Compliance with regulations payroll holidays is a legal obligation and also the key factors to help businesses maintain credibility retain personnel, uplifting work. According to The Labour code 2019, employees who work on holidays to be paid at least 300% of salary, not including salary, vacation days, however, many businesses still applied incorrectly, leading to complaints or administrative violations.

This article Lac Viet will help the business understand the nature of a rule, avoid risk, and optimal benefits for both the employee and the organization.

1. Provisions salary calculator holidays is what?

1.1. Concept, scope of application

Provisions salary calculator holidays are the instructions specific legal state issued aims to determine the pay for the employees when working in the holidays. According to Article 97 of The Labor code 2019if the employee works on a public holiday, they must be paid at least 300% of the salary of a normal working day, not including pay for holidays, enjoy the raw wage.

Quy định này áp dụng cho tất cả người lao động làm việc theo hợp đồng lao động, không phân biệt loại hợp đồng (xác định thời hạn, không xác định thời hạn hoặc theo mùa vụ). Điều này đảm bảo mọi nhân sự từ văn phòng đến sản xuất, đều được bảo vệ quyền lợi công bằng.

For example: An employee receives salary 12.000.000, if working on 2/9, will be entitled to at least 300% of normal days, equivalent to about 1.200.000 vnd/day (not including salaries of public holidays).

1.2. The holidays are entitled to the special

According to Article 112 of The Labour code 2019, workers are entitled to work and enjoy full pay in the following occasion:

- New year's day: 01 January (1/1 calendar)

- Lunar new year: 05 days

- Death anniversary Hung Vuong: 01 day (th 10/3 lunar calendar)

- Victory day 30/4: 01 day

- International Workers ' day 1/5: 01 day

- National day 2/9: 02 days

If the business requires work on the day, how to calculate the salary holidays will apply a minimum by law, may be higher than if the agreement in the contract or statute bonus. The clearly specified in the contract, the internal regulations will help business transparent limitation disputes help enhance the satisfaction of employees.

2. Legal grounds on payroll holidays

2.1. The Labor code 2019 and the Decree related

Legal grounds most important to business applicable regulations, payroll holidays is The Labour code 2019, in particular in Article 97 and Article 112.

- Article 97 stipulates clear: employees work on a holiday will be paid at least equal to 300% of the salary of a normal working day, not including the salary of the holidays enjoyed by the raw wage. Case work at night or overtime during holidays, this level is plus 20-30% depending on working conditions.

- Article 112 complete listing of holidays, new year, enjoy the raw wage, help the business determine the exact time of applying special mode.

- Decree 145/2020/ND-CP hướng dẫn chi tiết cách tính lương tháng, cách xác định đơn giá giờ công và quy định với các trường hợp lao động làm theo sản phẩm, khoán hoặc theo giờ.

The keep abreast of the legal documents this business:

- Ensure legal compliance and avoid penalties from 10 to 100 million by Decree 12/2022/ND-CP if pay is not strictly regulated.

- Create trust retain personnel for their rights is to ensure transparency of the law.

- Optimal process management, personnel management, when the regulations are uniformly applied, limiting the risk of dispute.

For example, A company that produces apparel in Binh Duong been fined 75 million (in the year 2023, source: molisa.gov.vn) do not apply the level of 300% when employees work on the lunar new year. This is clearly evidenced that the understand, apply properly specified is not only obligations but also is vital to the business.

2.2. Regulation of pay and the time of payment

In addition to the pay, the law also specified on the moment of payment:

- According to Article 95 of The Labour code 2019, businesses must pay wages on time, not later than 30 days from the date paid under the contract.

- With wages, work on holidays, new year, businesses should pay the same salary to ensure transparency helps employees easily follow.

- Case shift lasts through 0h (for example ca 22h 30/4 to 6am 1/5), the entire work time belonging to the time frame of the holidays will be charged at the rate of 300% or up.

Compliance deadlines principle paid help:

- Avoid complaints and disputes due to late payment or false.

- Increase corporate reputation in the eyes of employers and regulatory bodies.

- Đảm bảo sự minh bạch khi financial statements, quyết toán chi phí lương.

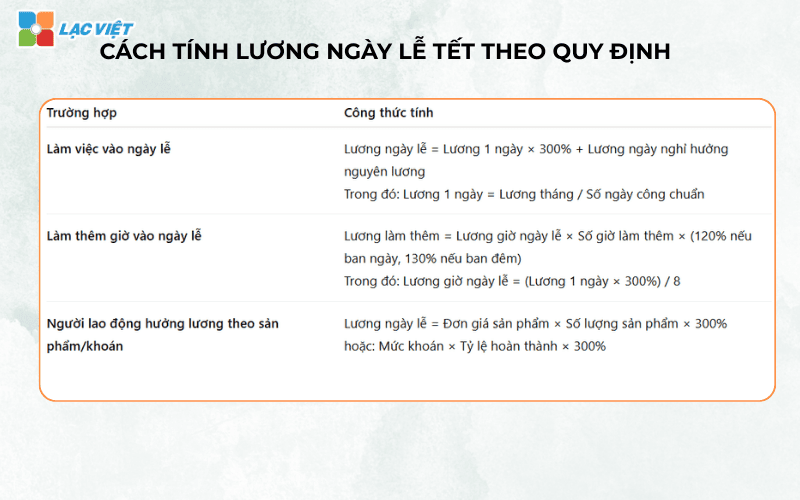

3. How to calculate wages, holidays under the provisions

3.1. Formula for calculating pay while working on holidays

According to Article 97 of The Labor code 2019, when workers work on a public holiday, new year, wages have to pay at least 300% of the salary of a normal working day, not including the salaries of the holidays enjoyed by the raw wage.

Formula:

Salary holidays = Salary 1 working day × 300% + Salary holidays enjoy raw wage

In which:

- Salary 1 day work = monthly Salary / Number of working days standard in months (usually 26 days according to specified business).

- Salary holidays enjoy raw wage has been prescribed in Article 112, ensuring workers receive the wages for the holidays by law.

Illustrative example: An employee whose basic salary 10.400.000/month, business working 26 days/month.

- Salary 1 day = 10.400.000 / 26 = 400,000.

- Salary when working on the National day 2/9 = 400.000 × 300% + 400.000 = 1.600.000 copper.

Applying the right formula not only helps businesses avoid violating the provisions salary calculator holidays, but also to show transparency in wage policy, contributing to the retention of personnel.

3.2. Case workers do overtime on holidays

When workers just work on holidays, just overtime, wages will be plus 20% (ca day) or 30% (ca night) on the basis of actual wage paid to the holidays.

Illustrative examples:

Staff on to do 2 more hours shift night into day:

- Hourly holidays = (400.000 × 300%) / 8 hours = 150,000/hour.

- Money making extra night = 150.000 × 2 hours × 130% = 390.000 vnd.

- The total salary in days = 1.600.000 + 390.000 = 1.990.000 copper.

According to the ILO report 2024, the business properly apply enough mode paid to do more on holidays recorded resting rate, the reduction of an average of 12% compared to the business does not comply with (Source). This suggests that the policy pay transparency is important lever for the mounted staff.

3.3. Salaried workers under product exchange

With labor paid by the product or exchange, how to calculate the salary holidays based on the unit price of the product or the exchange, with the number of products or completed work, then plus 300% of the normal price for the volume of work on holidays.

For example, A worker may be paid 15,000/product, do be 20 products in holidays:

- Salaries holidays = 15.000 × 20 × 300% = 900,000 vnd (not including salary, vacation days to enjoy raw wage if available).

Apply exactly to each form of paid help businesses avoid errors, especially in the manufacturing industries and construction – where more than 60% of workers paid according to the product (according to the General statistics office of Vietnam, 2024).

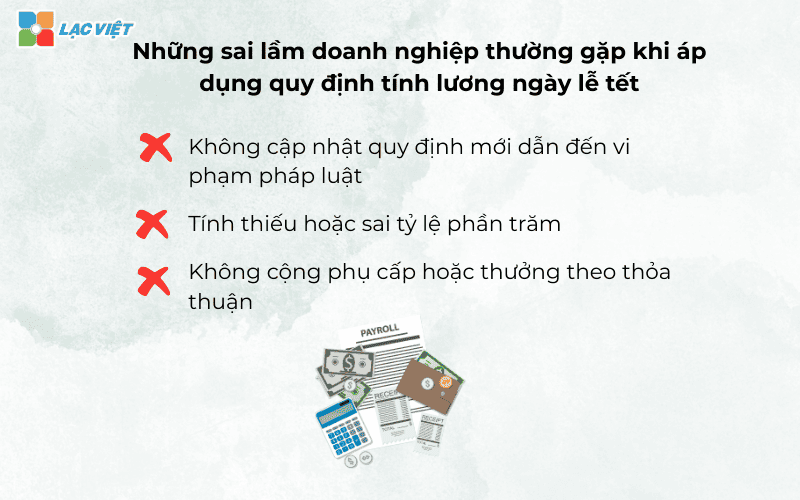

4. Mistakes businesses often encountered when applying the provisions salary calculator holidays

4.1. Teen or wrong percentage

One of the most common errors is applied not right level of 300% of salary for time worked on holidays and new year according to the provisions of Article 97 of The Labor code 2019. Some businesses only add 200% or confusion between percent overtime on weekdays and holidays. This makes the total wages paid lower than in the law, which led to complaints from workers.

For example, Staff salaries 400,000/day working on holidays, but business only pays 200% instead of 300%, leading to lack of 400,000 for a shift. This number, however small, in an individual, but if on the scale of hundreds of workers, many holidays, damages and legal risk is significant.

4.2. No allowance or award under the agreement

In addition to the basic salary, many businesses ignore the allowances fixed (lunch, gasoline, toxic...) or the bonus was stated in the contract when payroll holidays. This reduces the benefits fact of the labor and violation of the principle of “pay up, pay the right” in the specified payroll holidays.

According to the survey of the General confederation of Labor of Vietnam 2024, with up to 18% of the workers reflected that the business has sufficient allowance in salary, holidays, cause psychological dissatisfied reduce mounted. Businesses need to scrutinise regulations, payroll, contract to ensure that all income has been committed are to salary calculation holidays.

4.3. Do not update the new rules lead to violation of the law

Labor laws are regularly amended and supplemented, as the increase in the number of vacation days National from 1 to 2 days (apply from 2021). However, many businesses still applies holiday calendar old or formula for calculating the salary does not match, lead to pay money or layout work schedule against the law.

Consequences not only is violation of legal but also affect the business image. According to the Decree 12/2022/ND-CP, behavior, pay wages do not comply can be fined from 10 to 100 million, depending on the number of workers affected.

The mistake on not only cause financial losses due to fines, but also generate losses invisible: lose the trust of employees, increase the rate of absenteeism, loss of reputation in the recruitment market. A policy, payroll, holidays obviously, the right rules will help medium businesses comply with the law, while improving the professional image retain talent.

- Lac Viet SureHCS C&B paid by the customized products according to specific business

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

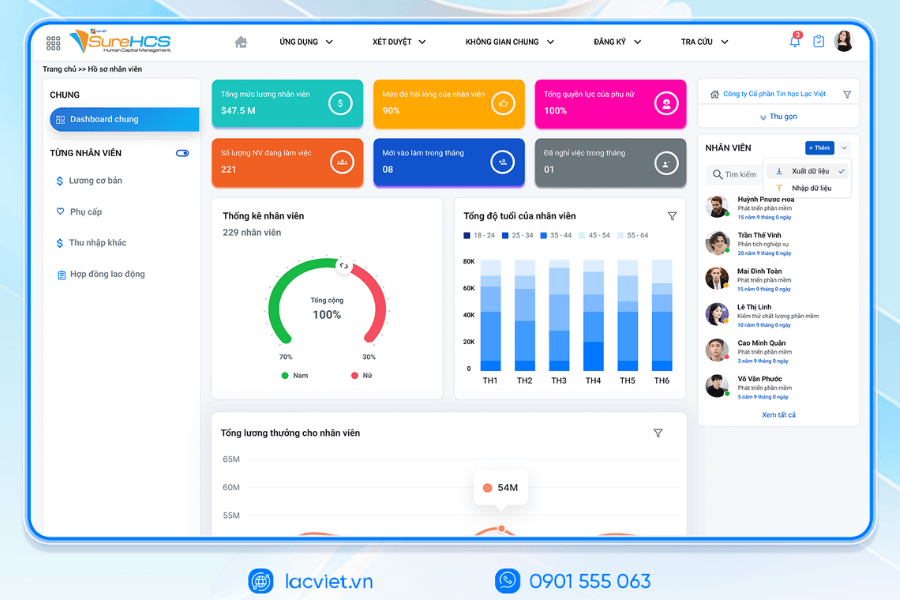

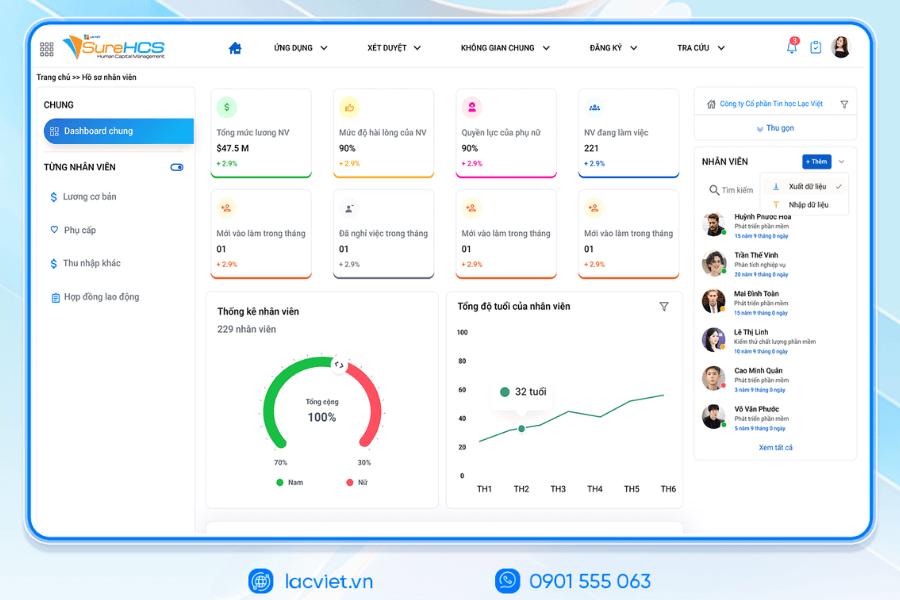

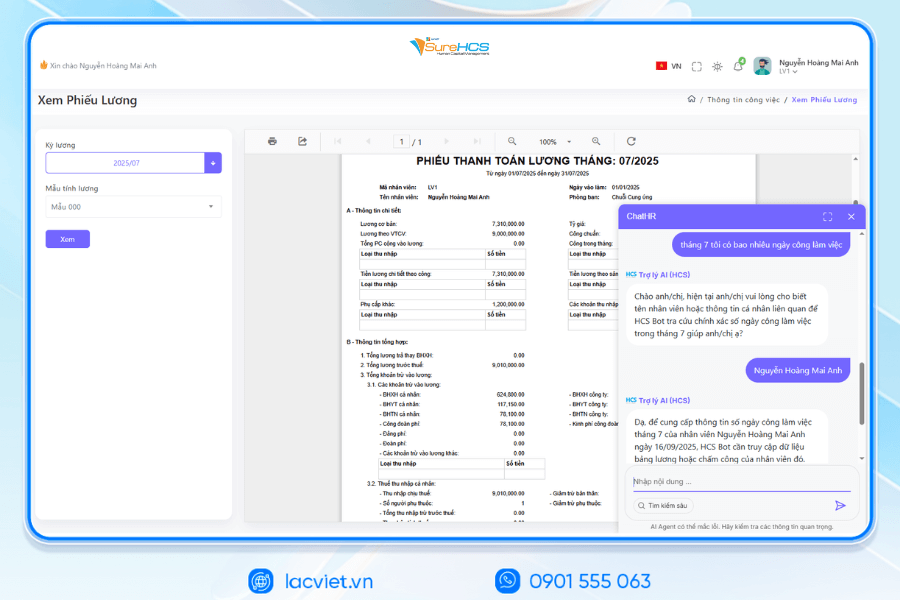

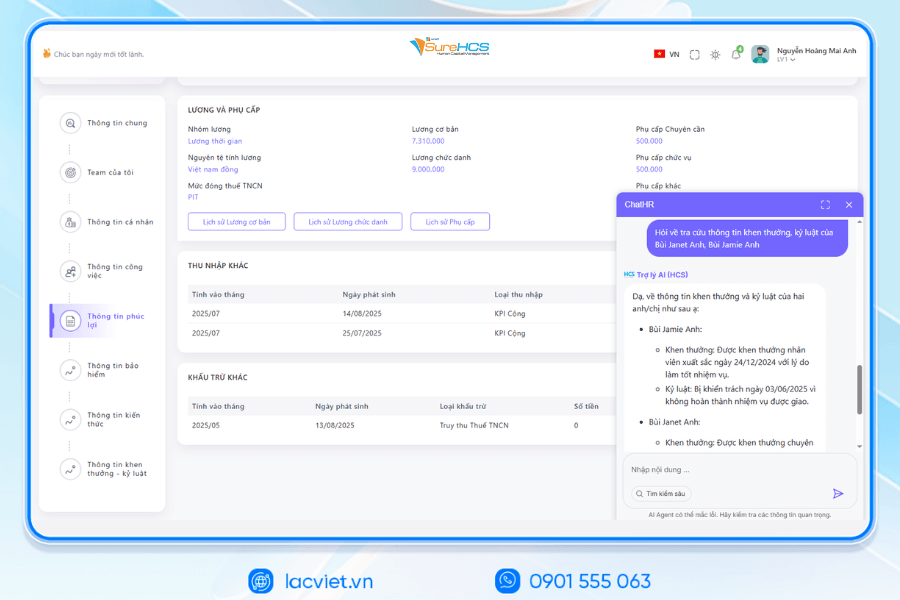

5. Solution hr LV SureHCS support, payroll, holidays, accurate, fast

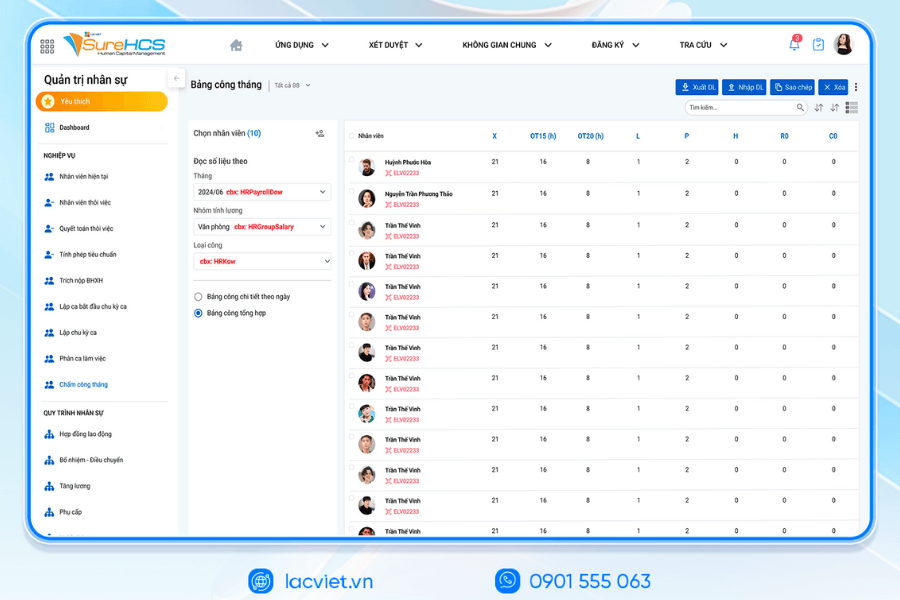

To properly apply the specified payroll holidays reduce errors, many businesses now choose human resource management software – tiền lương LV SureHCS. Payroll software này được thiết kế để tự động cập nhật các thay đổi pháp luật liên quan đến lương và chế độ làm việc vào ngày lễ, tết, đảm bảo tính lương nhanh chóng, chính xác minh bạch.

Highlight features:

- Tự động áp dụng quy định mới nhất: hệ thống cập nhật trực tiếp các điều luật, nghị định liên quan đến lương ngày lễ tết giúp doanh nghiệp không phải tra cứu thủ công.

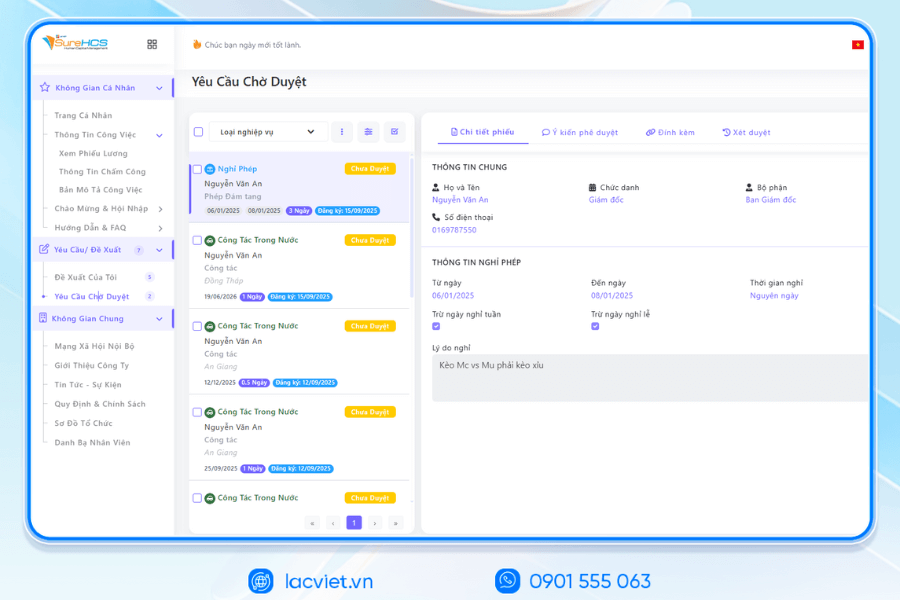

- Salary calculator in many forms: support all salaried employees, month, according to the product or exchange the job.

- Báo cáo kiểm tra nhanh: tự động tạo bảng tính lương ngày lễ tết, giảm thiểu sai sót giúp phòng nhân sự dễ dàng kiểm tra.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

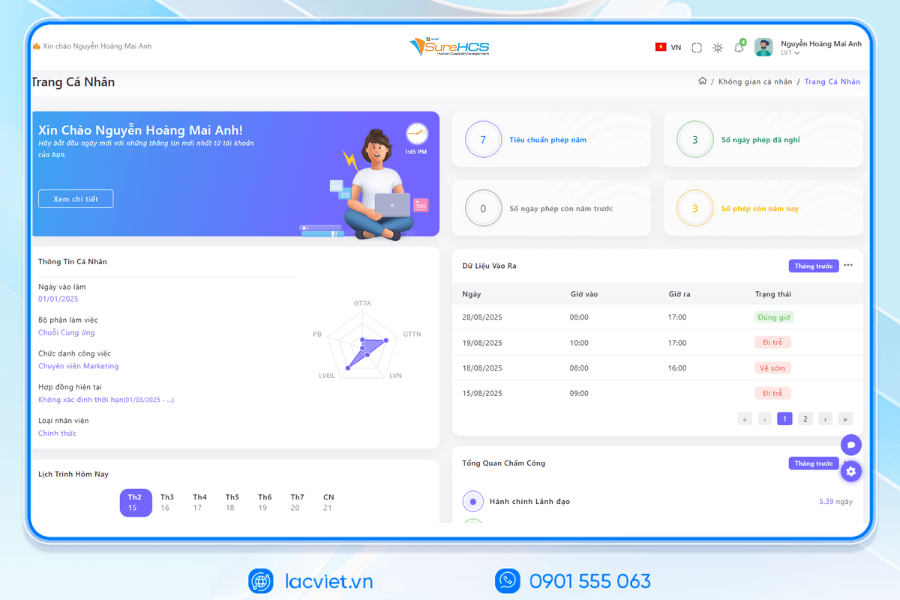

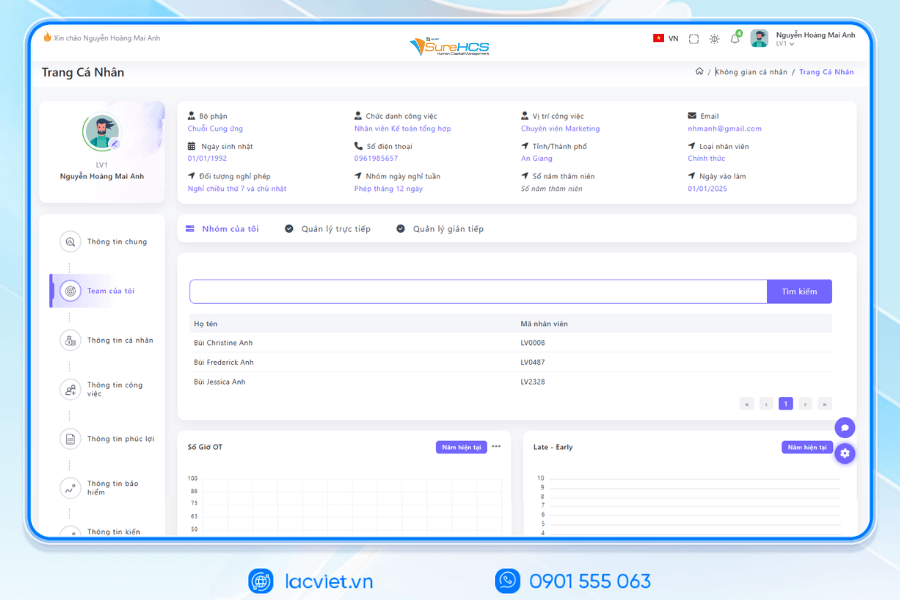

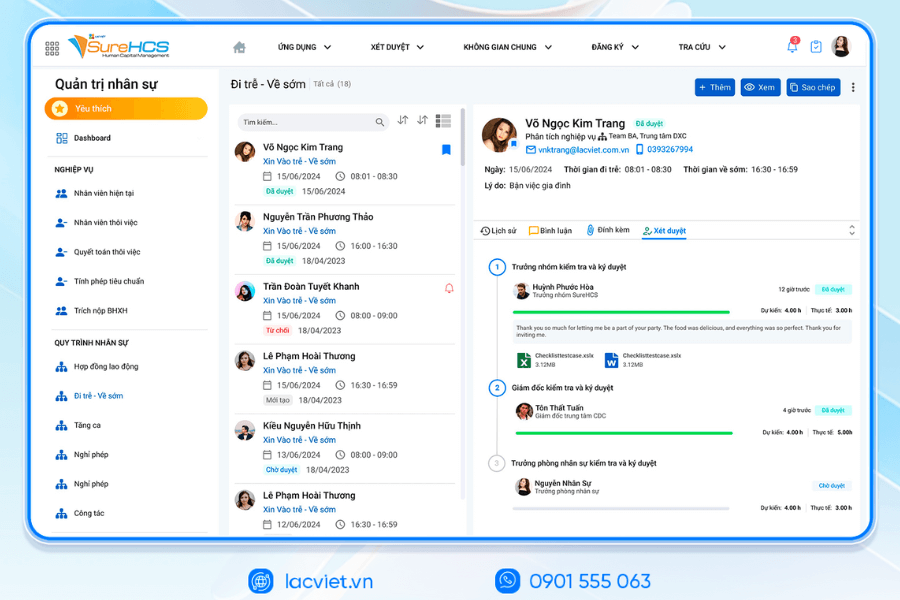

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

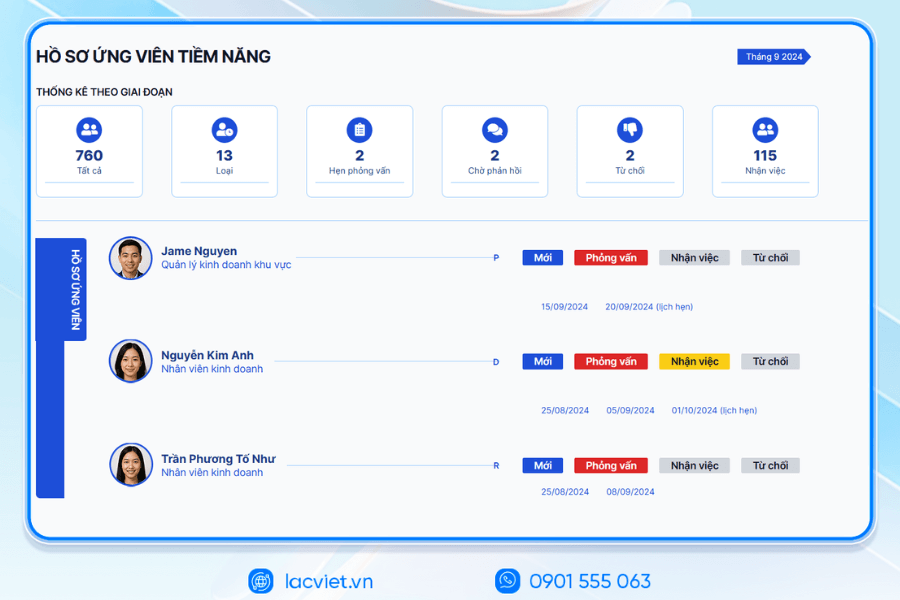

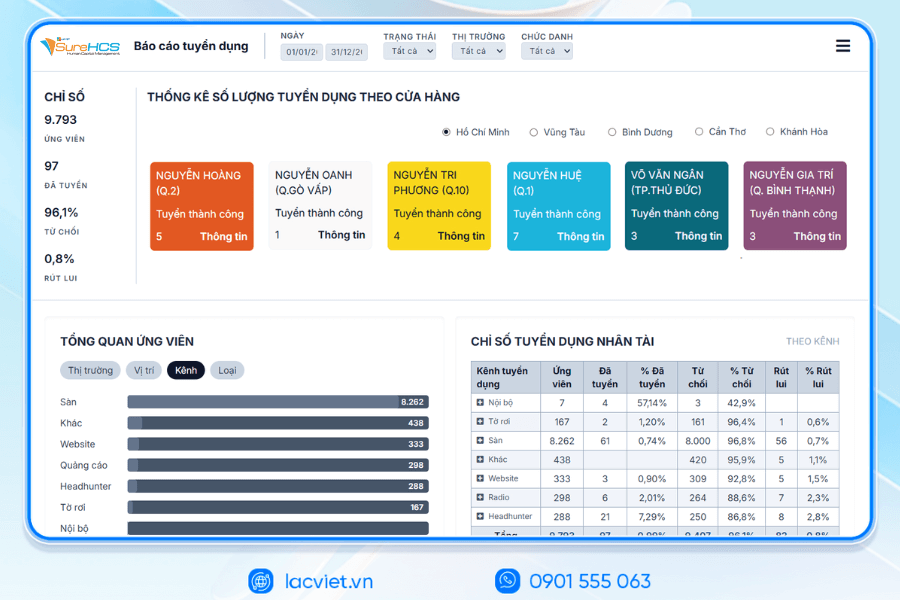

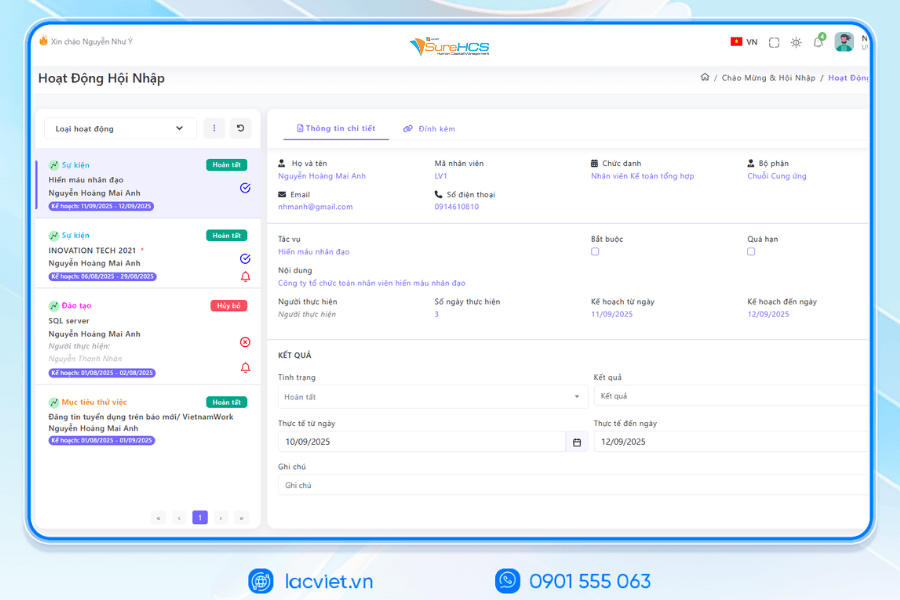

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

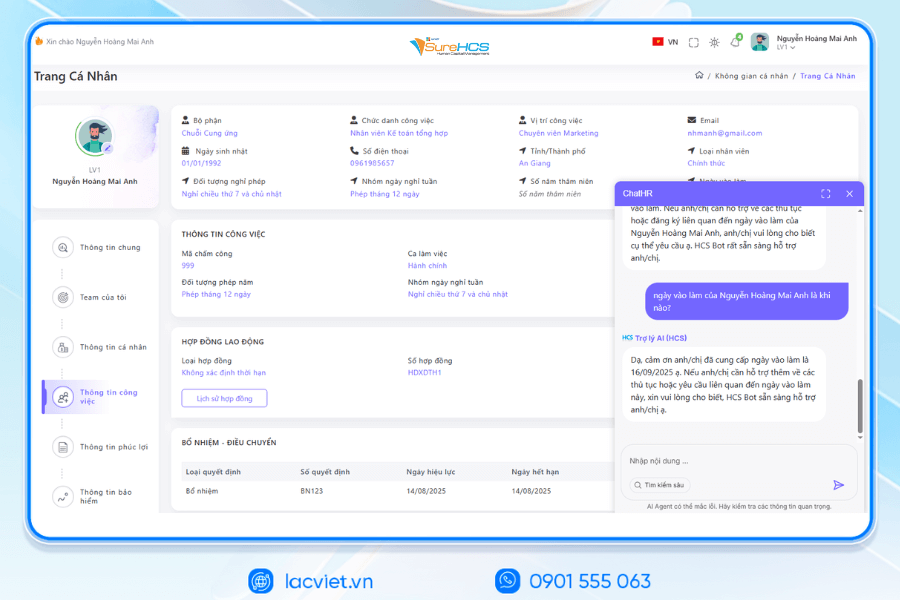

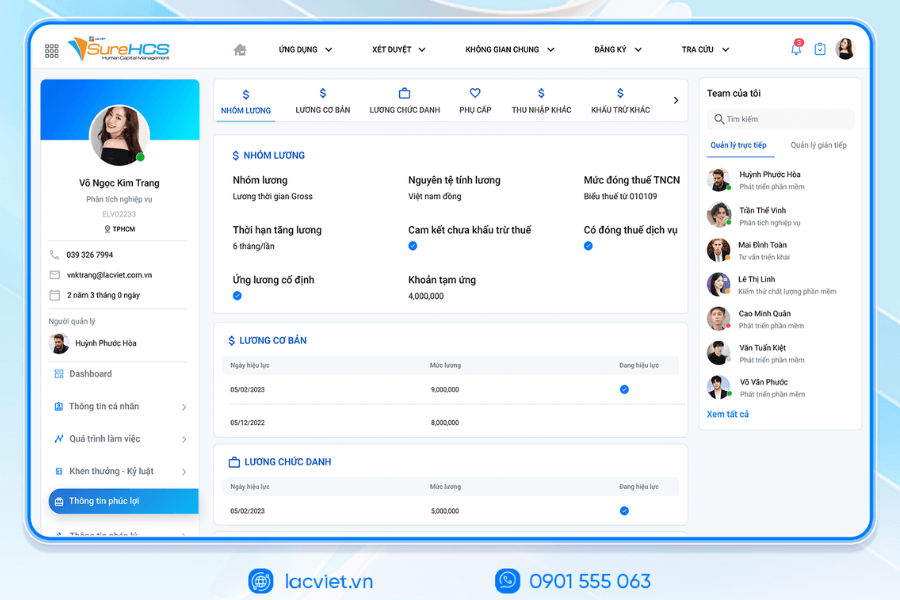

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

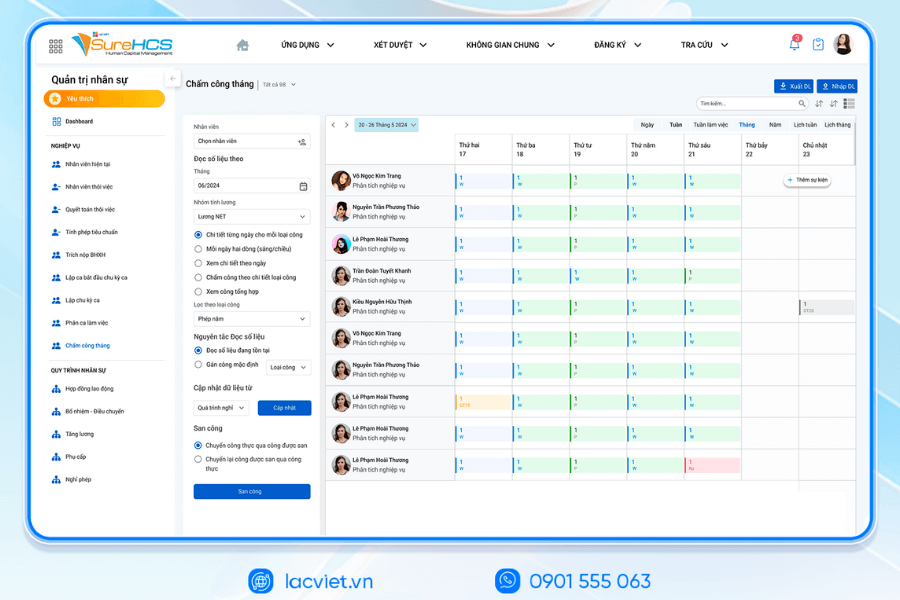

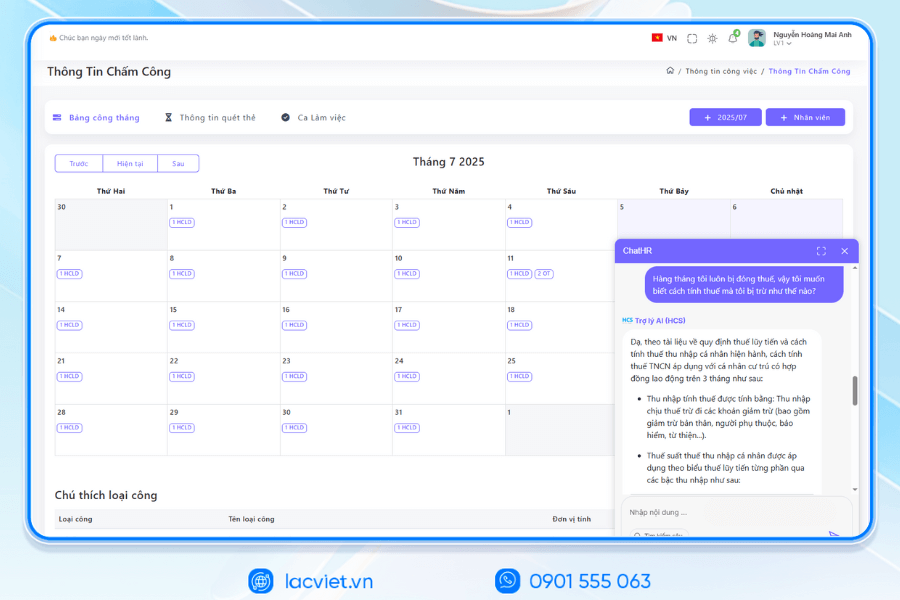

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

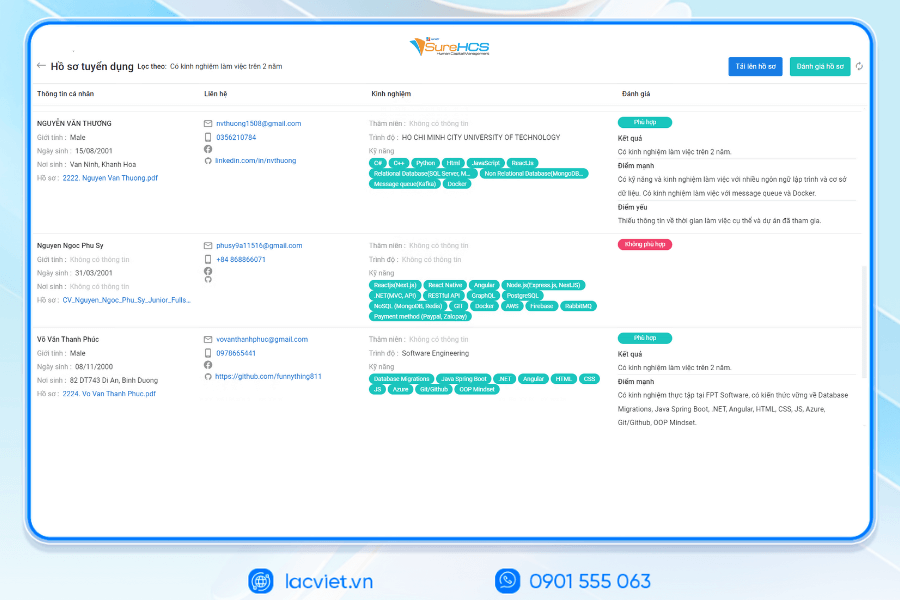

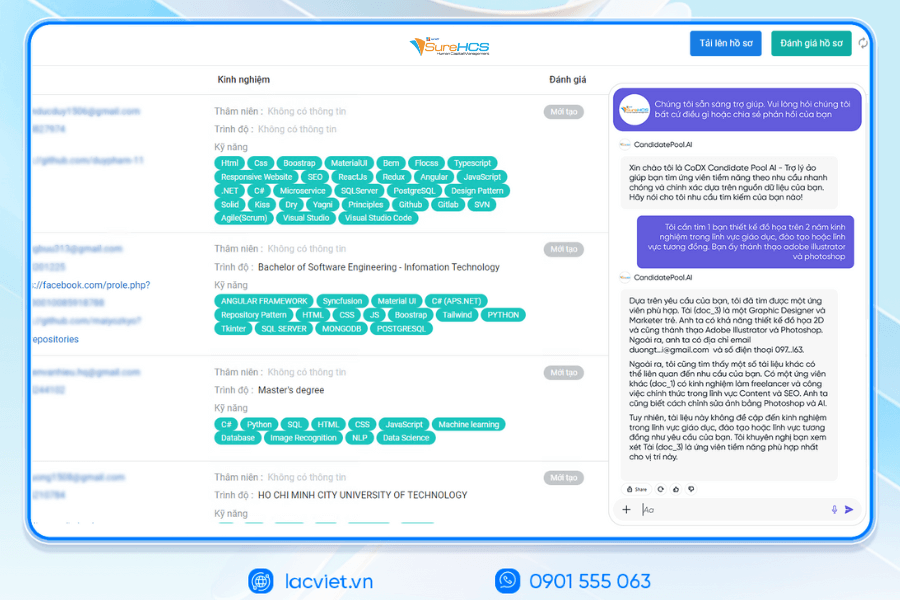

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The application software LV SureHCS not only help businesses to comply with the provisions salary calculator holidays, but also enhance the effective hr management, cost transparency increase the satisfaction of employees.

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time