Accounting discount seller's price adjustment after the transaction has finished, is now applied to adjust revenue for fit with reality, such as goods not reaching the quality, the wrong way rules contract, or to maintain customer relationship. Here's seemingly simple, but has a direct impact to revenue, profit and receivables of the business.

Many businesses still have trouble profession discounts on goods for sale, from determining the right time, choose accounting accounts suitable to the way reflected on the financial statements. If done incorrectly, the business is not only misleading business results but also are at risk when tax settlement.

Therefore, the master regulatory principles of accounting as well as the steps noted reduced revenue by standard circular 200/133 are important factors help businesses ensure transparency, revenue management – public debt effectively, at the same time maximize profit. The same Lac Viet learn in detail how accounting, illustrative examples and specific note practices to business operating standards.

1. Overview of professional discounts seller in business

1.1. Accounting for discount sale what is?

Accounting discount sales process is recorded account adjustment deduction that business (the seller) approved carry on selling prices listed or the total invoice value of the products or services sold to the customer (buyer).

The key point to distinguish with trade discounts (reduction immediately upon sale) is: Discount wholesale arise only after the sales transaction has finished, the goods have been delivered, the revenue has been recorded and the bill was casting.

Discounts this usually happens in the following cases:

- Goods do not meet the quality standards: the product is discovered to poor quality, there is a technical error, damaged during transit, or obsolete compared with the requirements of the market.

- Deviations from the contract: goods delivered not in accordance with instructions, sample code, or number as originally agreed in the contract economics.

- Stimulating consumption/liquidation inventory: Business initiative launched policies to reduce the price after the sale to encourage customers to continue to purchase in the future, or to liquidate quickly large inventory without the need to perform return the item.

- Keep customer relationships: As a goodwill move to compensate for the dissatisfaction of customers, from which maintain loyalty and long-term business.

1.2. The role of business, the seller and the benefit of the buyer.

For sale (Business): accounting, this works as a tool of risk management to maintain customer relationships important.

- Manage risks and resolve quality goods: Help fast processing of shipment errors, poor quality product without paying the order, saving shipping cost, and recycling.

- Customer retention: expressing goodwill, customer retention, strategy and reinforce the belief long.

- Determine the net revenue accuracy: discounts is a revenue deduction, which helps to reflect the actual value transactions and assess business performance.

- Support inventory management: encourage customers to keep inventory optimization warehouse without liquidation fold.

Accounting discount goods sold for the buyer (Customer): the Role for the purchaser is getting the economic benefit of the same flexibility in asset management.

- Reduce the cost of buying goods: Reduction in the total value of payments, improve the profit margin or the optimal cost of production.

- Adjust inventory value: Base discount helps accurately reflect the actual costs on the financial statements.

- Ensure continuous operation: Keep stable supply chain and production without interruption thanks to the shipment still be used with the price already adjusted.

2. Regulations on discount sales in business

2.1. Legal regulation current

The handling of the business reduced sales in Vietnam must comply with strict regulations of the ministry of finance, is concretized in the following text:

- Circular 200/2014/TT-BTC

- Scope of application: this circular is accounting standards basic, applied to businesses of all fields all economic sectors, except for the microentrepreneurs.

- Rules of accounting: circular 200 clear rules using account 521 – deductions revenue, which includes both accounts 5212 – Discount sales. Accordingly, sales deductions must be recorded on the debt of TK 5212 at the same time be transferred to the debit of accounts 911 – defined business outcome at the end of the accounting period to determine the net revenue. This ensures transparency and accuracy of the identification results of business activities.

- Circular 133/2016/TT-BTC

- Scope of application: Apply for the small business – medium.

- Rules of accounting: circular 133 also have provisions similar to the circular 200 in principle recorded accounting discount sales, however, businesses can use the account 511 – revenues, sales, and service providers to track detailed account business arising in states that do not need to use separate accounts 521, in order to simplify the accounting for business on a smaller scale.

- The law on value added tax (VAT) – The text guide about bill

- The rules about VAT as well as the bill (as a decree 123/2020/ND-CP & circular 78/2021/TT-BTC) governs the way the selling party set stock from to legalize the discount.

- When discount arises after the invoice, business required to set up adjustment invoice as prescribed. Invoice adjustment, this must specify the number of pre-adjusted to reduce (including reduce the value of goods as well as the corresponding VAT, if applicable), reason adjusted and linked to the original invoice was set up previously.

2.2. Conditions to account discounts are accepted as settlement

To account this is the tax authority accepted as a revenue deduction reasonable when calculating the corporate income tax (CIT) – that is, reduce the amount of tax payable, businesses need to fully meet closely the condition of stock from legal and transparency as follows:

The legal basis establishing the discount rate: the Business must have a legal basis clearly to demonstrate the discounts are not acts arbitrarily or shipping prices:

- Economic contract or sales policy: there Should be economic contract or sales policy was officially announced, in which clear rules about what conditions are entitled to a discount (for example: of inferior quality, not properly) as well as the method of determining the discount rate, respectively.

- Memorandum of agreement/verified discount: Must have written certification or memorandum of agreement was officially signed between the seller with the buyer. this is the most important testimony, which must specify:

- Reasons specific discounts (of poor quality, outdated, not properly as agreed, etc.).

- The number of goods is a discount.

- Discounts by amount or percentage (if any).

- Number the date of the original invoice was set up previously.

Accounting vouchers – valid invoice: Business to ensure full compliance with regulations on establishment vouchers to legalize sales deductions:

- Adjustment invoice: This certificate is mandatory. The seller must set up VAT invoices or bills of sale revised down (or invoice marked negative/specifies the amount of sound according to the current regulations on electronic invoice) to record deductions. This invoice must be set right time, right content as defined in the decree 123/2020/ND-CP.

- Proof of payment (if any): where the seller has to collect the money and now have a partial refund to the buyer must have a proof of payment, clear (as the debit authorization, payment receipt) to demonstrate the refund was actually happening.

3. Accounting discount wholesale circular 200

Circular 200 applied system full account, use the account 521 details to keep track of sales deductions.

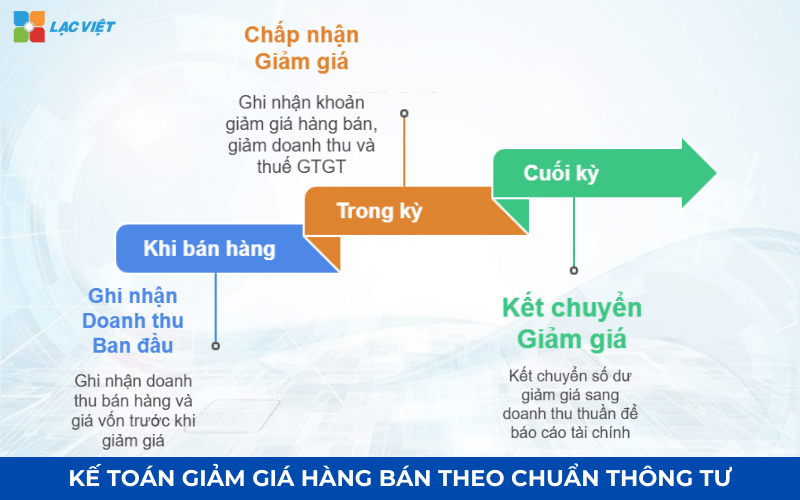

3.1. When the sales – revenue recognition, the original

This pen is a payment recorded sales transaction, the price of capital as the ordinary, before arising discounts.

| Profession | The account | Notes |

| Revenue recognition |

|

Recorded sales revenue and accounts receivable/'ve collected from customers. |

| Record the number of output VAT respectively. | ||

| Recorded the price of capital |

|

Recorded cost of capital price of goods sold. |

3.2. When accepted discount sales to customers (arising in the states)

When business approval accounted for discount sale (due to poor quality, improper,...), discounts this reduces the revenue was recorded and reduced by the amount receivable/payable to customers, at the same time reduce the number of output VAT payable.

| Profession | The account | Notes |

| Recorded discounts |

|

Discounts are tracking details on TK 5212. |

|

Reduced directly to the receivables of the customer or refund the money to guests. |

3.3. The end of the accounting period

At the end of the accounting period (month/quarter/year), account 5212 have a Debit balance, need to be transferred to the account 511 to determine the net revenue fact.

| Profession | The account | Notes |

| The shipping discount |

|

Pen the move reduces the total revenue was recorded, leaving the balance of the debt at TK 511 is net revenue. |

4. Accounting discount wholesale circular 133

Circular 133 apply for small business – medium, therefore, the account system is simplified. Although TT 133 not specified detail TK 5212, but TK 521 still be used to aggregate the sales deductions.

4.1. When the sales – revenue recognition, the original

(Similar to TT 200, the accounting recognition of revenue as well as the price of capital does not differ in essence.)

4.2. When accepted discount sales to customers (arising in the states)

| Profession | The account | Notes |

| Recorded discounts |

|

Account 521 is common to all deductions (deductions, discounts, sales returns). |

|

Rules reduction in liabilities and VAT similar to TT 200. |

4.3. The end of the accounting period

The business made the transfer whole balance of the debt of TK 521 to TK 511 to determine net sales.

| Profession | The account | Notes |

| The transfer deductions |

|

Pen calculate the shipping total of all the deductions revenue in the period. |

5. Examples discount sale

Situation business: company A sells 100 products X for client B in the form of semi-resistant (not collect).

- Sales price without tax (listing): 2.000.000 VND/product.

- Accounting reduce the cost of goods sold (principal): 1.500.000 VND/product.

- VAT: 10%.

Step 1: recognize revenue – cost of initial (Before delivery)

Business A invoice for 100 product X:

- Total revenue before tax (TK 511): 100 product x 2.000.000 VND/product = 200.000.000 VND

- Output VAT (TK 3331): 200.000.000 x 10\% = 20.000.000 VND

- The total amount to be collected (TK 131): 200.000.000 + 20.000.000 = 220.000.000 VND

- Cost of goods sold (TK 632): 100 product x 1.500.000 VND/product = 150,000,000 and VND

| The account | Content | Debt | Have |

| Revenue recognition | Debt TK 131 (customer receivables B) | 220.000.000 | |

| Have TK 511 (sales revenue) | 200.000.000 | ||

| Have TK 3331 (output VAT) | 20.000.000 | ||

| Recorded the Price of capital | Debt TK 632 (cost of sales) | 150.000.000 | |

| Have TK 156 (goods) | 150.000.000 |

Step 2: Calculate – accounted for rebate sale (Upon agreement)

Customer B is 10 defective product, small (not right colors commitment). Company A accepts up 20% of the value of 10 this product.

Calculate the reduced value except:

- Value of goods be reduced (before tax):

10 products x 2.000.000 VND/products x 20% = 4.000.000 VND - VAT is adjusted discount (10%):

4.000.000 VND x 10% = 400.000 VND - The total value of reduction in public debt:

4.000.000 VND + 400.000 VND = 4.400.000 VND

Accounting recorded a Reduction in the price of sale: discounts are recognized immediately in the period incurred on account 5212 – up except revenue (value excluding tax) and account 3331 (the VAT is adjusted reduction). Assume company A & B customers uniformly except account this discount on receivables (TK 131).

| The account | Content | Debt | Have |

| Recorded Discount | Debt TK 5212 (Discount sales) | 4.000.000 | |

| Debt TK 3331 (VAT payable – adjusted discount) | 400.000 | ||

| Have TK 131 (customer receivables B) | 4.400.000 |

Step 3: The transfer discount sale (End of the accounting period)

At the end of the accounting period (month/quarter/year), business make the balance transfer debt of TK 5212 to TK 511 to determine net sales.

| The account | Content | Debt | Have |

| The shipping discount | Debt TK 511 (sales revenue) | 4.000.000 | |

| Have TK 5212 (Discount sales) | 4.000.000 |

Abstract – analysis of the results final: After the implementation of the accounting on the financial indicators of company A is adjusted as follows:

- Net revenue (TK 511): 200.000.000 VND (Original) – 4.000.000 VND (Discount) = 196.000.000 VND

- Gross profit: 196.000.000 VND (net revenues) – and 150,000,000 VND (Price of capital) = 46.000.000 VND

- The debt to income (TK 131) rest of the guests B: 220.000.000 VND (Original) – 4.400.000 VND (Reduced) = 215.600.000 VND

- Output VAT (TK 3331) reality payable to: 20,000,000 VND (Original) – 400,000 VND (adjust up) = 19.600.000 VND

This example clearly illustrates the way in discount sales, reduce turnover and VAT directly in the period incurred, ensuring targets net sales reflect the actual value of sales transactions has been adjusted.

6. A number important note to the accounting discount sales standards

To account service is duly noted, are precisely the tax authority accepted as settlement, accounting students need to pay special attention to the aspects of vouchers, internal policies and procedures in coordination.

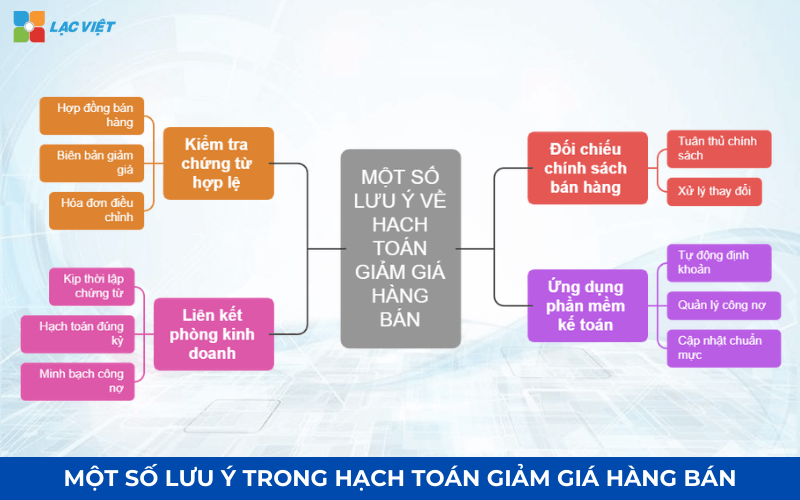

6.1. Check out the full voucher is valid before the account

The validity of the voucher is vital to account discount price is considered reasonable cost. Accounting must check out, collect fully the following documents before making any accounting entries would be:

- Contract/commitment to selling original: Must have a contract or policy of sale was signed, in which the specified conditions and principles apply discounts (for example: only discount when items have technical error or not properly). This document is the legal basis initially prove the rationality of the transaction.

- Acknowledgment/agreement discounts: This is the most important confirmation of the event. The minutes must be signed by an authorized representative of both parties (seller & buyer), stating: reasons specific discounts (of inferior quality, code templates false,...), the amount of goods related discounts by amount or percentage, as well as the number of the original invoice was set.

- Bill adjustment/replacement: According to the current regulations on electronic invoicing (for example: Decree 123/2020/ND-CP), as incurred discount after invoicing, the seller is required to set up adjustment invoice. This invoice must specify the amount to be adjusted up (including value & VAT), affiliated with the original invoice at the same time is grounded to the seller to reduce the VAT output and accounted for discount sale for the purchaser to reduce VAT corresponding input.

6.2. Collate sales policy – contract – annex adjustable

Consistency between the document's elements prove the transparency of business:

- Compliance policies: accounting must ensure that the actual discount is applied does not exceed or is not located outside the terms of the original commitment in the contract or policy, the sale was announced.

- Handle change: In special cases, if the discount is not specified in advance (for example: incurred serious error, unexpected), need to set addendum to the contract or memorandum of agreement supplements are both signatories to browse. This appendix the role legalize the change, protect the business before the tax risks later.

6.3. Link business accountant to handle reduced price transparency – Timely

Process and coordinate internal is the key to properly accounted states & right tax:

- Timely establishment stock from: Office business unit is directly working with the client is the initiator of the discount. Information from the business (memorandum of agreement on discount) must be transferred immediately to the accounting department.

- Properly accounted states: accounting need to be based on the time of signing the acknowledgment to invoicing adjust and record journal entries in the correct accounting period of the service (TK 5212/521), avoid to put the end of the year new handle. The accounting wrong states can lead to deviations of output VAT & net revenue in the reporting period.

- Transparent public debt: Coordination helps to control exactly the except clause discount on the debt of the customer (TK 131), to avoid confusion or duplicate, in the payment, refund money.

6.4. Application accounting software to minimize errors

In the environment of modern business, the use of the accounting software dedicated to help automate and standardize processes, significantly reducing the risk of errors:

- Automatically the account – The transfer: The software automatically keeps the accounts, the accounting entries arising discount into account 5212 (or 521) standards (TT 200/133). Most important, the software will automatically make pens payment, the transfer of Debt 511/There are 521) at end of the period, remove the risk, forget the shipping, ensure the accurate determination of the net revenue.

- Debt management client (TK 131): tracking software, detailed public debt each customer. When input adjustment invoice, the system automatically deducted discounts (4.400.000 VND in the example) from the balance of the debt of the customer B, help accounting public debt always exactly easy for projection.

- Update standards: The accounting software often are constantly updated according to the latest regulations of the Ministry of Finance and the General department of Taxation, help enterprises always adhere to the change of electronic invoices, as well as the rules of accounting latest.

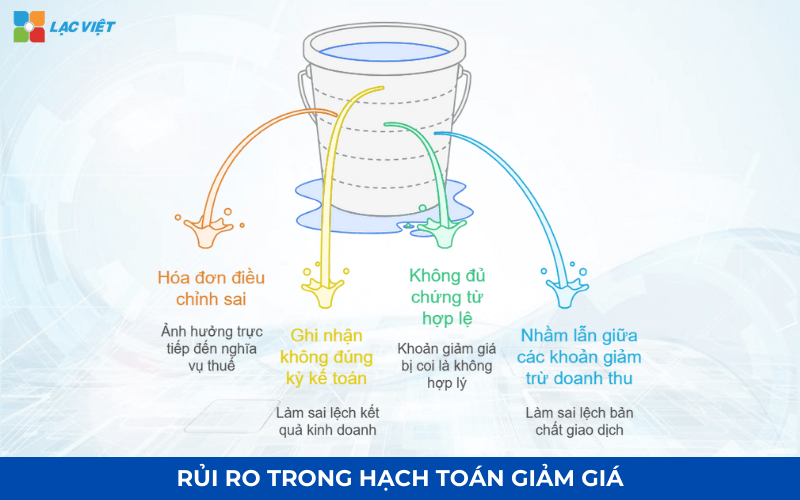

7. Common risks in accounting discount

The accounting discount sale requires the high precision of vouchers and the time recorded. If not, comply with strict regulations, business vulnerable to the legal risks – finance the following:

7.1. The risk of invoicing parallax adjustment

This is common risks have a direct impact on the tax obligations of the business.

- Consequences: The establishment bill adjustable wrong (wrong amount, discount and wrong targets of the goods value or VAT) lead to declaration of deviations of output VAT. The tax authority may require business re-adjustment tax. More serious, if the parallax adjustment reduces the tax payable in a reasonable manner, businesses can be sanctioned for administrative violations of tax (penalty acts wrong, late payment, or even tax arrears).

- Causes: accounting can confuse the establishment adjustment invoice (when discounted) and bills clean (when return the item), or incorrect calculation of the VAT is adjusted with a corresponding decrease in value of goods.

7.2. Risks of recorded not correct accounting period

Matching principle (matching principle) professional requirements must be documented properly states arise.

- Consequence: If the account discount that arise in this period (e.g., 12-month/N) but is accounted for in the previous period (month 11/N) or after (January 01/N+1), this will distort the serious business results of both the reporting period.

- States is accounted late will increase his revenue, increased gross profit artificially, leading to the ability to temporarily pay corporate INCOME tax rate higher than the actual.

- States is accounted wrong will be reduced revenue as well as reduced profits in a way not true essence.

- Causes: Lack of coordination between business & accounting, led to the memorandum of agreement on discount and Invoice adjustment is independent delay, do not timely transferred to the accounting records.

7.3. The risk of not enough vouchers are valid

This is a legal risk as well as the largest expense for the business.

- Consequences: When the tax authority performs finalization & check, if the business is not presented full contract/sales policy, or memorandum of agreement on discount, signed by both parties, the price of that sale will be regarded as unreasonable, groundless.

- Meanwhile, the tax authority will remove the account this discount from the sales deductions, leading to the increase in taxable revenue increase of corporate INCOME tax payable up significantly, accompanied by fines and money for late payment.

- Cause: the process of evidence from internal loose teen, process control, signature verification of the parties involved.

7.4. Risk of confusion between the sales deductions (TK 521)

System account Vietnamese accounting clearly distinguish the type of reduced revenue and the confusion will distort the essence of the transaction on the financial statements.

- Consequences:

- Accounting for discount sale (TK 5212/5213) is accounted mistake to trade discount (TK 5211) or sales returns (TK 5212). This makes the present analysis reports the results of business activities is false, misleading for the reader report (administrators, investors).

- Each type of deduction have nature and how to handle bills in different (for example: trade Discount is usually reduced except on the original invoice, also reduced the price of sale then need to invoice adjustment). The accounting wrong account could lead to wrong process to invoice attached.

- Causes: accounting't understand the meaning as well as conditions arising of each deduction.

8. The optimal solution of accounting software, LV-DX Accounting

To reduce errors, shorten the processing time business to ensure the recognition of revenue deduction is correct, the business should application solutions accounting numbers as LV-DX Accounting. The software brings many practical benefits:

- Automate the entire pen payment discount: automatically recorded reduced revenue, affiliate bills – contracts – evidence from adjusted, eliminates risk accounting craft.

- Control revenue – public debt in real time: the fast track to the influence of price reduction to revenue, profit and debt to income.

- Management transparency policy discount: Mounted, discount in each order, customers and sales program; meet the right standard circular 200 & 133.

- Analysis report standardized: Synthetic details, deductions, sales support, leadership assessment effective price policy.

- Electronic storage full: automatically save vouchers adjustable, convenient for auditing as well as for internal passport.

Business can learn and experience the software at https://lacviet.vn/lv-dx-accounting/. The application of LV-DX Accounting not only help accounting discounts accurate but also create a solid foundation for financial management digitization, improving operational efficiency and optimal profit.

Accounting discount sales are business essential, directly affect net sales and profit. Business required strict compliance with the provisions of circular 200/133 about vouchers, contract, and invoice adjustments. Made precisely this helps to minimize tax risks and ensure faithfully reflect trading results. The digitization process is also supported debt management and financial reporting efficiency, optimize profits.