Accounting sales department is pivotal in management, finance business, responsible for recording the whole of the transaction arising from the sales process, including sales orders, stock, invoicing, revenue recognition and to manage public debt customers. The role of this position is not only records, but also provides data management to leadership assessing business performance, strategic decisions, as well as control the flow of money.

In fact, many businesses, especially new businesses or medium-sized deployment process digitization, still crestfallen when recognition of revenue, the account, the sales professional and handle the debt. Mastering the rules, understand the concept to deployment professional sales standards not only help businesses comply with the accounting standards, but also ensure transparent data, manage cash flow effectively to support the business planning more accurate.

The same Lac Viet learn in detail the aspects of the last recorded sale, from concept, task, work in cycles, specialized knowledge to skills, as well as the implementation process is standard in the article below.

1. Accounting what is merchandising? The role of accounting

Sales accounting department is responsible for recording the whole of the transactions arising in the sales process: from order, production inventory, invoicing to recognize revenue and public debt customers. This is a critical step in the chain the account, the sales professional, ensure each service have valid documents as well as to be fully reflected on the books.

The role of the sales department:

- Revenue recognition precision: This is the most important role, ensure that all sales transactions are recorded properly enough, as well as timely as a rule, is the basis for calculating the tax and profit.

- Debt management customers: tracking details the amount of money the customer owes, as well as the payment term, to help businesses manage cash flow while reducing risks for doubtful debts.

- Provide data management: Provide reports on sales, discount, promotion products, hot selling... help leaders take business decisions and strategies in a timely manner.

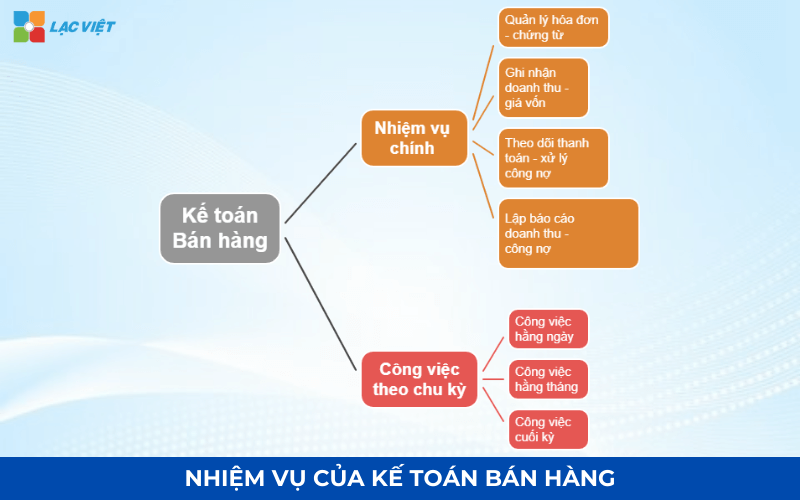

2. Accounting sales do what? Job duties the

2.1. The main task of sales accounting

- Invoice management – stock from sales: This is the most important task for vouchers is the legal basis for all accounting entries. Accounting to check the completeness of documents: contracts, warehouse, minutes of delivery as well as invoice. The flaws in stitching this leads to the risk of the invoice at the wrong time, slow declaration or mismatched data between the business and the warehouse.

- Recorded revenue – cost of capital – debt customers: When the goods were delivered, issued invoice, the accountant made the account, the sales professional to recognize revenue as well as receivables. This is the core part of the sales profession, requiring data must match the sales system and inventory. Difficult point in this step is to identify the right time revenue recognition. Revenue is recorded only when the enterprise was obliged to complete the delivery or service provider. If noted earlier, the financial statements will reflect the wrong business.

- Track payments – processing public debt: One of the common questions of business owners is: why have reported higher revenue, but the money not about the app? This is often due to the public debt, customers can also hang long. This department should:

- Updates to the payment schedule according to each contract.

- Track limit public debt of the customer.

- Prompt payment when close to limit.

- Work with business when incurred debt slowly pay.

- Reporting revenues – liabilities: finally, the general accounting revenue daily, monthly and reports the debt to leadership assessing business performance. This is the input data, important for analysis, sales, financial planning, and risk assessment, customer.

2.2. Detailed work in each cycle

The split cycle helps business build process, and help new people understand accounting sales doing what in each stage.

| Jobs by states | Details |

| Daily work |

|

| Work every month |

|

| Work period end |

|

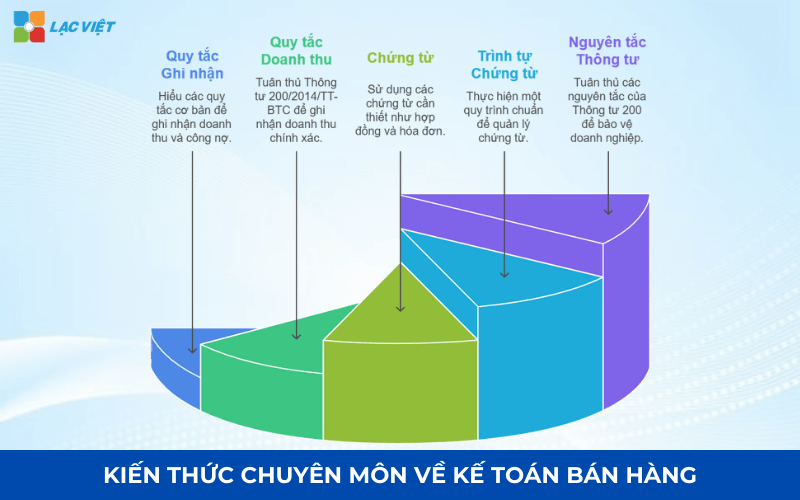

3. Accountant sales grasped the expert knowledge how?

3.1. Rules recorded sales accounting

Rules noted is the foundation of every sales professional. Learn an easy way to visualize: accounting records only revenue and public debt when the transaction actually has arisen at the same time there is enough evidence to prove.

In real business, I always apply two basic principles:

- Revenue is recorded when goods – qualified customers payment: this means That the contract or deposit is not the time of revenue recognition. Revenue is recorded only when the obligation delivery has been completed.

- Vouchers must be full – valid: A certificate from the standards usually include: contracts, warehouse, delivery order, invoice. Discrepancies at any stage also affect the account, the sales professional as well as tax reporting.

For example: If the delivery day 28, but the bill founded on December 30, accountants must still recognize revenue on delivery (28) to ensure the correct states accounted for.

3.2. Rules of revenue recognition

In addition to complying with accounting standards, accounting, sales must specifically comply with circular no. 200/2014/TT-BTC. Some important points to understand:

- Revenue must reflect the true nature of transactions, not based on the wishes of business. For example: If the goods delivered but not yet been accepted by the customer the quality of revenue is not considered to be complete.

- Revenue recognition, the proper accounting period: this is very important to ensure financial reporting transparency. The push revenue to the states after or drag on the previous period are falsifying business results.

- Sales must be accompanied by evidence: Bill is a mandatory document, but comes to have warehouse, delivery orders or to confirm complete service – this is the “evidence” to help businesses avoid risks when tax inspectors.

3.3. The accounting records are often used

Below is the evidence from compulsory in the sales profession. The role of each type of word is my analysis for business to easily visualize how to apply:

- Economic contract: Is the basis for determining the obligations as well as rights of both parties. The contract also express the time of delivery, terms of payment – important factor when determining the time of revenue recognition.

- Warehouse: Proven business was delivery. Export receipt must match the number in the bill, minutes of delivery.

- VAT invoices: Is stock from legal recognition of revenue, for tax declaration.

- Receipt of goods: Is evidence the customer has received the goods. Without this, business risk to record the decrease in revenue or customer complaints.

- Memorandum for debt comparison: Is set periodically to ensure data between enterprise and client system.... This is important tool to help reduce disputes about payment.

3.4. Sequence rotation vouchers

A standard procedure to help accountants avoid confusion as well as to limit errors when the account sales accounting. Below is the order I applied in business:

- Get orders from sales department: Check on selling price, terms of payment the discount policy.

- Export warehouse – delivery: parts warehouse establishment votes, cumshot, accompanied by the minutes of delivery.

- Invoicing: accounting, invoicing right time prescribed in the contract, the tax law.

- Recognition of revenue: The revenue, public debt on accounting software.

- Payment tracking: Update the public debt, collated with the customers according to each states.

- Archive documents – collated periodically: vouchers are stored by month or by contract to easily lookup and serve check out.

This process not only helps to ensure the accuracy but also avoid tax risks at the same time reduce the duration lookup data.

3.5. Rules under circular no. 200/2014/TT-BTC

In the positions record sales, compliance Circular 200 not only the legal requirements but also help businesses protect themselves from mistakes.

The key principles include:

- Revenue recognition the right states: Avoid recorded early or late, help report reflect true business results.

- Accounting price of capital corresponding to revenue: the revenue and the price of capital must go together. If you only record the revenue that has not recorded the price of capital, profits will be deflected.

- Track debt in detail according to each customer: Help control the flow of money, limit the risk of bad debts.

- Ensure truthfulness – full of data: All figures must have proof of being updated consistently between the parts.

4. Accounting sales are hard? Need skills?

In fact, the professional knowledge is not enough; people make need to develop some essential skills to ensure all business is done accurately, efficiently and timely. These skills not only helps to reduce errors, but also increase value to the business, saving time support to manage cash flow effectively.

4.1. Voucher management – book

The accountant should have the ability to organize, categorize, as well as store vouchers science. A voucher system helps clear:

- Avoid loss or confusion invoices, warehouse, contract.

- Fast support when comparing the debt with the customer or when the tax inspection.

- Reduce the search time data, reports and increase work performance.

This skill also directly related to the applied professional sales standards, help all the account, the sales profession is evidenced by vouchers valid.

Illustrative example: In a medium enterprise/small, the vouchers do not follow the order that accounting takes 1-2 days last month just to scrutinize revenue and public debt. After deploying the storage system are classified according to the contract, the date, the time is reduced to less than half a day.

4.2. Data analysis – reporting

An accountant not only record data, but also must understand as well as analyze data to service management. This skill includes:

- Analysis of revenue by customer group, product group or market.

- Evaluate sales effectiveness, detection of debt likely risks.

- General report on public debt, revenues periodically for leadership, help them make a decision fast and accurate.

Actual value: the Business have to report accurate analysis will reduce the risks cash flow shortage, increasing the ability to recover the debt, and optimize sales policy.

4.3. Communicate and coordinate with sales department, treasury, tax

Accounting sales often have to coordinate with the sales department – warehouse – general accounting. Communication skills and effective coordination help:

- Solved express the arising data discrepancies between inventory – sales – accounting.

- Convey information about the public debt, discounted or returned goods correctly.

- Ensure information sync, avoid data conflict between the parts.

Practical example: When the sales department to update order but not timely notifications for accounting, can lead to deviations in revenue in the month. Coordination skills helps to reduce this risk at the same time ensure the final report accurately.

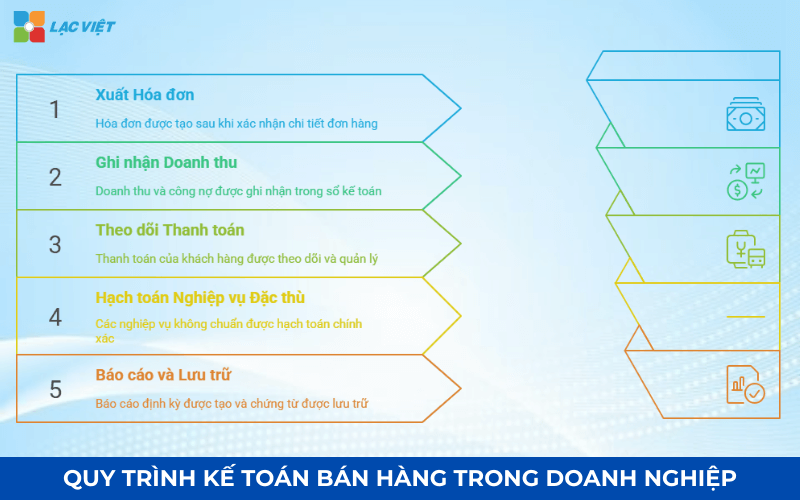

5. Process sales accounting in business

A standard procedure to help accounting sales done sales professional, accurate, saving time as well as reducing the risk of errors. Here are the basic steps that I'm often applied in business:

Step 1: Get orders – invoice

When the sales department to receive orders from clients, accountants need to check:

- Customer information (name, tax code, address).

- Products/services, quantity, unit price, discount if any.

- Conditions of payment under the contract.

After full validation, accounting, invoice (VAT or sales invoice) right according to the delivery date. This is precisely apply: revenue is recorded only when the obligation was complete and valid documents.

Actual values: correct Invoice to help avoid tax risks, support timely payments form the basis for revenue report rightly states.

Step 2: revenue recognition – public debt

When the bill was founded, as well as goods/services has been providing accounting, implementation of the sales profession:

- Revenue recognition in accounting.

- Recorded receivables and corresponding with clients.

- Track the price of capital if the goods are export warehouse.

Actual value: Recorded timely help financial statements properly reflect the profit, and to manage public debt accuracy, reduce risk, shortage of cash flow.

For example: Business 100 products worth $ 50 million, the price of capital is 30 million. Accounting entries will be recorded a turnover of 50 million, the price of 30 million and debt of 50 million clients.

Step 3: track customer payments

Accounting continuous progress tracking customer payments:

- Status update payment under the contract.

- Remind customers when close to limit.

- Coordinate with sales department to handle the case of delayed payment or dispute.

Actual value: debt Management closely to help businesses optimize cash flow and reduce bad debt ratio.

Step 4: accounting services peculiarities

A number of professional services incurred in addition to standard as:

- Discount wholesale, discount commercial.

- Sales returns.

- Adjusted revenue due to flaws in the bill.

Accounting to recognize the right time, as well as vouchers valid to report accurately reflected. This step is important to ensure professional accounting sales are carried out in full, avoiding deviations in financial reporting period-end.

Step 5: report periodically – store vouchers

The end of each period (usually weekly, monthly, quarterly), general accounting:

- Reported revenue by customer group, product group.

- Report receivables, debts and overdue.

- Collated data between sales – inventory – general accounting.

- Store receipts according to accounting standards to cater check, collate or tax inspection.

Actual value: process periodic reports help leaders to grasp the situation timely business, increased ability to make decisions quickly, while minimizing errors due to storage and processing of data.

6. LV-DX Accounting – accounting solutions integrate AI financial increase performance for business

In the actual management of the business, the majority of errors and delays in the accounting profession sales comes from manually processing vouchers, note, notebook or debt comparison in Excel. LV-DX Accounting is the solution that helps to digitize the entire process, from receiving orders to financial reporting, optimizing each step in the sales profession.

The actual value that the business received when using the LV-DX Accounting:

- Automatic recognition of revenue the public debt, reduce errors and crafts.

- Collate the debt quickly, alerts, overdue support, making for projector periodically.

- Set up real time reports on revenue, public debt, the price of capital, profits.

- Store vouchers, standardized, easy to access when the audit or inspection.

- Optimized the entire process from sales – inventory – general accounting, accounting and business peculiarities.

With LV-DX Accounting, organizations and businesses are to find out information about sales accounting can digitize the entire business sales, ensure data accuracy, transparency and fast at the same time improve the efficiency of financial management. Visit for more detail about software: LV-DX Accounting