Accounting purchase order is recorded, tracked, and reflect the services to purchase goods, materials or services from suppliers, in order to manage costs, determine the inventory value and ensure transparency in financial reporting. The purchase of domestic and imported there by accounting different.

However, in fact, many businesses, especially new businesses or medium-sized establishment, still have difficulties in the implementation of the right process accounting: from the determination of the time recorded, cost classification, to the way the account reflected on the ledger. Errors in shopping activities not only deflects the financial statements, but also potential risks on cash flow management as well as tax settlement.

Therefore, mastering prescribed the same method of accounting purchase standard not only help business comply with legislation and accounting standards, but also improve efficiency, manage costs, optimize shopping to support financial planning more accurate. The same Lac Viet Computing find detailed understanding of the business principles recorded the purchase process in business.

1. Accounting purchase order what is it? The role of accounting

Accounting purchase is the process to track all transactions arising when the business buys raw materials, goods and services from suppliers. This process includes both the import warehouse, immediate payment or unpaid, discount, discount price and related taxes.

The role of accounting:

- To ensure accuracy in financial reporting: All purchases are recorded full report reflect the true financial situation. For example, if the business recorded purchase transactions to pay cash but not yet precisely controlled, will lead to discrepancies in cash balances, together with public debt.

- Support cost management – inventory: Thanks to detailed tracking of transactions for the purchase and business know is the actual cost at the same time existing inventory, from which optimize purchasing decisions in the future.

- Optimize cash flow – debt management: distinction between purchases paid with a purchase, unpaid help business control is the time to spend money, avoid liquidity pressure.

- Compliance with laws – accounting standards: The accounting full, according to tax regulations, the invoice along voucher ensure businesses meet the requirements of the audit in order to avoid legal risks.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- Accounting unearned revenue is what? Principle & how accounting

- Instructions on how accounting cost shipping details as TT200/133

- Accounting what is merchandising? Detailed description of work and tasks

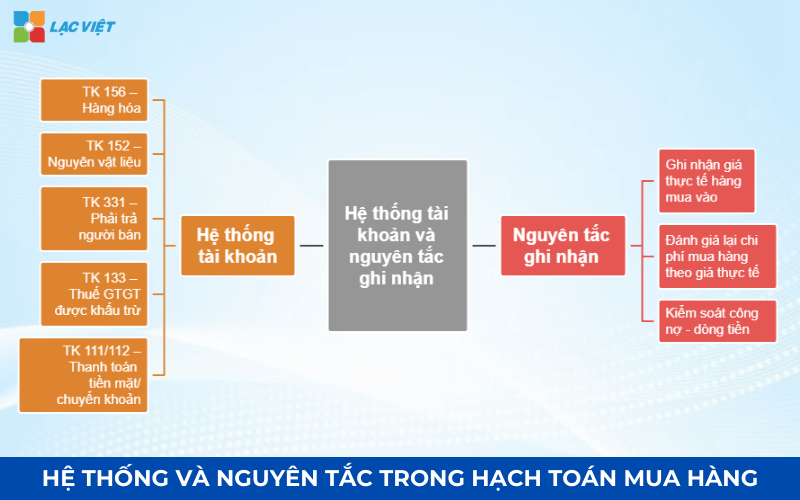

2. Account system – principles recorded in the accounting purchase

Trong doanh nghiệp, việc nắm vững hệ thống tài khoản kế toán cùng với các nguyên tắc ghi nhận là nền tảng để thực hiện đúng nghiệp vụ mua hàng, bao gồm cả việc mua hàng nhập kho, mua hàng hóa dịch vụ, thanh toán ngay hay chưa thanh toán. Khi kế toán hiểu rõ vai trò của từng tài khoản, doanh nghiệp sẽ kiểm soát được chi phí, tồn kho, công nợ một cách chính xác, từ đó tối ưu hóa dòng tiền đồng thời hỗ trợ ra quyết định mua sắm thông minh.

2.1. The system of accounts used in accounting

- TK 156 – cargo: This account is used to record the value of goods entering the warehouse. For example, when businesses buy 500 products to sell, the payment amount will be reflected on TK 156. The correct use of this account to help track the exact amount of inventory as well as worth the cost of purchase.

- TK 152 – Raw materials: Recorded raw material purchase to production service. For example, the company bought 1,000 pounds of steel to produce components will be credited the purchase value on TK 152, in conjunction with the shipping costs or insurance, if any.

- TK 331 – pay the seller: Recorded debts with suppliers when applying accounting for purchases not paid or purchases unpaid. The use of this account to help businesses control the liabilities, the risk of late payment.

- TK 133 – VAT is deductible: Recorded input VAT related to purchase transactions, including business buy goods and services. This is the basis for enterprises to deduct the correct tax rules.

- TK 111/112 – cash payment/bank transfer: Used to record the payments to suppliers, including purchase to pay cash the purchase pay now. The record in full at TK 111/112 help businesses control cash flow real and for reference only debt accurate.

2.2. Principles recorded in accordance with the ministry of finance

When recorded purchase transactions, the accountant should comply with the principle according to Circular no. 200/2014/TT-BTC and circular 133/2016/TT-BTC, ensure financial data is accurate, legal:

- Recorded the actual price buy on: including purchase price, cost of shipping, insurance, tax the expenses incurred. For example, if you buy 1,000 products with the price 50,000/pcs, free shipping 5.000/pcs, the total cost recorded will be 55.000 vnd/unit on purchases entered the warehouse.

- Re-evaluate the cost of purchase according to the actual price – principles of accounting: In case of any discount, discounts from suppliers, accountants need to adjust the figures accordingly, recorded a purchase price reduction. This ensures that the financial statements properly reflect the actual costs incurred, support effective analysis of shopping and cash flow management.

- Control of debt – cash flow: When combining the business, such as purchases unpaid or purchase pay now, the accountant should collate invoices, vouchers, payments to avoid errors at the same time legal risks.

Apply the correct account, the same principles noted not only help businesses make business purchases goods and services accurate, but also increase efficiency, inventory management, cost control, public debt, at the same time minimize accounting errors, ensure compliance with the law.

3. The business accounted for purchase common

Trong mọi doanh nghiệp, hoạt động mua hàng diễn ra liên tục với nhiều hình thức khác nhau. Mỗi hình thức đòi hỏi kế toán phải áp dụng đúng phương pháp ghi nhận để đảm bảo chi phí, tồn kho, công nợ được phản ánh chính xác. Việc tuân thủ đúng hướng dẫn của Thông tư 200 cùng Thông tư 133 không chỉ giúp báo cáo tài chính minh bạch mà còn hỗ trợ quản trị hiệu quả hơn. Dưới đây là các nghiệp vụ mua hàng phổ biến nhất mà kế toán cần nắm vững.

3.1. Accounting purchase warehousing

Accounting purchase warehousing apply when business buy goods or materials, then put into warehouse for sale or production service. Under circular no. 200/2014/TT-BTC dated the same circular 133/2016/TT-BTC, the value of the warehouse must be recorded according to the actual price, includes purchase price as well as the related costs such as shipping, handling, insurance costs, machining processing.

Meaning of accounting:

- Accurately reflect the cost of inventory.

- Support inventory control, planning goods.

- Ensure financial statements reflect the full costs incurred.

How to account:

- Recorded value into the treasury and public debt provider

- Debt TK 152/156

- Have TK 331

- Recorded input tax is deductible (if any)

- Debt TK 133

- Have TK 331

Illustrative example: company ABC purchased 1,000 products with the price 50,000/products; free shipping 5,000,000, unpaid. VAT 10%.

- Value stock: 1.000 × 50.000 + 5.000.000 = 55.000.000 dong

- VAT: 10% × 55.000.000 = 5.500.000 dong

- Debt TK 156 => Have TK 331: 55.000.000

- Debt TK 133 => Have TK 331: 5.500.000

3.2. Accounting purchase do not enter the warehouse

Apply when goods or services to be used immediately, do not put into the repository. For example: office products, repair services, the cost of transport service management. Accounting directly to the corresponding expense: management, sales, production.

Meaning of accounting:

- Avoid recorded an increase in inventory are not real.

- Cost allocation correct accounting period.

- Support effective analysis actual cost.

How to account:

- Recorded costs incurred and payment methods

- Debit account: 642 / 641 / 154

- Have TK: 111/112/331

- Recorded input tax is deductible (if any)

- Debt TK: 133

- Have TK: 331

Illustrative example: Buying services, server maintenance 12.000.000 copper, 10% VAT, transfer payment.

- Debt TK 642 => Have TK 112 : 12.000.000

- Debt TK 133 => Have TK 112 : 1.200.000

3.3. Professional purchases paid immediately (cash / transfer)

Apply when business immediately pay to the supplier. Accounting purchase helps to reduce public debt, easy for projecting cash flow.

Meaning of accounting:

- Control line actual money.

- Reduce the risk of overdue debt.

- Transparent accounting data bank.

How to account:

- Recorded cost/goods warehousing and immediate payment

- Debit account: 152 / 156 / 642 / 641

- Have TK: 111 / 112

- Input VAT (if available)

- Debt TK: 133

- Have TK: 111/112

Illustrative example: Purchase of raw materials vnd 25,000,000, transfer payments now; free shipping 2,000,000.

- Debt TK 152 => Have TK 112: 27.000.000

3.4. Accounting purchases unpaid (buy bear)

Business to receive the goods but pay later. Accounting recorded public debt in TK 331, track-term payment, time of payment to avoid overdue.

Meaning of accounting:

- Optimize cash flow.

- Maintain liquidity.

- Planning a reasonable payment.

How to account:

- Recorded value/unpaid bills

- Debt TK: 152/156/642/641

- Have TK: 331

- Input VAT (if available)

- Debt TK: 133

- Have TK: 331

Illustrative example: Purchase 120.000.000 copper, free shipping 3,000,000 unpaid.

- Debt TK 152 => Have TK 331: 120.000.000

- Debt TK 152 => Have TK 331: 3.000.000

3.5. Accounting for purchased goods – services

Business to buy goods for sale or production use, at the same time buying service (transportation, repair, maintenance...). Need to distinguish cost how to original price, cost of any record directly.

Meaning of accounting:

- Classification of the cost of the right audience.

- Specify the price on capital precision.

- Assess the effectiveness each type of cost.

How to account:

- Goods warehousing / payment

- Debt TK: 152/156

- Have TK: 111/112/331

- Cost of service use

- Debt TK: 642/641/154

- Have TK: 111/112/331

Illustrative example: Purchase 200,000,000, free shipping 10,000,000 → on the price.

- Debt TK 156 => Have TK 112: 210.000.000

3.6. Purchase discount, discount, returned goods

Trade discounts, rebates or goods returned must adjust the discount value of the purchase was recorded. Payment discount can be recorded in financial income or adjusted directly at the original price.

Meaning of accounting:

- Reflect the correct value actual cost.

- Support effective analysis of transactions, negotiations with suppliers.

- Reduce the cost reasonable, transparent.

How to account:

- Adjusted debt / original price by the discount or return

- Debt TK: 331/156

- Have TK: 515/156

Illustrative example: Purchase 150,000,000, 5% discount → reduce 7.500.000 copper.

- Debt TK 331 => Have TK 156:7.500.000

3.7. Purchased item related to the VAT input

Input VAT is recorded if the conditions deduction under the tax Code, VAT: valid invoice, payment of non-cash if >20 million, goods/services, active service taxable.

Meaning of accounting:

- Optimal tax VAT is deducted.

- Avoid legal risks, errors when the tax declaration.

- Ensure financial statements properly reflect the actual cost.

How to account:

- Recorded value buy

- Debt TK: 152/156

- Have TK: 331/112

- Record input VAT deductible

- Debt TK: 133

- Have TK: 331/112

Illustrative example: Purchase supplies 100,000,000, 10% VAT, transfer payment.

- Debt TK 152 => Have TK 112: 100.000.000

- Debt TK 133 => Have TK 112: 10.000.000

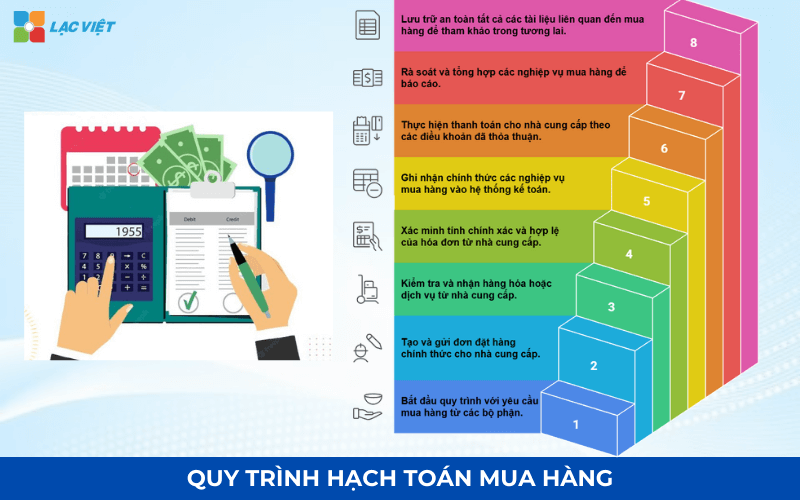

4. Process accounting purchase standard in business

Process accounting purchasing is the step platform to help businesses manage expenses, inventory, liabilities correctly, at the same time ensure compliance with accounting standards and the law. Applying the right process also helps businesses optimize cash flow, avoiding errors in the recorded costs and enhance operational efficiency. The process includes the steps of:

Step 1: Get request purchase

This is the official start, where the demand for the procurement of supplies, goods or services arising from the departments (Production, sales,...) is shown through the text. Requires purchase must indicate the type of goods, quantity, unit price, expected, intended use at the same time need of the row.

Accounting receiving the request to check the reasonableness at the same time reconciling the budget. The accounting purchase helps to determine the form of accounting for costs that:

- If the goods will be put into warehouse: preparing for the purchase warehousing (TK 152/156).

- If service is or drain right: orientation purchases do not enter the warehouse or buy goods and services (TK-related Expenses).

Censorship soon to help businesses control the budget from the beginning, prevent purchase excess, optimize inventory to ensure all expenses have clear purpose, to create the correct foundation for the steps of accounting next.

For example, production department, purchase request 500kg material production service. Accounting test budget, calculation of the estimated value, recorded a preliminary to track expenses, inventory, at the same time prepare for the step accounting of the next. Censorship soon to help businesses avoid buying excess or lack of control over the budget effectively.

Step 2: Set orders (Purchase Order – PO)

After the purchase request is approved, the purchasing manager will be officially set orders (PO) then send to the supplier. PO is committed to the legal details of the key terms of the transaction, including: quantity, unit price and conditions of delivery and especially your payment method with the terms of discounts, rebates.

PO is the basis for accounting expected to record a value of the actual transaction. Accounting base on the PO to:

- Determine shopping discounts (if applicable trade discounts).

- Set up payment plan, classification of the transaction is paid or not paid.

Help PO strictly control the purchase price agreed at the same time set the foundation for the management of public debt, cash flow, ensure all payments after this are the base contract clearly.

For example: Business purchase 1,000 products with the price 50,000/pcs, get 5% discount. Accounting recorded actual value 47,500 to the system, at the same time planning, payment by agreement with the supplier.

Step 3: Receive the goods

This is the stage of goods or services actually delivered to the business. Parts Warehouse, or consignee conduct a reality check about the quality then collated strict with the information on the purchase order (PO) signed.

The test results decide how to record inventory – cost:

- Accounting purchasing and warehousing: Recorded value in TK 152 (supplies) or TK 156 (goods) if the goods are put into storage.

- A purchase does not enter the warehouse: Recorded directly into the account associated cost (TK 621, 641, 642,...) if item is consumable or service.

- Business to buy goods and services: recognition of the extra expenditures incurred attached as transportation, loading and unloading along allocate them to the original price inventory.

Confirm the correct quantity and quality of goods received help control inventory in real time provided the initial data on the value of goods to prepare for the accounting of tax liabilities.

For example: company get 1,000 kg of raw material, check the sufficient quantity and quality. Accounting recorded expenses into TK 152, VAT input, apply professional buy goods and services when there are free shipping or maintenance comes.

Step 4: Check out – bill note

This is step accounting check the validity as well as accuracy of invoices from suppliers pre-recorded main window form. Accounting for projection invoice with purchase order (PO) and receipt (Step 3) to confirm the total payment value, the price hasn tax, VAT.

This step ensures all transactions are legitimate, is the basis for:

- Classification of public debt: Determine the transaction was a purchase to pay or has not paid (recorded public debt in TK 331).

- VAT validation: recognition of input VAT is deductible (Debt TK 133).

- Value adjustments: Make the final adjustments to the accounting for purchase discounts according to the fact.

Ensure data billing accuracy, avoid errors in recorded liabilities, costs, and comply with the provisions of the bill of vouchers to be tax deductible.

For example: Bill 50 million, 5% discount, the accountant recorded the actual value of 47.5 million with VAT deducted 10% on TK 133.

Step 5: accounting professional purchases

After the invoice has been checked, the confirmation is valid (Step 4), accounting conduct recorded in the official accounting system of bookkeeping.

Here is the steps to transfer data from documents to books, including:

- Buy warehouse import: Record increase in assets inventory (Debt TK 152/156) the input VAT (Debt TK 133).

- Buying goods and services: Recorded increase in cost related (Debt TK 621, 642, etc.).

- Accounting for public debt/cash: Recorded obligations paid (TK 331) if is accounted for purchases not paid, or record the decrease in cash (With TK 111/112) if is the purchase pay now.

Ensure all values from the inventory, the cost to public debt, which is reflected accurately and timely into the accounting system provides the data foundation for the establishment of financial statements.

The recorded details, help track inventory, costs, debts, exactly, at the same time support management reports and analysis effective shopping.

Step 6: payment for supplier

Business made the actual payment to the supplier based on the terms of the agreement with data, public debt was recorded in Step 5. The payment can be by cash or bank transfer.

Accounting for projection data, the debt must be paid prior to the current transaction then recorded pen payment:

- Reduce public debt: Notes from the obligation to pay (Debt TK 331).

- Decrease: reduced cash or bank deposits (With TK 111/112).

- Control public debt: monitoring payments unfinished with the balance accounted for purchase unpaid rest.

Closely manage cash flow paid out, ensure timely payment to keep credibility with suppliers and control the payment risk, slow.

For example, If pleasant buying 50 million, then payment of 25 million now, accounting recorded 25 million in shopping paid now, 25 million remaining on shopping don't pay yet. This helps businesses control cash flow to limit the risk of late payment term.

Step 7: test – reports

This step is performed periodically (usually end of the month/quarter) to scrutinize, sum up the whole of the business has incurred in the period.

Accounting proceed collated data overall between the window book related (window, shed window public debt, window cost) to detect, timely correction of errors. At the same time, establishment of management reports:

- Guaranteed accuracy: Confirm the import warehouse, goods and services, reduced prices for the same has not payment has been recorded accurately.

- Reporting: Provide analysis reports details about the purchase cost effective shopping for the management level.

Reviews operational efficiency of purchase, cost optimization, and inventory, and provide reliable information for decision making business strategy.

Step 8: record storage

This is the final step required to complete the process. Business conducted sort, sorting, storing all the documents, receipts related to business purchases.

Ensure all original documents, including requisitions, PO, invoice VAT receipt with proof of payment, are all stored in a scientific and safe according to the regulations on accounting and tax.

Storage full profile, easy to access not only ensure transparency as well as legal compliance in audits but also a source of important data for cost analysis, supplier evaluation at the same time improve the process for future purchases.

5. A number of important note in professional purchases

In the process of implementation of business accounting of purchases, businesses need to note some important points to ensure accuracy, transparency and efficiency:

- Control costs incurred: purchases often come with many costs beyond the purchase price as shipping, insurance, installation, or cost of services. The accountant should record the full account of this to the financial statements properly reflect the actual cost at the same time support business analysis effective shopping.

- Collated vouchers, invoices and PO: errors in the projector can lead to recognized the wrong metrics or costs. Accountants must ensure that the services are based on evidence from authentication. This not only helps to manage inventory accuracy, but also reduce legal risk, audit.

- Debt management – cash flow: When a business applies purchases unpaid or purchases paid by cash, need to track the actual amount control, payment term, as well as ensure that the account public debt is not past due. Here are important factors to help optimize cash flow and avoid financial pressure at the same time maintain good relations with suppliers.

- Track discount – discounts: When receiving a discount or rebates from suppliers, accounting to adjust timely to reflect the correct accounting for purchase discounts. This helps businesses control the actual cost at the same time gave the exact price, profit from operations, shopping.

- Records storage transparent: All vouchers, invoices, PO, receipt the payment slip should be stored in full. This helps business lookup information, quick service, auditing, cost analysis, supplier evaluation to optimize the purchase process in the future.

6. The optimal solution of accounting software, LV-DX Accounting

To minimize errors, increase processing speed and optimum value management, business should now app solutions, digital technology, such as LV-DX Accounting. This software brings many practical benefits:

- Full automation interface: automatically recorded every purchased item (warehousing services, pay immediately, buy bear), remove errors manually.

- Track debts and Real-time control to pay debt with cash flow, real-time support financial decisions quickly.

- Managers the exact Cost – Tax: automatically calculate the discount, discount price with VAT input, ensure reflect the original price.

- Strategy report: provider analysis report details about cost, inventory, help optimize budget with shopping decision.

- Storage Of goods: All documents are stored electronically, easy access at the same time check service audit.

Business can learn detailed, experience, software, LV-DX Accounting at https://lacviet.vn/lv-dx-accounting/. The application software is not only help to improve the accounting of purchases, but also create a platform for financial management digitized comprehensive, improve operational efficiency, to optimize profits for the business.

Accounting purchase is accounting profession platform to help businesses manage expenses, inventory, liabilities correctly, while ensuring the financial statements reflect the true state of operation. To comply with the process, principles of accounting not only help comply with the laws, accounting standards, but also optimize cash flow, improve efficiency shopping and support strategic decisions.