Accounting unearned revenue is the process of using TK 3387 (Liabilities) to acknowledge the funds were collected before (rent, installment sale...) but have not yet arisen full obligation to provide services/goods. When receiving money, Debit TK 111, 112; Have TK 3387 and Have TK taxes incurred. Periodically, when the obligation to complete, accounting metabolism gradually these terms of revenue by pen payment: Debit TK 3387 / Có TK 511.

However, many businesses just apply the long-term contracts, leases property or in installment sales, often have difficulty in determining the time recorded, allocate revenues or adjusted when there are changes to the contract. The accounting mistakes or omissions can lead to the financial statements do not reflect the true business results, increased tax risks and affect the decision financial management.

The same Lac Viet learn in detail the steps recorded, the principles of allocation and the important note in order to perform accurate and efficient.

1. Revenue has not done what is?

Unearned revenue is the amount of money that the business has received from customers but not yet recorded on the actual revenue, by obligation to provide goods or services not yet complete. This is the sum of revenue “the moment has not recognized”, but was reflected on the balance sheet through account 3387 – unrealized revenue.

Accounting unearned revenue is the recognition of monies received in advance from customers (such as rent the property or interest collected in advance) into TK 3387 (Liabilities) on the balance Sheet. This account reflects the supposed future of the business and only be transformed gradually into actual revenue at the completion of the supply of goods/services in accordance with accounting principles.

The role of the recorded service revenue not yet implemented:

- Ensure appropriate principles & accuracy of financial statements: revenue is recorded only when the obligation to provide goods or services is complete, help avoid recorded soon and reflect the true state of business.

- Control the flow of money & the obligation to provide services: Business understand the amount of money received in advance, manage obliged to perform in the future.

- Reduce tax risk & compliance accounting standards: Recorded unrealized revenue helps to avoid errors in VAT and report business results, especially with long-term contracts or installment sale

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- Instructions on how accounting cost shipping details as TT200/133

- The accounting entries accounting purchase standard TT200 & TT 133

- Accounting what is merchandising? Detailed description of work and tasks

2. Accounting unearned revenue should comply with the rules?

2.1. Principles recorded under the current

Revenue is recorded only when the enterprise complete obligation to provide goods or services under the contract and ensure that the financial statements accurately reflect the results of operations, business practice, avoid revenue recognition early, thereby creating the data does not reflect the true financial situation.

According to the accounting Standards of Vietnam 14 – revenue and other income revenue is recorded only when:

- Business has transferred the majority of risks and benefits associated with the goods to the buyer, or has completed the service provider.

- Revenue is determined with relative certainty.

- Business has been or will be obtained economic benefits from the transaction.

- Identify the costs related to the transaction.

The funds business has received from customers but not yet implemented obligation to provide goods or services is not recorded as revenue in the period, which must be recorded as unearned revenue.

As defined in:

- Circular no. 200/2014/TT-BTC (for business applied business accounting),

- Circular 133/2016/TT-BTC (for small and medium business),

the account unearned revenue is accounted for in TK 3387 – unrealized revenue.

Compliance with principle recognizes business transparent financial statements, managing cash flow effectively and meet the legal requirements, limit the risk of VAT and CIT.

2.2. Principle of allocation & adjustable

Allocation of revenue received in advance is the movement gradually revenue from TK 3387 to TK 511 according to schedule completed obligations to supply goods and services. Revenue is recorded only correspond to the actual value, made in usa, guaranteed reflect true business results.

This principle is clearly stated in circular no. 200/2014/TT-BTC, according to which:

- Ensure the correct fit of the financial statements properly reflect the relationship between revenue and related costs, avoid revenue is recorded before but it still costs incurred after causing deviations actual profit.

- Effective management of long-term contracts, including accounting unearned revenue long-term, revenue from contract services, many states or contract for hire of property, by allocating gradually these sales in each accounting period.

- Timely updates when there is adjustment of the contract (change, terminate, or not use incentives): accountants have to adjust corresponding balance TK 3387 and the account payment related (TK 111, 112), ensure unearned revenue on the balance sheet always reflect the true obligations of the business.

This principle helps businesses minimize risk, tax, and compliance with accounting standards in Vietnam.

Therefore, strict adherence to the principles noted – allocation – adjusted unrealized revenue is the foundation to financial management, transparency, efficiency and legal compliance. At the same time, support managers, accountants to audit accurate assessment of the business situation and cash flow.

3. By accounting for the revenue has not made according to standard circular current

In Vietnamese accounting, unearned revenue is recorded mainly on TK 3387 – unrealized revenue. The accounting must comply with circular 133 or circular 200/2014/TT-BTCto ensure data on the balance sheet reflect the obligations of the business.

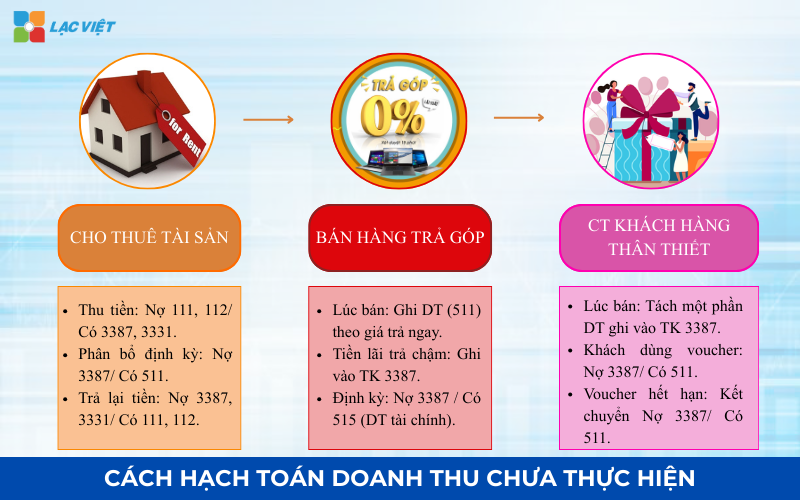

3.1. Accounting of money received in advance, many states about rental activity in fixed assets and real estate investment

With respect to the lease of property or real estate, spanning many states, businesses often receive the whole or a large part money rent right from the start. So we need to ensure the principle recognize revenue when the obligation to complete and allocation gradually according to states.

| Transactions | The account |

| When collecting money in front of customers for many states |

|

| Periodically, transfer the revenue of the states (allocated gradually) |

|

| The case of termination of the contract and to pay the money back |

|

Example of unrealized revenue: company, A rental building, office 3 years with the total amount of rent 360 million, the entire payment at the time of signing the contract. This entire amount is credited to TK 3387 and allocation gradually each year 120 million in revenue when the obligation to provide service has been performed.

Transactions in the account:

- When collecting money in advance:

- Debt TK 111, 112...: 360 million

- Have TK 3387: 360 million

- Allocation of revenue each year:

- Debt TK 3387: 120 million

- Have TK 5113: 120 million

- The case of termination of the contract, to pay the money back:

- Debt TK 3387 (remaining amount)

- Debt TK 33311 (VAT of the sales not made)

- Have TK 111, 112... (total return)

3.2. Accounting for installment sales deferred

Sales revenue amortization, deferred recorded according to the selling price paid immediately, the interest paid on deferred contribution revenue is not yet implemented and are allocated gradually to the revenue from financial activities (TK 515) according to each states.

| Transactions | The account |

| When sales deferred installment (revenue recognition according to the selling price paid right) |

|

| Periodically, revenue recognition, cash deferred interest |

|

Example of accounting unearned revenue: company B sells product 100 million customers have to pay 50 million now, the rest in installments 50 million in 5 months. Revenue 50 million received in advance is recorded in TK 3387, interest-free installments allocated gradually to fiscal revenue in each period.

Transactions in the account:

- When the installment sales:

- Debt TK 111, 112, 131: 100 million

- Have TK 511: 50 million (the sale price paid right)

- Have TK 3387: 50 million (interest-free installments not yet implemented)

- Have TK 333: VAT payable

- Recurring revenue recognition interest-free installments:

- Debt TK 3387: 10 million (for 1 semester)

- Have TK 515: 10 million

3.3. Accounting unearned revenue from client program traditional

Revenue accounts correspond to value deals, discount or goods/services provided free of charge for traditional customers will be credited to the TK 3387 at the time of sale.

| Transactions | The account |

| When sales and incurred obligations deals |

|

| When customers use preferential/free goods |

|

| When the customer does not use preferential/expired |

|

Note: The accounting account 3387 must comply with the current regulations, especially accounting Standards in Vietnam and the circular guide (such as circular no. 200/2014/TT-BTC).

Example of unrealized revenue: company C deployed Loyalty program, the customer is gift voucher for 1 million when you purchase a product. Value voucher recorded at TK 3387, when customers use the voucher, the corresponding value is transferred to revenue TK 511.

Transactions in the account:

- When arising obligations deals:

- Debt TK 111, 112, 131: 10 million (gross proceeds/receivables)

- Have TK 511: 9 million (actual revenue)

- Have TK 3387: 1 million (value deals)

- Have TK 33311: 0.9 million (VAT)

- When customers used deals:

- Debt TK 3387: 1 million

- Have TK 511: 1 million

- When the customer does not use all/deals expire:

- Debt TK 3387: 1 million

- Have TK 511: 1 million

4. The note when accounting for revenue recognition have not yet made

To ensure revenue recognition has not done correctly transparency and compliance with accounting regulations, businesses should note the following points:

- Track balances TK 3387 regular: Ensure balance accounting unearned revenue 3387 reflect obligations not yet implemented, avoiding deviations on the balance sheet.

- Allocation of revenue according to the progress of implementation: Ensure that revenue is recorded in accordance with the supply of goods or services, helping financial statements accurate.

- Updates when there are changes to the contract: When a contract change, is terminated, or the customer does not use incentives, need to adjust the revenue has not made timely to reflect obligations properly.

- Compliance with accounting standards & legal: accounting must comply with unrealized revenue circular 133/200 as well as the current regulations, ensuring lawful and reduce tax risks.

- Invoice regulations: The funds received prior to the required invoice in accordance invoice for unrealized revenue, avoid errors when the settlement of VAT.

- Track long-term contract & program preferences: Help to manage the contract of long-term services or programs, customer Loyalty effectively ensuring the allocation of revenues the same at a reasonable cost.

Note the full score on helping businesses accurately account management obligations and cash flow efficiency, while minimizing legal risks/ tax, create a solid foundation for financial management as well as strategic decisions.

5. The optimal solution of accounting software Accnet ERP

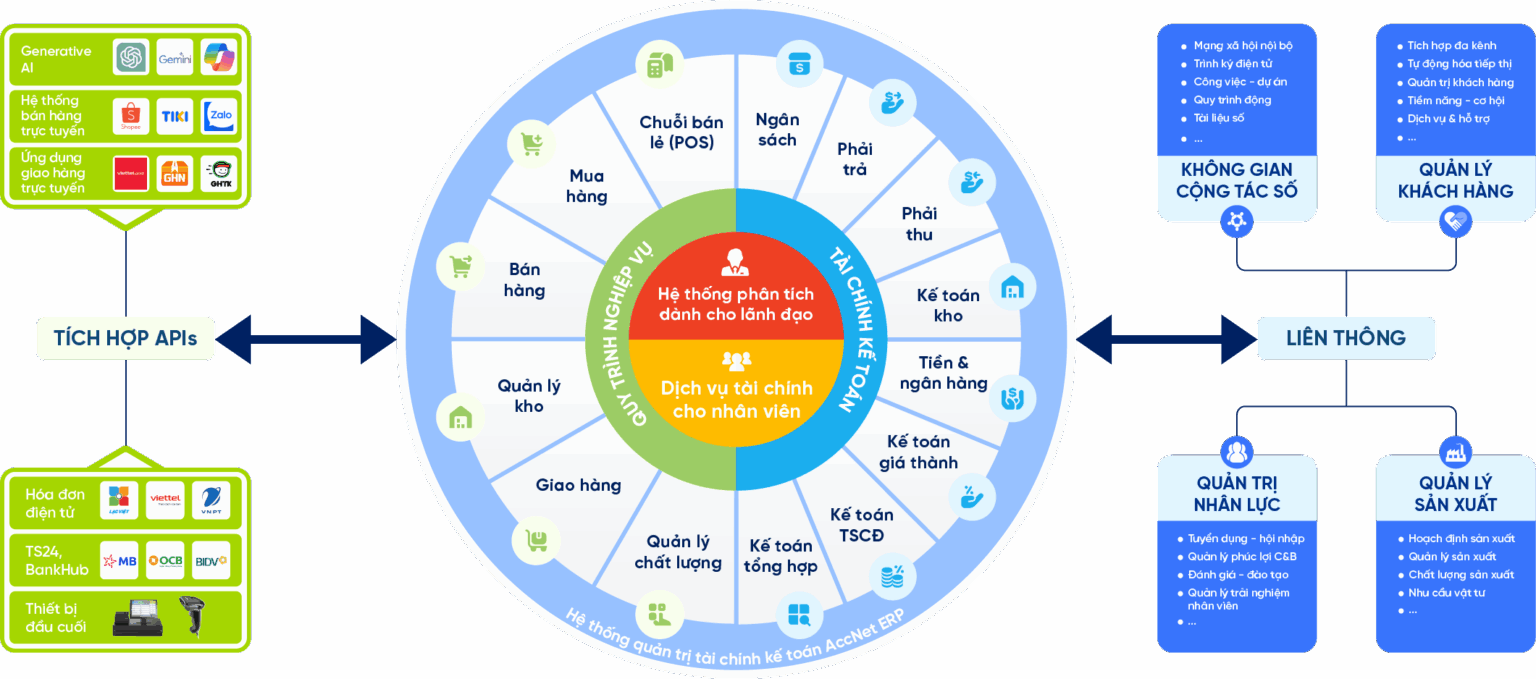

To optimize the process of accounting unearned revenue, the business can apply accounting software Accnet ERP helps to automatically transparency whole process:

- Automatically allocate the revenue has not made-in-progress: The software automatically recorded, allocated revenue from TK 3387 to TK 511-in-progress implementation of the contract, to ensure accounting accuracy, and reduce errors manually.

- Create pen automatic payments for long-term contracts and incentive program: the System automatically allocate revenue, expenses, and tax the correct account by each states to help save time, reduce errors and ensure accounting of revenue has not done right circular 133/200.

- Voucher management – reminder obligations: Accnet ERP store the entire stock from electronic tracking the progress of implementation of the contract and deadline reminders allocation of revenue, limit the risks noted the wrong figures on the balance sheet.

- Synthesis report revenues, cost – obligations: The software provides detailed reports about the unrealized revenue, revenue was recorded, costs associated with tax arises, help leaders evaluate the effectiveness of contract as well as strategic decisions correct.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

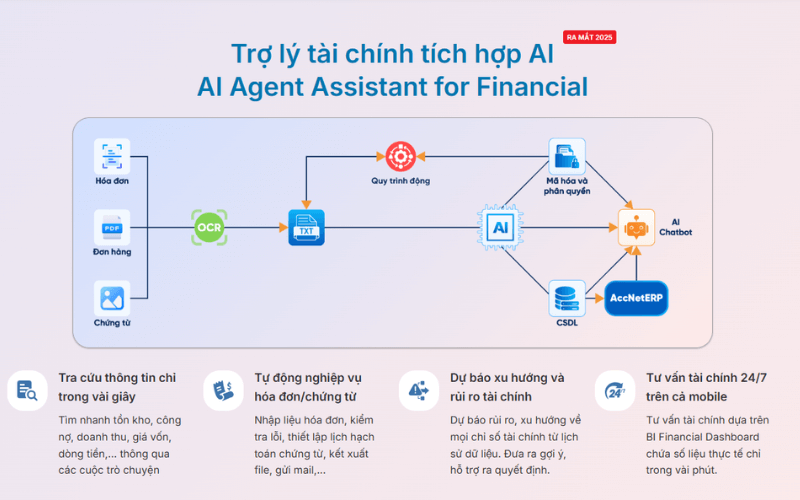

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The application software Accnet ERP not only optimize the process of accounting, but also improve the efficiency of financial management overall business support, management cost, liabilities as well as cash flow in a transparent, accurate, and effective.

The accounting revenue has not performed a key role in the financial management business, helping to ensure financial reporting accuracy, transparency and reflect the obligations to supply goods and services. Full implementation of the principles noted, allocate and adjust unearned revenue to help control cash flow, contract management, long-term and minimize tax risks. At the same time, the track and manage the account unearned revenue also create a solid base for financial planning, resource allocation and strategic decisions effectively.

Frequently asked questions (FAQs)

Unearned revenue account is what?

Unearned revenue is recorded in the account 3387 – unrealized revenue. This is a business account had collected money from customers but not yet provide goods/services in full, or has not meet conditions for revenue recognition standards. TK 3387 help accurately reflects the obligation to make of the business at the time of receipt of money.

When recorded into account 3387?

Business recorded in TK 3387 when:

- Customers pay in advance for the future.

- Business offers property for rent, but revenue should allocate time to time.

- The contract services are performed many states, has not qualified recognize revenue immediately.

- The case of installment sales, the interest rate differential installment was recorded gradually.

Unrealized revenue accounting how?

Step 1 – Record cash received in advance:

- Debt: 111/112

- Have: 3387 – unrealized revenue

Step 2 – When eligible revenue recognition:

- Debt: 3387

- Have: 511 – sales and service provider

Depending on the business, the business will be allocated according to the month/quarter/year to reflect the value provided to customers.

Account 3386 what is?

TK 3386 is Accept escrow, sign on to record the account business money received from partners to ensure execution of the contract. This is not revenue and not related to unrealized revenue. When the contract ends, the amount of the deposit/sign on will be returned or disposed of by agreement.

Unearned revenue is now on the balance Sheet?

Unearned revenue is presented in The Liabilities short-term or long-term depending on the time business is expected to perform the obligations:

- If the obligation to complete in 12 months, recorded in Liabilities short term.

- If the execution time exceeds 12 months, recorded in long term Liabilities.

The essence of this clause is obliged to provide goods/services in the future, not the revenue made.

Accounting unearned revenue how?

- When you receive money in advance of the customer:

- Debt: 111/112

- Have: 3387

- When providing services or goods correspond with the revenue to be made:

- Debt: 3387

- Have: 511

Case to the invoice when you receive money in advance:

The revenue has still not recorded, only business tax declaration according to the bill, the revenue will be allocated gradually from 3387 to 511 according to progress made.