enshrined shipping cost to help businesses control costs, optimize cash flow and improve the efficiency of management. The same Lac Viet learn how accounting to allocate the cost of shipping into the price of capital or cost of sales standards, ensuring financial reporting transparency and accuracy.

1. Overview of accounting shipping costs

1.1. The shipping cost is what?

Shipping costs are all the costs that a business must pay to bring goods from one place to another. This cost includes not only the transport of purchases of inventory or shipping the goods sold to the customer, but also all the service related support, such as loading, unloading, packing, insurance and rent out.

Shipping costs include:

- Shipping charges purchases of inventory: payment for bringing the goods from the supplier of the inventory of the business.

- Shipping charges seller: cost to delivery goods to end customers.

- Free unloading, packing, shipping insurance: help ensure the safety of goods during the move.

- The cost to outsource logistics: if the business uses the services of the transport company external to the cargo.

The record received in full, exactly the cost of this business there are paintings operating costs, transparency, thereby optimizing cash flow and loss reduction.

1.2. Accounting the shipping cost is what?

Accounting shipping costs is the recognition, allocation and tracking of expenses incurred related to shipping of goods, raw materials and products in the business. Services performed under circular no. 200/2014/TT-BTC, including shipping goods, purchasing, sales, and cost to outsource logistics to ensure the cost is reflected full transparency on bookkeeping.

Important role in the cost of shipping:

- Cost control, accurate shipping: business know exactly each shipment takes how much the shipping cost.

- Support financial reporting transparency: when making statements price of capital, cost of sales or profit reports, all costs are accounted for in full, easy to check.

- Analysis of the operational efficiency & reduce loss costs: data recorded shipping costs purchase or hire outside help businesses assess the cost, according to each partner, route, since that optimize operating costs.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- Accounting unearned revenue is what? Principle & how accounting

- The accounting entries accounting purchase standard TT200 & TT 133

- Accounting what is merchandising? Detailed description of work and tasks

2. Principles recorded cost of shipping in business

Accounting shipping costs must adhere to the following principles to ensure the accuracy of transparency and governance support cost-effective:

- Record expenses when incurred, there are vouchers valid: All shipping costs are recorded only when valid documents including invoice, delivery note or contract of carriage.

- Cost allocation for the right purpose: the shipping Cost should be allocated to the correct purpose of use, depending on the into account the cost or account inventory corresponding to the purpose of birth:

- The shipping cost of purchases of inventory recorded in the price of capital goods (account 152, 153, 156).

- The shipping cost seller: recorded in cost of sales account (641 following Circular 200or 642 by Circular 133).

- Cost management general shipping: if the shipping cost to outsource related to many activities, should allocate reasonable in proportion to use.

- Cost segregation domestic shipping – international – rental cost outside: the shipping Costs can arise in many forms.

- Domestic shipping: free delivery in the country, the cost of fuel, handling and insurance.

- International shipping: freight shipping, customs charges, insurance, import and export goods.

- The cost to outsource logistics: Costs paid to the Tuesday, noted depending on purpose is the purchase or sale of goods.

- Track, collate evidence from in order to avoid loss or falsifying accounting: reconciliations performed continuously vouchers arise with accounting data on invoices, export, import, warehouse, transportation contracts.

3. How to record journal entries shipping cost according to circular 200 & circular 133

Core rule governing professional shipping cost is the principle of the original price (for buy orders) and matching principle (for sale). The clearly distinguish these two cases is key to ensure financial reporting accuracy.

3.1. Accounting shipping costs purchase (calculated on the original goods)

Shipping costs purchase about such charges, loading and unloading, insurance is required expenditures to bring the property on the status ready to use. So, these costs must be calculated on the actual value (original price) of assets according to the accounting regulations.

Principles & accounts apply:

- Principle: the original Price of the inventory (or fixed assets), including all of the costs directly related to the procurement and processing assets to put into a state ready to use.

- Debit account main: TK 152 (Raw material), TK 156 (goods), TK 211 (fixed Assets).

The account details accounting shipping costs purchase:

| Transactions | The account | Notes |

| Noted shipping cost outsource |

|

|

| Recorded shipping costs internal (If allocated) |

|

|

For example: Business, buy a lot of goods (TK 156) with price and 150,000,000 VND (excluding VAT) and pay the freight in addition to 5,000,000 VND (VAT 10%) bank deposits.

Table 1: Recorded purchase price (assuming buy bear)

- Debt TK 156: 150,000,000 and

- Debt TK 133: 15.000.000

- Have TK 331: 165.000.000

Table 2: Recorded shipping cost (to the original price goods)

- Debt TK 156: 5.000.000

- Debt TK 133: 500.000

- Have TK 112: 5.500.000

Original price fact of the shipment on the books (TK 156) is 150,000,000 and + 5.000.000 = 155.000.000 VND

3.2. Shipping cost when selling (charged to cost of sales)

Accounting shipping costs when sales incurred after the product has completed, is the cost related to the process of consumption of products and goods. This is considered to be cost states are collated with the revenue of that.

Principles & accounts apply:

- Principle: matching Expenses incurred to generate revenue to be recorded along with that revenue.

- Debit account main: TK 641 – Cost of sales. TK 641 set of costs related to consumption of products, goods and services.

The account detailed accounting of the shipping costs when sales:

| Transactions | The account | Notes |

| Noted shipping cost outsource |

|

|

| Recorded shipping costs internal |

|

|

For example, The company pays the freight for cash customers, the cost is vnd10, 000, 000 (excluding VAT 10%).

- Debt TK 641: 10.000.000 (directly affects the net profit of the states)

- Debt TK 133: 1.000.000

- Have TK 111: 11.000.000

Expenses 10.000.000 this will be the shipping to TK 911 at the end to determine the results of the business, reducing the profitability of that.

3.3. Shipping costs outsource (applicable for both buy & sell)

This is the most common form, when the business use of transport units independently. The accounting depends entirely on the purpose of your shipping is stated on the contract/invoice.

Classification – The account accounting shipping costs outsource:

| Purpose outsource | Principles applied | The account (assuming payment by deposit NH) |

| Shipping buy | Original price |

|

| Shipping wholesale | Cost of any (Suitable) |

|

For example: Businesses hire Logistics company X shipping goods sold to the customer (sales), with a cost of service 50,000,000 VND (VAT 10%). Business hasn payment (debt TK 331).

- Debt TK 641: 50.000.000 (Recorded cost of sales of “VAT”)

- Debt TK 133: 5.000.000 (input VAT)

- Have TK 331: 55.000.000 (Recorded public debt to pay for Logistics company X

Upon payment of public debt for Logistics company X after this: Debt TK 331 / Có TK 112 (55.000.000 USD).

Although the shipping cost is self-operated or outsourced, the nature and purpose of cost always decide to debit account finally, adhere to the principle of original price for the property as well as suitable for operational costs.

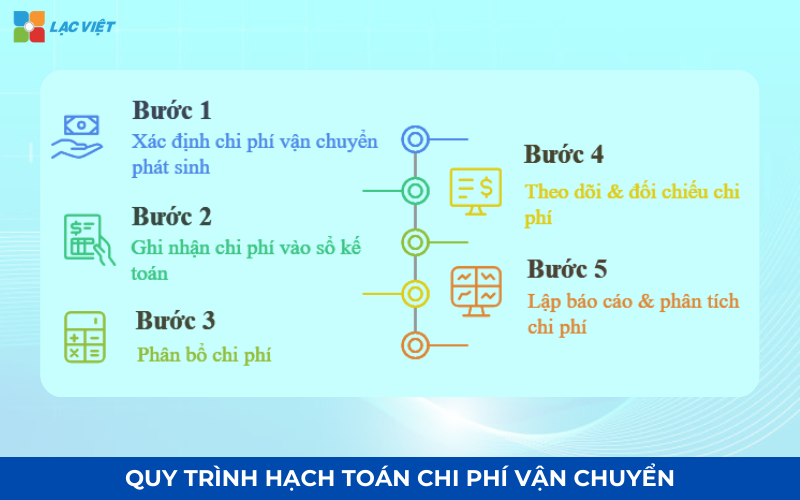

4. Process of accounting for cost of shipping details

Accounting cost of shipping is not just the recognition of expenses incurred, which is also important tools to help businesses control cash flow, optimal price of capital as well as improve the efficiency of management. Below is the implementation process details:

Step 1: Determine the shipping cost incurred

First, the business should be listed in full the expenses related to shipping, including:

- Freight purchases of inventory: Cost to pay for bringing the goods from the supplier about the business. This is part of the cost will be added to the price of capital goods.

- The freight goods sold: Cost of delivery to the end customer, to be accounted for in cost of sales.

- Cost of loading, unloading, packing, shipping insurance: Free this ensure the goods are not damaged in the shipping process.

- The cost to outsource logistics: When business use, transportation services, party Tuesday. Depending on the purpose outsource, this cost can be accounted for in the cost of shipping goods purchased or shipping cost before a sale.

Step 2: recognition of expenses in accounting books

After determining the expenses, business perform accounting on accounting accounts respectively:

| Profession | Accounting |

| The shipping cost of purchases of inventory |

|

| The shipping cost seller |

|

| The cost to outsource logistics |

|

Step 3: cost allocation

The shipping costs incurred need to be allocated for the right purpose to reflect accuracy:

- Purchases of inventory: shipping cost is added to the capital, serves calculate the price of stock and profit reports.

- Seller: the shipping cost is recorded in cost of sales, to help businesses accurately assess the profitability of each product or order.

- Cost of shipping management, general: if costs are incurred for multiple activities, allocated according to the proportion of actual use.

Step 4: Follow & for lighting costs

Businesses need to make for projector periodically between invoice, delivery note, a contract of carriage with accounting data. The objective is:

- Detection of errors or discrepancies the cost timely.

- Avoid losses, costs or recording the wrong entry.

- Ensure financial reporting transparency, adequate for audit or tax settlement.

Step 5: reporting & analysis, cost

After accounting, business reporting, shipping costs according to each item:

- Report cost shipping buy: to help businesses assess the capital fact of inventory.

- Reported cost of shipping wholesale: support profitability analysis by product, customer, route.

- Cost analysis outsource logistics to help businesses choose the offer optimum cost savings.

Compliance processes accounted for the shipping cost to help businesses ensure compliance with the legislation and transparent information governance. Through that, control cost effective logistics and support leadership decision making strategy to raise competitiveness.

5. The note when accounting for cost of shipping

To ensure accuracy as well as compliance with the law in accounting, business need to pay attention to the points noted the following:

- Cost segregation shipping local & international: Help business recorded properly on the price of capital or cost of sales, at the same time evaluate the effectiveness of each route shipping to choice and suitable suppliers.

- Check the cost incurred in addition to the contract: All costs incurred in addition to the contract need to be verified as well as allocate the right purpose, assurance, financial statements accurately reflect the price of capital and cost of sales.

- Control BLACK & cost to outsource: Ensure valid VAT invoices, accounting the cost of rent in addition to the right type in order to allocate according to each order or shipment, help optimize costs, and support tax settlement accurate.

- The risk when accounting for wrong shipping costs: accounting mistakes can lead to the price of capital or cost of sales is not correct, do wrong to report profits as well as settlement tax affect the cost management and business decisions.

Compliance with the note not only meet the requirements of the audit but also strengthen the foundation of financial management of the business.

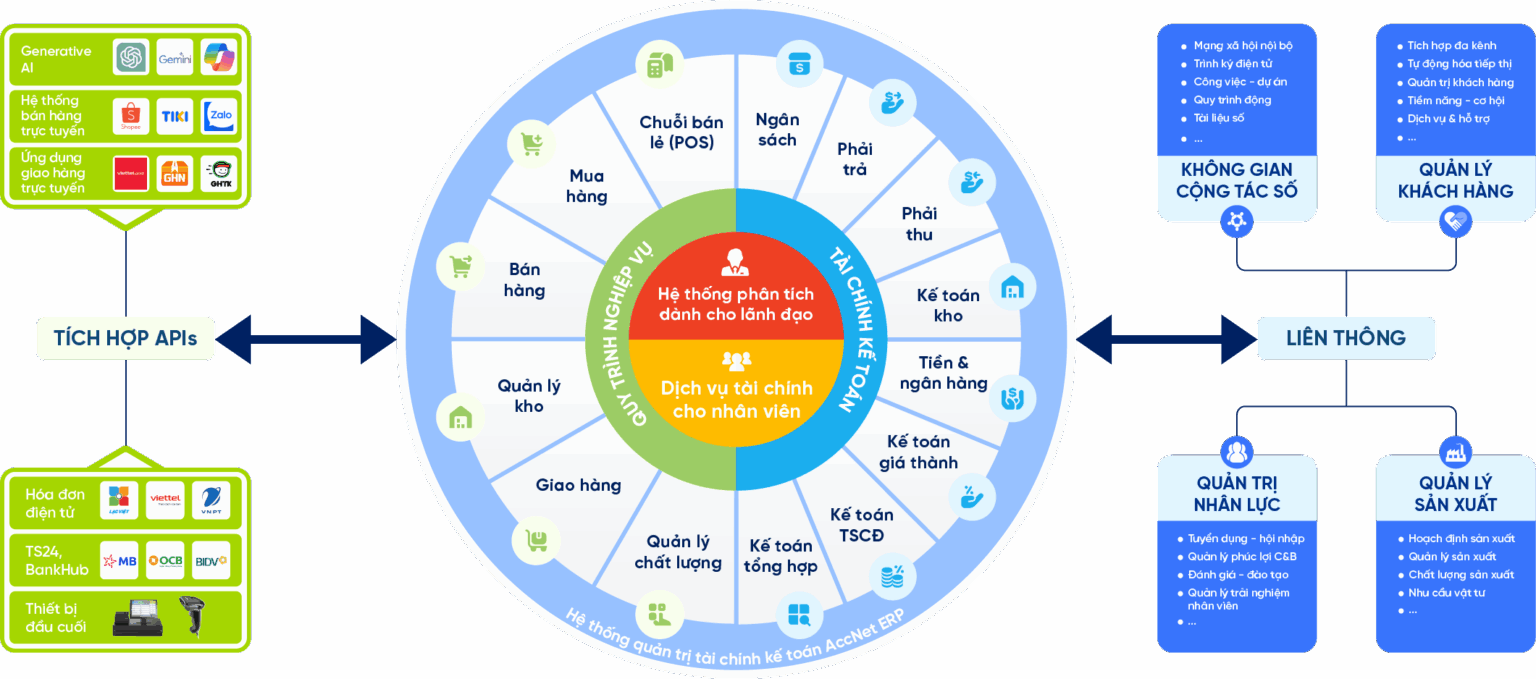

6. The optimal solution of cost accounting by accounting system Accnet

To reduce errors, shorten the processing time business and ensure the recorded cost of shipping is correct, the business should application solutions accounting numbers as Accnet. The software brings many practical benefits:

- Automate the entire pen shipping costs: automatically recorded accounting for cost of shipping item purchased, shipping costs when sales and cost of hiring external links invoice – delivery note – certificate from transport, to help eliminate risk accounting craft.

- Cost control in real time: the fast track to the influence of the shipping cost to the price of capital, cost of sales and cash flow, ensuring accurate control each item of cost incurred.

- Management transparent shipping cost: Classification of costs according to each shipment, projects, departments, or online shipping; meet the right standard circular 200 & 133.

- Analysis report standardized: Synthetic details of shipping costs, support leadership assessment effective shipping route, partner selection and optimization of logistics costs.

- Electronic storage full: automatically save receipts, bills and votes delivery, convenient for auditing as well as for internal projection, enhance transparency in administration costs.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

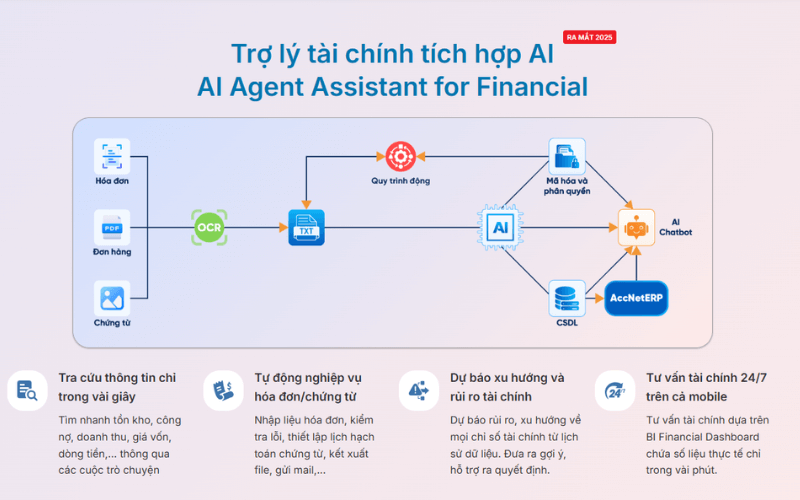

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting cost accurate shipping not only helps businesses control cash flow, price of capital, but also raise the effective cost management overall. Compliance with the process and principles of accounting help reduce the risk of errors, ensure financial reporting transparency in order to support strategic decisions based on real data. At the same time, management costs, reasonable shipping also help businesses optimize profit, choose partners transportation efficiency and enhance competitiveness in the market.