Accounting cost of goods sold is the process of recording the value of goods and services have warehouse in TK 632 (Debt TK 632 / Have TK 154, 155, 156, 157...), includes cost of materials, labor, depreciation... done exactly help calculate gross profit true, inventory management, cost control and decision support strategy. Apply the correct method of calculating the price of capital (the actual purpose of the weighted average, FIFO) ensure faithfully reflect costs and reduce risks misleading financial statements.

However, in fact, many businesses still have difficulty in the accounting price of capital correctly – from the recorded cost of raw materials, labor, production costs common to the way the transfer price of capital in financial statements. If recorded wrong or apply the method of calculating the price of capital does not fit, the business can meet the risk of false profits, loss of control cost cause difficulties in the decision-making strategy.

Therefore, master the rules, principles of accounting and the method of calculating the price of capital not only help business faithfully reflect costs incurred, but also optimized financial management, inventory control efficiency, enhance decision-making abilities business. In this article Lac Viet will detailed analysis of cost of goods sold, the method of accounting, important note, as well as how effective management to support business operation, transparency and more effective.

1. Overview of cost of goods sold and how of accounting in business

1.1 cost of goods sold, what is?

Cost of goods sold is the total cost that businesses have to spend to produce or buy goods and services sold during an accounting period. This is a extremely important, not only reflect the direct costs related to production activities – business, but also as a basis for determining the gross profit, from which assess the effectiveness of business operations of the business.

The cost structure of cost of goods sold (COGS) is divided into three main groups, reflect the full costs incurred to bring the goods/products to status ready for sale:

- The cost of Buying raw material/goods: This is the basic costs, including the actual purchase price paid to the supplier. In addition, the group cost of this plus the import tax as well as taxes are non-refundable (if available), along with the shipping costs (freight, handling and insurance) for bringing goods to the warehouse of the enterprise.

- Cost Direct – Manufacturer General:

- Direct labour is the cost related to the direct labor to create the product, including the salaries, allowances and insurance of employees engaged in manufacturing, processing.

- Production overhead is the indirect cost but required for the production process, such as cost management, production, depreciation of machinery and equipment the cost of utilities (electricity, water, fuel) of the workshop.

- Shipping costs – Storage: this Group includes the costs incurred to bring the goods to the status ready for sale, namely the costs of storage and preservation of goods, work in process inventory (for example: cold storage, warehouse storage in particular), and the cost of shipping goods from the warehouse to the point of sale or customer (as the time the product is ready to be sold).

1.2. Accounting cost of goods sold, what is?

Accounting cost of goods sold is the process to track allocate all of the costs structure of the cost price of the goods or services were sold. In other words, this is the accounting accurately determine the “true price” that the business was removed to create products or provide services. Through this profession, business not only manage the cost, but also get a real profit arising on each item or each service.

Business accounting this includes the basic steps: record the cost of raw materials cost, direct labour costs, overall production costs, shipping and storage... When products or services are sold, the total cost of this will be the shipping into the price of capital as a basis to calculate gross profit in the accounting period.

The role of accounting and the price of capital in business:

- Determine the exact profit: Help calculate (gross profit = revenue – cost of capital) profit on each product in a transparent way, as the basis for the pricing reasonable.

- Inventory management & Expense: tracking number of the value, inventory accuracy, and help control the cost of production (raw materials, labor) to minimize waste as well as inventory obsolescence.

- Support strategic decisions: Provide data to decide on the pricing strategy, promotions, and optimized production processes (for example: determine the stages which are consuming high cost).

- Increased Management Responsibility: cost allocation clear, forcing the parts (production and logistics) have a responsibility to control costs in the range of their activities.

- Planning – Financial reporting: Is the foundation to financial reporting (gross profit, net profit), to help businesses profit forecast to make the decisions, investment, extending the long term.

2. Principles of accounting cost of goods sold

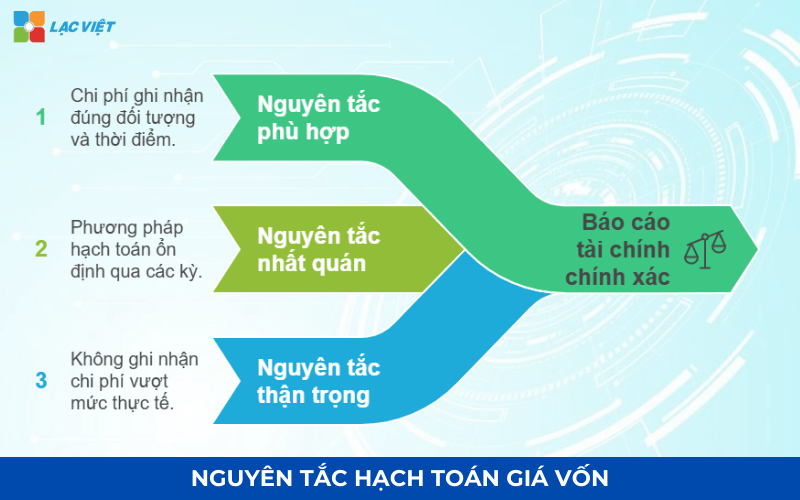

Accounting cost of goods sold is important profession that helps businesses accurately determine the gross profit, cost management as well as monitor the effective use of resources. To ensure the results accounted accurate and reliable accounting business needs to comply with some basic principles:

2.1 matching principle

This principle requires expenses incurred must be recorded properly with the objects and time of occurrence.

- The right audience: the Cost must be directly related to the product, service or consignment sale. Only when the cost of serving directly to the production or purchase, it will be counted into the cost of goods sold.

- The right time: the Cost must be recorded in the accounting period when products or services are sold, not recorded before or after the time of birth.

Matching principle ensures that the business to properly evaluate the actual cost for each product or service, from which to make decisions about sale prices, promotions or production strategy accordingly.

2.2 principle of consistency

Requires businesses to adopt a method of accounting cost of stable throughout the accounting period at the same time maintain by the states if there is no logical reason to change.

- Applying consistency helps to compare the results of trading between the states become more accurate and meaningful.

- Avoid status change method of accounting in an arbitrary way, as this will result gross profit, profit margin, therefore, cost of goods sold is volatility does not reflect reality.

Principle of consistency not only helps in accurate accounting, but also create transparency and trust for leaders and investors as well as stakeholders.

2.3 principle of caution

Requires no recorded cost exceeds the actual level, ensure that business results faithfully reflect the financial situation of the business.

- This means that only recorded the actual cost was incurred, there are vouchers valid.

- Avoid the anticipated costs not yet incurred or estimate too high to reduce profits in the period, as this can lead to misleading financial statements do influence business decisions.

Principle of caution to help businesses ensure the truthfulness and accuracy of financial reporting, the risk management related to strategic decisions based on accounting data, deviations in order to increase credibility with investors, banks and regulators thanks to the reports reflect true costs, actual profit.

3. Method of accounting cost of goods sold

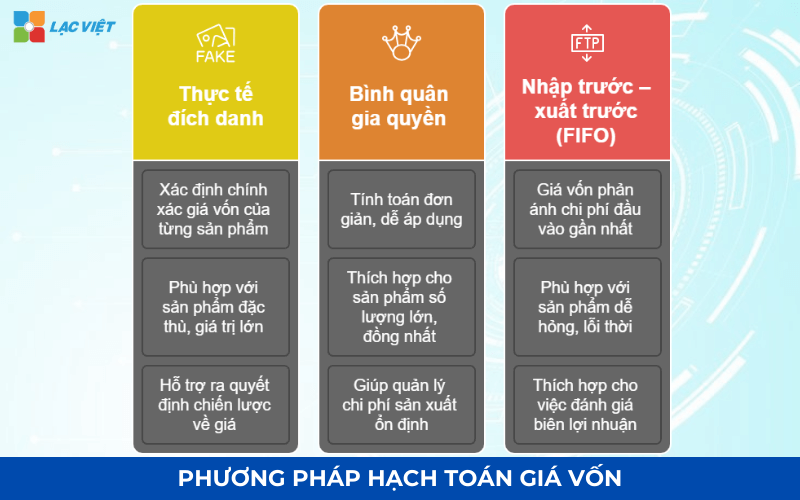

In fact, now there are many methods of accounting for cost of goods sold different, depending on the particular product, the number, scale and target cost management. Choosing the right method to help businesses determine the gross profit, accurate inventory management efficiency to business decisions justified.

3.1. Accounted for by the method of the actual purpose of the

This method is suitable for the special product, quantity less, high-value or each product is different about the cost. Each product or each shipment is recorded separately actual costs, from raw materials, labor, production costs to the cost of shipping, warehousing related.

| Characteristics | Advantages | Cons |

| Determine the price of capital | Determine the exact price of capital of each product, closely reflects the actual costs incurred. | Spending a lot of time and effort because the accountant should be recorded as well as track expenses for each product/shipment individually. |

| Suitability | In accordance with the special product or the shipment, import value, helping businesses manage the cost of concrete. | Difficult to apply for business production/business bulk, homogeneous, so will generate the volume of accounting work great. |

| Management support | Support strategic decisions about the selling price and the profit on each product. |

Illustrative example: A business importing electronic components according to each different plot. The first batch of 100 sets of components worth $ 50 million, plots Monday, including 150 sets worth $ 80 million. When selling, accountants must record the actual cost of each batch of production according to orders, namely, from that calculate the price of capital correct for each order.

3.2. Accounted for by the method of weighted average

This method is suitable for manufacturing enterprises or business bulk, homogeneous on product type. When applicable, the accounting price of capital the weighted average of all inventory and enter new in the states, and then apply this price for the products export warehouse.

Formula: the Price of the average capital = (value survive the beginning of the period + value of income in the period)/(Number of inventories the beginning of the period + Number of entry in the states)

| Characteristics | Advantages | Cons |

| Perform | Calculate the simple, easy to apply with a large number of homogeneous products. | Not accurately reflect the actual cost of each shipment separately has been shed. |

| Cost management | Help manage production costs and the price of capital in a stable manner, limiting the volatility of the price of raw materials of each batch import. | When the price of raw materials, volatility, this method can make the price of capital of a number of products from the actual price at the time of production warehouse. |

| Application | Easily deployed on the accounting software automatically. |

Practical example: Business inventory, beginning of the period, 1,000 products worth 50,000,000, enter more 2,000 products worth 120.000.000 in states. Cost of average = (50.000.000 + 120.000.000) / (1.000 + 2.000) = 56.667 /products. Each product export warehouse in the states will be credited with the price of capital 56.667 copper, help accounting simplify the calculation.

3.3. Accounted for by the method of first in – first out (FIFO)

FIFO method suitable for the business wants to manage the flow of goods, especially perishable products, outdated or limited use. Under FIFO, the products enter the warehouse will be sold in advance, the price of capital calculated according to the cost of the lot entered first.

| Characteristics | Advantages | Cons |

| Price of capital | The price of capital closely reflects the actual cost head into the nearest (because the inventory period end is calculated according to the purchase price closest), which helps businesses better control inventory. | When the price of raw materials, volatility (especially the price increase), the price of capital calculated according to the FIFO may be lower than real price of the lot, enter the last row, resulting in gross profit volatility and reported higher profits in the period of inflation. |

| Suitability | In accordance with perishable products (perishable goods) or technology changes fast (avoid inventory obsolescence). | The calculation more complicated than the method of weighted Average, in particular when the number of batches income as well as costs fluctuate much. |

| Management | Suitable for the assessment of marginal profit and analyze business performance according to each shipment/each time. |

Illustrative examples: Business food production 2 plot line:

- Lot 1: 1,000 kg sugar price 20,000 vnd/kg

- Lot 2: 1,500 kg sugar price 25.000/kg

When sold 1,200 kg of sugar, according to the FIFO:

- 1,000 kg first price lot 1 = 20,000 vnd/kg

- 200 kg next by price lot 2 = 25.000/kg

Capital price of 1.200 kg = (1.000 x 20.000) + (200 x 25.000) = 25,000,000 vnd.

Thanks to FIFO method, business know the exact cost of goods, export warehouse order entry, inventory control, and evaluate the profitability practical observation.

4. Diagram & Professional accounting cost of goods sold account 632

Accounting cost of goods sold are pivotal to help track expenses, manage inventory and determine the gross profit of the business. TK 632 recorded the price of capital goods, finished products, services, real estate investments have been sold in the states, as well as the cost of which exceeds the normal level or the account adjusted discount capital. Purchase scale business, accounting apply Circular 200 or circular 133.

4.1. Diagram & how accounting circular 200

The pen basic math, including:

- Warehousing of goods/Raw materials: When business income raw materials, finished products or goods, accounting recorded value enter the warehouse.

Journal:

| Profession | The account | Notes |

| Warehousing of raw materials | Debt TK 152/156

Have TK 111/112/331 |

Recorded value NVL goods enter the warehouse, including the cost of buying, tax, shipping |

| Enter the warehouse of finished products | Debt TK 155

Have TK 152/156 |

Recorded cost of raw materials used, product finishing |

- Export inventory recorded the cost of goods sold: When selling goods or raw materials, value of stock be transferred to cost of goods sold.

Journal:

| Profession | The account | Notes |

| Sale of goods | Debt TK 632

Have TK 155/156 |

Recorded cost of goods sold was |

| Production raw material production | Debt TK 621/622

Have TK 152 |

Recorded MATERIAL cost used in production |

- The price of capital services – unfinished products finished

| Profession | The account | Notes |

| Sale service completed | Debt TK 632

Have TK 154 |

The price of capital services completed and put into consumption |

- Cost exceeds normal levels, do not allocate

| Profession | The account | Notes |

| NVL exceeds normal levels | Debt TK 632

Have TK 621 |

Is not calculated in the price |

| Costs not allocated | Debt TK 632

Have TK 622 |

CPSXC fixed not allocated |

| CPSXC not allocated | Debt TK 632

Have TK 627 |

Production costs general unusual |

- Costs directly related to goods sold:

| Profession | The account | Notes |

| The cost of buying timeshares in the price of capital | Debt TK 632

Have TK 156 |

Cost of purchasing of the lot goods sold |

| Costs directly related | Debt TK 632

Have TK 641/642 |

Cost of sales/QLDN directly related |

- Accounting deduct the price of capital

| Profession | The account | Notes |

| Import tax refund/SCT/LEP | Debt TK 111/112

Have TK 632 |

Adjust discounted capital |

| Provision for diminution in value of inventory | Debt TK 632

Have TK 2294 |

Extract of the room |

- The price of real estate capital investment (if available)

Accounting

| Profession | The account | Notes |

| Reduced real ESTATE investment when selling | Debt TK 2147 / 632

Have TK 217 |

Reduced cost + residual value |

| Costs related to real ESTATE investment | Debt TK 632

Have TK 111/112/152/153/331 |

Costs incurred related |

- The accounting cost of goods sold, the late period: Late period, cost of goods sold transfer to the account business results to determine gross profit.

Journal:

| Profession | The account | Notes |

| The shipping cost of goods sold | Debt TK 911

Have TK 632 |

Transfer pricing capital to business results, determine the gross profit |

The diagram illustrates the flow of accounting price of capital according to circular 200:

Entering stock → stock → The transfer pricing capital → reported gross profit

(TK 152/155/156 → TK 632 → TK 911)

4.2. Accounting cost of goods sold according to the circular 133

Medium enterprise/ small use system account more simple, but the principles of business remain the same.

The basic circular 133:

| Profession | The account | Notes |

| Enter kho NVL/merchandise | Debt TK 152/156

Have TK 111/112/331 |

Recorded warehousing |

| Sale of goods | Debt TK 632

Have TK 156 |

Recorded the price of capital |

| Cumshot NVL production | Debt TK 621/622

Have TK 152 |

Cumshot NVL production |

| The price of capital services | Debt TK 632

Have TK 154 |

Recorded the price of capital services completed |

| The shipping price of capital | Debt TK 911

Have TK 632 |

The end of the period |

Highlights of TT133:

- Not ripped detail as many accounts as TT200

- Easy to deploy – fit small business

- TK 632-end to the switch over to TK 911

The diagram illustrates the flow of accounting price of capital according to circular 133:

Entering stock → stock → The transfer pricing capital → reported gross profit

(TK 152/156 → TK 632 → TK 911)

Important note when applying circular 133:

- To ensure inventory tracking as well as value import correctly to avoid misleading the price of capital.

- Due to the simplicity, attention should be paid to control the costs incurred directly related to production or sales, avoid omissions.

- Support the preparation of financial statements quick, easy but still ensure transparency and honesty.

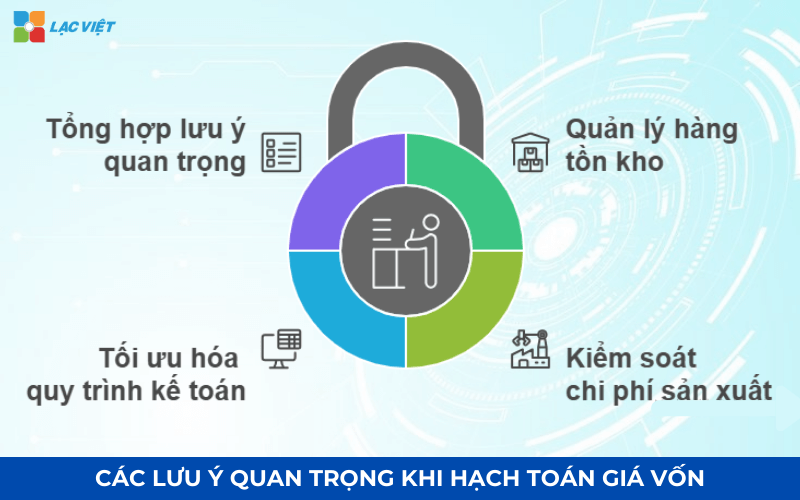

5. The important note when accounting for the price of capital

- Inventory management: Enterprises need to make an inventory periodic inventory to ensure the number as well as the value of goods in the books match the reality. The inventory of help timely detection of deviations due to damage, loss, loss or error in the import – export of goods. Goods, raw material should be classified in batches, product group or by value to management in order to apply the method of calculating the capital price match as FIFO, weighted average or actual purpose of the.

- Control production costs: Businesses need to keep track full cost of production, from raw materials, labor to the cost of joint production, transport, storage, to detect promptly the cost of excess or abnormal. When there are fluctuations in cost, for example, material price increases or cost changes, accountants need to adjust the accounting cost of goods sold to business results reflect the true fact. This is especially important with businesses large-scale production or trading of goods and high value.

- Process optimization, accounting: Business should develop a standard process for the record price of capital, from warehousing, warehouse export to the end of the period, in order to avoid mistakes, to confuse the accounting period to ensure data consistency. Apply software design, modern math help automate the business accounting, calculate the price of capital according to the selected method (FIFO, average, actual destination list), and to manage inventory and to check deviations in real time.

- General important note: inventory periodic inventory to ensure accurate data, as well as detect deviations timely; track production costs, practical to adjust the price of capital, avoid false profits; standardized process accounting applied digitizing tool to help optimize service, reduce the risk of errors and improve the efficiency of management; classification of inventory, reasonable in batches, product group or value to apply the method of calculating the capital price match.

6. Giải pháp tối ưu các hạch toán kế toán bằng hệ thống kế toán LV-DX Accounting

In the context of conversion of LV-DX Accounting provides accounting solutions digitized comprehensive help enterprises deploy accounting cost of goods sold and revenue correctly, transparency, at the same time process optimization financial management.

- Automatic calculation of the cost of flexibility: the System supports calculate the capital by several methods (such as purpose the average, FIFO), helps business recorded price on capital precision, closely reflects the actual cost is the basis for strategic decisions appropriate to the specific product and business scale.

- Automatic transfer end: automate the transfer price of capital as well as revenue to the business results, ensuring data consistency, help enterprises to quickly determine gross profit and net profit for effective analysis.

- Manage real-time: allows For tracking inventory, production costs & import cargo in real time. System details are easier to detect excess inventory or cost of abnormalities, from which optimize costs and improve profitability.

- Visual reports – profitability analysis: Provide a dashboard to visually track the financial index important (the price of capital, revenue, profit margin), supportive leadership, in-depth analysis to take timely decisions on strategy, sales and cash flow management.

- Fit all sizes: the Solution is designed to standardize processes accounted for easily scalable, consistent, rapid deployment for both small & medium business (SME) to large corporations.

For businesses that want to optimize the process of accounting for the price of capital and revenue, LV-DX Accounting is the foundation of comprehensive help standardize business, track inventory, evaluate the profitability as well as improve the efficiency of financial management. Businesses can learn more and experience solution at: https://lacviet.vn/lv-dx-accounting/

Management accounting cost of goods sold is the foundation key to business control costs, the optimal profit to strategic decisions effectively. The application process accounting standards, inventory tracking, as well as production costs, the fact not only helps to reduce errors, but also provides accurate data to profitability analysis and strategic planning in business. Investment into the management system, the price of capital efficiency is step strategy to help businesses maintain a competitive advantage, improve operational efficiency at the same time ready to adapt to the fluctuations of the market. Business needs to focus on standardized accounting, cost control right from the base to ensure transparency, accuracy and sustainability in financial management.